Hard Or Soft Landing: Which Funds Would Benefit?

The big issue facing investors at the moment is whether the economy will experience a hard or soft landing. Whichever way it plays out will have a huge impact on the performance of the different asset classes, so it is important that you are comfortable with the impact on your portfolio.

Most of the data suggests that a soft landing is the more likely of the two scenarios. In the US, which is the dominant economy to look at, growth has held up better than expected and inflation – although a little sticky – is on a clear downtrend.

The risk of interest rates being increased any further seems remote and the market has now adjusted to the idea of fewer cuts this year. Current pricing suggests that we could see a one percent reduction in the Fed funds rate by the end of 2024.

Soft Landing

A soft landing would require growth to slow enough to allow spare capacity to emerge, thereby allowing inflation to return to the Fed’s two percent target. The data suggests that this is what is happening, as core year-on-year US inflation has fallen to 3.8% from 5.5% in 2023 and 6.4% the year before, while unemployment has only shown a modest increase.

It is possible that the first rate cut will come in June, but the fact that it is on the radar is incredibly bullish for most risk assets. The biggest beneficiaries to date have been US growth stocks and Bitcoin, although the majority of asset classes should do well in this scenario.

There are lots of investment trusts to take advantage with a good example being the £1.5bn Allianz Technology Trust (LON: ATT) that has recently released its annual results. In the year to the end of December the tech specialist made an NAV total return of 46.3%, yet the shares are still available at a nine percent discount.

Tech Specialist

Lead manager Mike Seidenberg aims to identify fast growing companies that are trading at a reasonable valuation and that can benefit from the key macro themes. He has a structural underweight exposure to the mega-cap tech stocks that have been driving the market higher, as he believes that greater growth opportunities can be found in the mid and large caps.

Seidenberg thinks that the market rally can continue throughout 2024 and is optimistic about the long-term secular growth prospects for technology. In order to profit from this he has put together a 40-stock portfolio, where each of the holdings has the ability to deliver sustained growth over long periods from current or potential market leading positions.

The main risk of investing in a fund like this is that if we experience a hard landing the valuations might suddenly look awfully stretched and US growth stocks could experience a major correction. It all depends on how you see it.

Hard Landing

A hard landing would mean significantly weaker economic growth, a sharper drop in inflation, higher unemployment and a fall in company profits. In this sort of scenario, interest rates would be cut more aggressively, with share prices and corporate bonds coming under pressure and yield curves steepening rapidly.

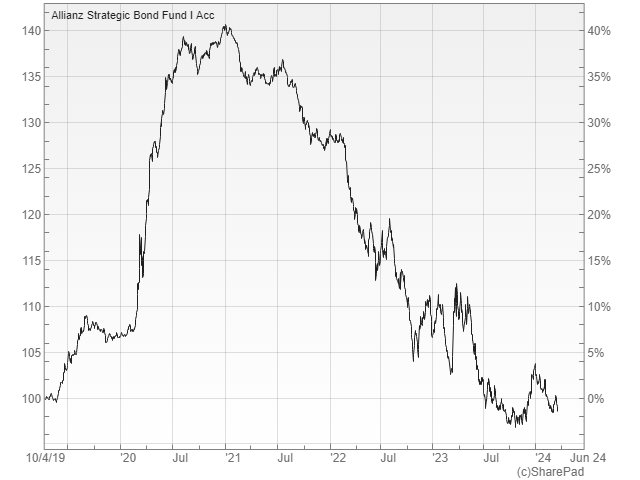

One fund that would benefit from this situation would be Allianz Strategic Bond, which invests across all the main fixed income markets with the currency exposures mostly hedged back to sterling. Manager Mike Riddell has positioned the portfolio for a recession with the assets almost fully invested in government bonds from around the world.

He has used yield curve steepeners to add to the effective duration, which currently stands at nine years and also has some bearish positions including outright shorts in risky assets. Scenario analysis suggests that the portfolio would perform well in a recession or crisis, so even if you don’t think this is actually what is going to happen, it could make a good diversifier for your other holdings.

Many mainstream outlets seem to be in the thrall of the mainstream media financial analysts who think that the Federal Reserve cutting interest rates is a given and that everything is going to be hunky-dory. Seventeen years ago America’s National Debt was under $10 trillion.

Reading analysts that do not buy that narrative would indicate that the Federal Reserve has very little room for movement after fifteen disastrous years for global Central Banks. America is already $35 trillion in debt and at the current rate of spending that debt will balloon to over $50 trillion in ten years time. The interest on servicing that debt will come to more than $2 trillion – so is the Federal Reserve just going to resort to more Quantitative Easing (free money) to bail out profligate America? The USA could become the next Japan, stuck in a cycle of stagnation with a debt to GDP ratio of over 250%. The US debt to GDP ratio was 124% in December 2023.

The only way to avoid disaster would be to balance the budget, something that no US President has been prepared to do this century. Almost every year Congress ends up voting through a budget comprised of more and more debt. They are piling up debt faster than GDP is rising to pay for it – the road to bankruptcy. The Magic Money Tree needs to be cut down and burnt for firewood.

Sooner or later, investors will wake up to this reality on the bond market and start demanding higher interest rates. The Federal Reserve will have to decide what it wants to do: print more money to sustain the bubbles in the AI stocks and the Big 7 on the S&P 500 and keep a few big businesses from going bust, or let real world economics collapse the house of cards that Central Banks have created over the last fifteen years.