Buying opportunity for the India Capital Growth Fund

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Investment trust discounts are narrow by historic standards, which makes the near 20% opportunity on the India Capital Growth Fund (LON:IGC) a standout trading buy.

The broker Numis has recently issued its investment trust recommendations for the year, and in this report they highlight how difficult it is to find funds that are available at attractive discounts. The broker has come up with a handful of trading buys to take advantage of the best opportunities, of which the India Capital Growth Fund (LON:IGC) looks to be one of the most interesting.

Numis describes IGC as an out-of-favour fund in an unloved asset class, namely Indian mid and small cap stocks. They believe that the wider than normal discount of 18% offers value, despite the fact that at £82m it might be too small to attract certain institutional investors.

In my recent article on the best and worst performing funds of 2019, I pointed out that the most surprising laggards in such a good year for the markets were the various single-country funds that invest in India. Many of these lost money, with India Capital Growth suffering more than most, but I felt that it had real turnaround potential and selected it as my fund of the month.

Noticeable de-rating

IGC has historically traded at a discount to NAV, yet the substantial sell-off in the Indian mid-caps that it invests in has resulted in a noticeable de-rating of the fund. Its performance in the last couple of years has been undermined by a credit crunch in the country, but conditions are now stabilising.

Once the Indian banks and non-banking financial companies start to increase their lending volumes in a meaningful way, it should enable the domestic economy to pick up. In such a scenario the mid and small caps that the fund invests in would be expected to be the major beneficiaries.

If the performance and the rating does not improve there is always a chance that the board may come under pressure to do something about it. IGC has the power to buy back up to 14.99% of the fund’s issued share capital and could use this facility to help close the discount.

Structural growth potential of the domestic economy

The fund management company, Ocean Dial, believes that the best returns from India will come from investing in well-managed businesses that can benefit from the structural growth potential of the domestic economy. In order to capitalise they have put together a 33-stock portfolio with the main sector exposures being financials, materials, consumer staples and consumer discretionary.

There are three other investment trusts that focus on India, but all of them have more of a large cap bias than IGC. Aberdeen New India (LON:ANII) and JPMorgan Indian (LON:JII) both have well-established track records, while Ashoka India Equity (LON:AIE) has only been around for about 18 months.

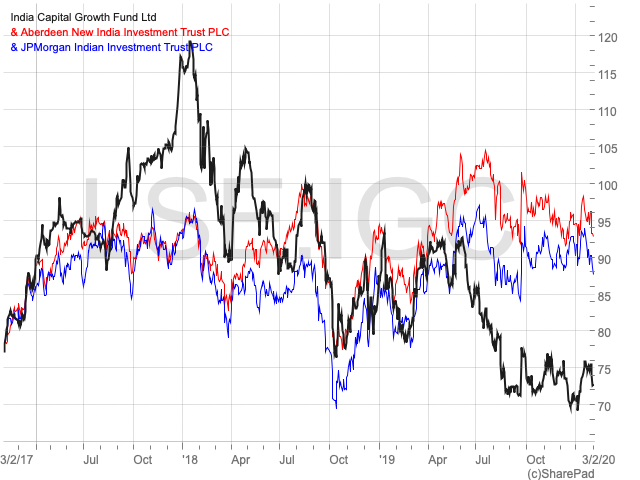

Up until 2018, IGC’s medium and long-term performance was the strongest of the three established funds, but since then its mid-cap focus has cost it relative to the larger cap portfolios of its peers. A chart comparing the three over the last three years gives a good idea of the scale of the potential opportunity.

Comments (0)