Could the tide be about to turn for Scottish Mortgage?

It has been another tough period for Scottish Mortgage (LON: SMT), with the £14bn investment trust reporting a 15% loss in the six months to the end of September, compared to a seven percent decline in the FTSE All World index. The long duration growth stocks that it focuses on have really suffered over the last year as a result of the sharp increase in interest rates, but it is possible that the worst could now be over.

Mangers Tom Slater and Lawrence Burns from Baillie Gifford have a bottom-up approach that they use to look for the best companies from around the world, although their search is shaped by the outlook for long-term structural growth trends. These currently consist of: digitalisation, as it broadens out into food, finance and enterprise; the merger of healthcare and technology; decarbonisation, with the evolution of transportation and the energy transition; as well as the catchall category of investing in pioneering companies.

The end result is a concentrated portfolio in which the ten largest holdings account for 42.1% of the assets. These include well-known names such as the biotech giant Moderna, electric car manufacturer Tesla, gene sequencer Illumina and ASML, which develops photolithography for semiconductors.

Updates and activity

Many of these stocks have experienced significant declines in their share prices, although the operational updates have been more positive. For example, the managers believe that Moderna’s technology will have applications well beyond the Covid vaccines, a view supported by Merck that has recently committed $250m to jointly develop a personalised cancer vaccine to treat melanoma, while Tesla has been able to sell every car it produces and continues to scale up its production capacity.

In the six months to the end of September additional funds were allocated around the decarbonisation theme with the recipients including Climeworks, which is developing technology to capture carbon direct from the air, as well as Northvolt. This private European battery producer is looking increasingly well-placed to supply the growing demand for electric vehicles.

Reductions were made to several Chinese holdings such as Alibaba and Tencent as a result of the country’s ever more challenging regulatory environment. However, the relative outperformance has meant that the allocation to this area has remained close to 16%, pretty much the same as it was at the start of the six month reporting period.

Outlook

Perhaps the most controversial aspect is the private element of the portfolio that has gone marginally above the 30% limit as a result of the sharp falls in the valuations of the listed holdings. There are obviously risks around this area, although it has been a key driver of the long-term returns, but it is important to understand that the fund will not be a forced seller as the 30% cap is based on the percentage at the time of investment.

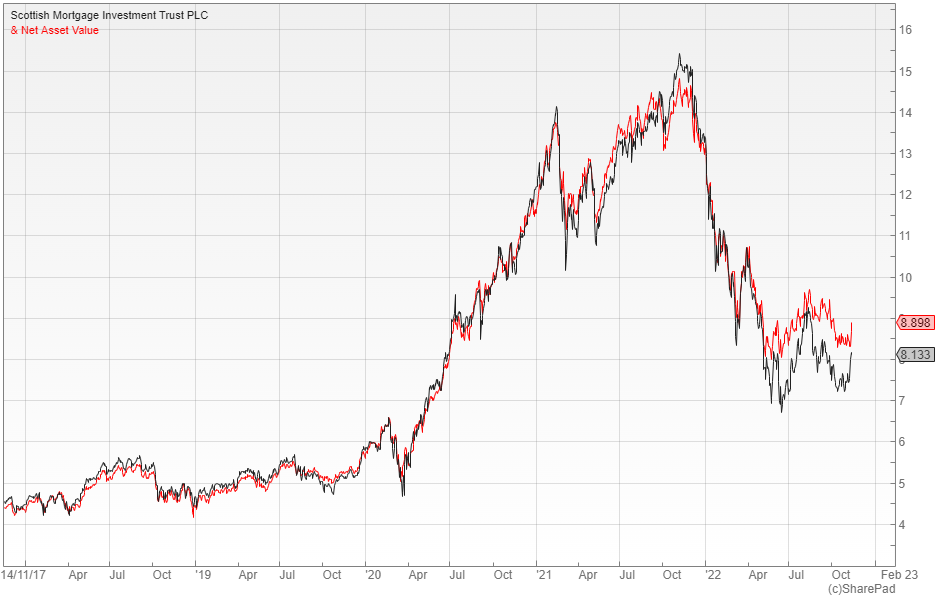

Scottish Mortgage’s shares are down nearly 50% from their peak in late 2021, yet over the ten years to the end of September the NAV is still up 528% versus a 208% increase in the FTSE All-World index. In the short-term the outlook will continue to be influenced by the path of interest rates, which may be closer to topping out than previously thought after the weaker than expected inflation data in the States last week.

The broker Numis says that the fund’s highly differentiated approach means that it warrants a material place in an investment portfolio and that buying a manager with a strong record after a period of weakness is generally a profitable strategy. SMT shares are currently trading on a discount of about seven percent, which is supported by an active approach to buybacks.

Comments (0)