Going for a song: will changes to streaming affect the music royalty investment trusts?

A recent report by the Digital, Culture, Media and Sport Select Committee concluded that streaming needs a complete reset, an outcome that could have major ramifications for the two investment trusts that specialise in music royalties.

Most of us now stream our music direct from the internet whenever we want to listen to it and although the most popular songs are downloaded millions of times the musicians only get a small proportion of the cash. The committee recognised the problem and recommended that the government look at ‘ways to provide performers with a right to equitable remuneration when music is consumed by digital means’.

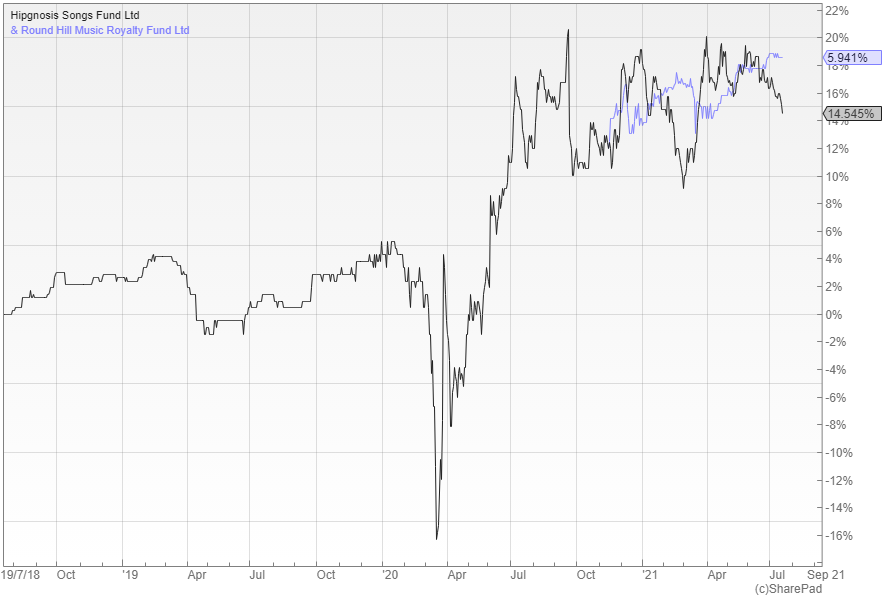

It seems unlikely that anything is going to happen quickly, but if there are changes the two investment trusts most at risk would appear to be Hipgnosis Songs (LON:SONG) and Round Hill Music (LON:RHM). They have both built up a portfolio of music royalties and make money each time one of the tracks is downloaded or used in some other way.

Royalty funds

Hipgnosis Songs was listed in July 2018 and has been back to the market a number of times since to raise extra capital to buy additional catalogues by different musicians. It now has a market value of around £1.5bn and has established a solid track record with the shares often trading at a small premium to NAV.

Round Hill floated in November 2020, but has also raised additional funds and now has a market value of £353m. It tends to invest in classic songs from the 1960s, 1970s and 1980s and benefits from an experienced management team that understands the music industry like Hipgnosis.

These types of funds are able to add value through the growth in streaming around the world, as well as by taking advantage of new licensing opportunities. The reliable nature of the underlying cash flows enable them to pay a decent dividend with Hipgnosis currently yielding 4.4% and Round Hill 4.3%.

Reaction to the report

Merck Mercuriadis, the founder of Hipgnosis Songs, has said that they are particularly focused on the full resetting of stream law to give songwriters and artists a fair share of earnings. As yet there has been no discernible impact on the share prices of either trust.

The broker Numis points out that it is too early to tell how these developments may look in their final form, or even if they will be enacted, but it has positive potential for the share of revenues for songwriters/artists. ‘It is ultimately a debate about splitting up the streaming pie and therefore there will be winners and losers depending on what exact ownership rights of a royalty is held.’

There is no doubt that total streaming revenues will continue to grow as new platforms come online and the industry reaches more people in the developed and emerging markets. This will provide a tailwind for both funds and even if a greater share of the money goes to the artists it has got to be in everyone’s best interests to make it a viable business for those that are at the very heart of it.

Why write that the trusts are at risk and then go on to indicate that those same funds could benefit from the changes. Confused.com!

i dont think you have read how Hipgnosis works.they go to the artist and with there lawyers and buy that artists song rights.in a lot of cases he also becomes a company advisor.so why would merck push for this if it was going to damage the trust.i have been with them as a shareholder from day one, and just cannot see where the risk from this is….tell me .