The Best Small Cap Trusts And Funds

It has been a turbulent period for investors in UK small cap funds with the sector powering ahead on the re-opening trade after the pandemic, but then giving back most of the gains in the face of higher interest rates. The threat of recession has resulted in many attractive valuations, so it is an interesting time to take stock of where we go from here.

According to data from FE Trustnet, there were just five of the 49 open-ended funds in the UK small cap sector that made a positive return over the last 12 months, with the best being Fidelity UK Smaller Companies with a 7.5% gain. Many of the others made double digit losses, although most still achieved a decent positive return over five years.

It is a similar picture with the UK small cap investment trusts, with the sector making a loss of six percent over the last 12 months, but a five year gain of 17%. Almost all of the constituents are currently trading at a discount, with the average figure being just under 10%.

Writing in the recent annual accounts, the managers of Aberforth Smaller Companies (LON: ASL), the largest investment trust in this area, said that inflation is likely to moderate, although they don’t expect it to fall to the very low levels seen in recent years. As a result, interest rates will probably remain elevated.

If they are right it suggests a difficult backdrop for risk assets, yet they also pointed out that UK small cap valuations are unusually attractive and while earnings may come under pressure, a lot of the risks have already been priced in.

A Tough 2022

Last year was a challenging one for virtually all asset classes with the return of inflation having a deeply negative effect on valuations right across the board. However, the small caps were more badly affected than most.

Rob Morgan, spokesperson and chief analyst at Charles Stanley, says that interest rates have risen so much that we could get quite a serious recession, as high energy and goods prices coincide with higher borrowing costs for businesses and individuals.

“This has been a particularly unhappy cocktail of issues for smaller companies, which tend to be more sensitive to both economic activity and borrowing costs compared with larger, more established businesses. In addition, smaller companies tend to be more oriented towards the domestic economy where there are concerns of a pronounced slowdown.”

A ‘risk-off’ environment is generally bad for small caps that are seen as higher risk than their larger peers. The investment trusts operating in this area tend to get hit even harder in this sort of situation and often move to a discount to NAV.

James Yardley, senior research analyst at Chelsea Financial Services, says that smaller companies tend to have better growth prospects, but higher interest rates are bad for growth stocks.

“Problems with supply chains have also hit smaller companies disproportionately hard. They lack the same capability to re-route supplies as some large caps. As an example, consider Fevertree’s problems with sourcing bottles relative to a company like Coca Cola.”

Outlook For UK Small Caps

Morgan says that small cap investors should be able to tolerate higher volatility in return for the prospect of strong longer term growth. This makes it an area that is suitable for people who can accommodate more adventurous investments in a broad portfolio.

“The pessimistic outlook for the UK economy and steady stream of outflows from the sector has left valuations in attractive territory. A catalyst for a re-rating may not be close at hand, but earnings resilience and the scope for M&A activity could help to underpin values, so it could be an opportune moment to build exposure and await better times.”

Smaller companies are well-placed to outperform the large caps over time as they have better growth prospects, are nimbler and are now a lot cheaper than they were 12 months ago. It is a sector that often makes sense to top up during difficult periods and the present circumstances could well fit the bill.

“Small cap stocks are cheap and the headwinds are either known or largely included in the price. I would add small cap to most long-term investors as they provide higher growth potential albeit with higher volatility,” explains Ben Yearsley, a director at Shore Financial Planning.

The immediate future for the UK economy remains challenging with the Bank of England (BoE) expecting the economy to fall into a recession. This means that the headwinds that smaller companies have been facing are not going away any time soon.

However, Ryan Hughes, head of active portfolios at AJ Bell, says that there are some positive signs given that inflation should fall back sharply during the year and the BoE doesn’t expect the recession to be as sharp as previously feared.

“The bad news of a recession has largely been priced into smaller company valuations, which means there may be some opportunity to add to this area at appealing prices. It is important to bear in mind however that the sector will be sensitive to economic news flow and any sign that the recession is worse than feared will almost certainly hit prices hard.”

The Situation Overseas

Small cap stocks have been struggling in many countries around the world in the risk-off environment, although it’s a different story in the US where they have held up reasonably well compared to the large caps.

“We really like global small caps long-term and think now could be a decent entry point with a lot of bad news already priced. We expect inflation to fall back and interest rates to follow, which could reignite some of the growth stocks,” explains Yardley.

It is important to appreciate that the definition of smaller companies varies across the world, with those found in the US typically much larger than those in the UK, many of them being bigger than stocks in the FTSE 100 large cap index.

Hughes says that smaller stocks have suffered around much of the world in the same way as UK smaller companies have. This is because they are more economically sensitive than larger companies and have a bias towards growth, which has been out of favour for the past 18 months.

“There is appeal in having exposure to global smaller companies as they offer very different exposure to the UK. For example, there are many more technology companies found in the US than the UK, so combining UK and global smaller companies funds will enhance diversification for investors.”

The Best Small Cap Investment Trusts

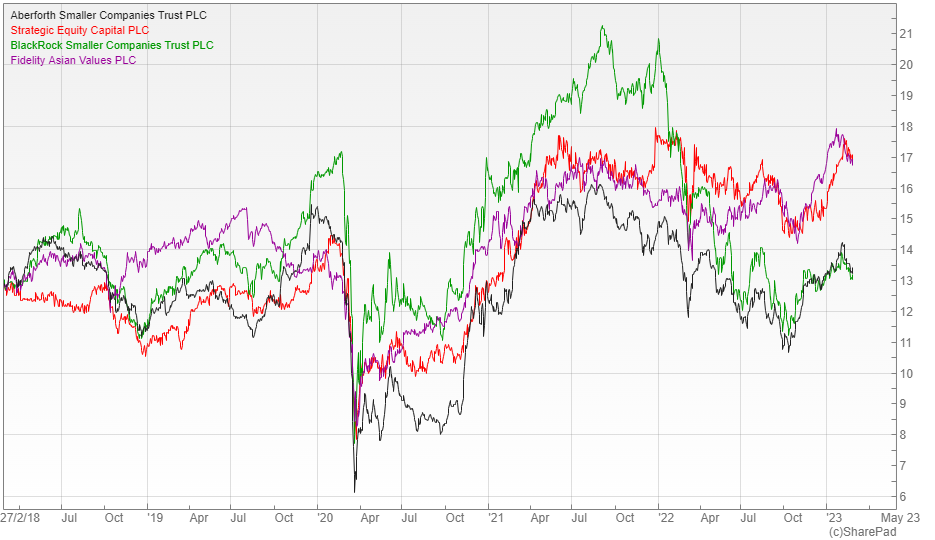

When it comes to the investment trusts, Mick Gilligan, head of managed portfolio services at Killik and Co, recommends Aberforth Smaller Companies (LON: ASL), which has a value approach that is better suited to a rising rate environment. It currently trades on an 11% discount.

Morgan is another advocate and says thatthe team’s adherence to a disciplined, valuation-focused strategy results in a differentiated portfolio.

“The managers aim to unearth cheap companies whose longer-term potential has been misunderstood or underestimated by the market. Their process aims to uncover less-fashionable businesses priced below what they consider to be their ‘intrinsic’ or sum-of-the-parts value.”

Alternatively Gilligan suggests Strategic Equity Capital (LON: SEC), a smaller £166m trust that holds a concentrated portfolio of highly cash generative niche businesses with good scope for M&A. It is trading on a six percent discount.

Another of Morgan’s favourites is the BlackRock Smaller Companies Trust (LON: BRSC), which he describes as a strong option that harnesses the expertise of a longstanding team. It is currently available on a 14% discount.

“The 100-stock portfolio is built of companies with good management, strong market positions, sound balance sheets and a demonstrable ability to convert earnings into cash. In other words, it steers away from highly cyclical, excessively leveraged, or blue-sky companies.”

If you would prefer some overseas exposure Hughes recommends Fidelity Asian Values (LON: FAS), which focuses on small and medium sized companies in Asia that are unloved and as a result has more of a value approach.

“Manager Nitin Bajaj has significant experience and a clear definition for the type of company he likes, namely one that has a good business, run by competent management and is priced attractively. He is prepared to rotate the portfolio as market dynamics change and has recently been selling expensive Indian companies and buying unloved Chinese stocks. The fund performs very differently to the benchmark, but offers a highly differentiated approach to the typical growth focused smaller companies fund.”

UK Small Cap Funds

An area like small cap investing lends itself to actively managed funds, as a decent manager who studies the fundamentals can realistically hope to deliver long-term outperformance.

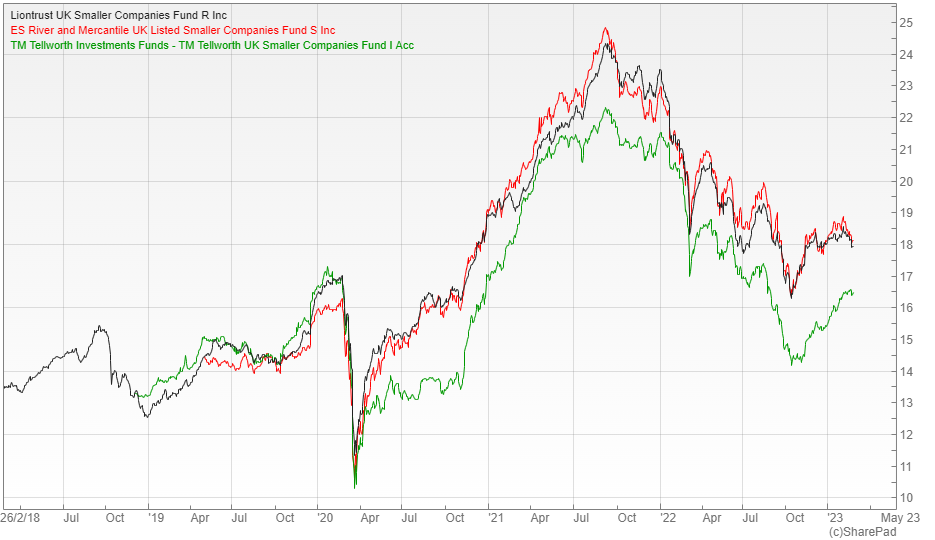

In terms of the UK open-ended funds, Yardley recommends Liontrust UK Smaller Companies that invests in stocks displaying a high degree of intellectual capital and employee motivation through equity ownership.

“The process has been executed with diligence and skill, not only in this fund but also in other mandates. The emphasis on quality and avoiding cyclical stocks has worked particularly well with smaller companies and the fund has produced excellent relative and risk-adjusted performance figures.”

Yearsley prefers River & Mercantile UK Equity Smaller Companies,which he describes as a core holding that will have bits of growth, value, quality and asset backed exposure. These allocations get moved around depending on the opportunity and the environment.

Alternatively Hughes suggests Tellworth UK Smaller Companies. Thefund is less than five years old, but managers Paul Marriage and John Warren have been around for many years and know the small cap universe inside out.

“They have a sensible approach, shunning unprofitable and blue sky companies, preferring those with sensible management teams and established track records. Last year was very challenging, yet the experience of the team should help them to recover in more friendly market conditions.”

Global Small Cap

Overseas small cap funds either operate with a global mandate or are regional specific, so it depends what type of exposure you want in your portfolio. Obviously the former are more diversified and make the better one-stop shop, whereas the latter could be ideal for a more tactical view.

Morgan recommends Kempen Global Small Cap, an under-the-radar fund that deserves more recognition. It has built up an impressive record, overcoming a longer term headwind from their value style.

“The managers look for stocks with quality characteristics that are trading at a valuation discount. They have an impressive hit rate that illustrates their research intensive process and high levels of constructive engagement with company management.”

The team, which is based in Amsterdam, try to avoid taking major bets in terms of geography and sector in order to maximise the influence of their stock picking. It’s a useful diversifier from all the various growth-oriented strategies that are available.

Hughes prefers Abrdn Global Smaller Companies that has a clear focus on stocks that are growing and have earnings momentum.

“It is a process that has been tried and tested over many years. The fund currently has around 40% invested in the US with 25% in technology, both of which have sold off sharply, potentially creating a good entry point.”

Alternatively there is Montanaro Global Select, a small and mid-cap fund endorsed by Yearsley, who describes Montanaro as the premier smaller companies boutique.

Regional Specific Mandates

When it comes to the more geographically focused options, Yardley likes the Barings Europe Select Trust, which invests in small and medium-sized companies and is run on what is known as a GARP (Growth at a Reasonable Price) basis.

“Europe – and especially small caps − tend to get forgotten by investors so this area is under researched and ripe for good stock pickers. This is where this fund comes into its own. It has an experienced four-strong team that produces extensive analysis on the wide range of opportunities.”

Another option he suggests is T. Rowe Price US Smaller Companies Equity, a fund that differs from the usual T. Rowe Price mould in that it is a more balanced core portfolio, with value names in addition to the usual growth focus.

“This approach has borne fruit, with considerable performance coming from stock selection. The manager is very detail-oriented and has been working at T. Rowe Price as a specialist analyst for many years, allowing him to build up a large knowledge base of the US smaller companies universe.”

Yearsley prefers Matthews China Smaller Companies, although he acknowledges that it isn’t everyone’s cup of tea.

“Lots of investors have a downer on China after the government’s crackdown on various sectors last year, but small cap doesn’t tend to get affected by things that like. The fund is growth focused and operates in a country with a captive audience of over one billion people.”

Comments (0)