Why turnarounds could be ahead for these 2 FTSE 100 shares

While the FTSE 100 may have fallen by 12% in the last five months, a number of its constituents have experienced far greater woes. Imperial Brands (LON:IMB), for instance, is down 18% during the same time period. Rolls-Royce (LON:RR), meanwhile, has dropped 26% in the last five months.

Both shares, as well as the index, could experience further declines in the near term. Risks to the global economy remain in place, with the prospect of rising US interest rates and a potential trade war likely to hold back investor sentiment to some extent. In the long run, though, the two stocks may offer turnaround potential.

Short-term challenges

As seen in Master Investor Magazine – sign-up now for free! |

Although the Federal Reserve is now expected to raise interest rates twice in 2019, having previously been due to increase them three times, a tighter US monetary policy could prompt investors to become increasingly cautious. There are already concerns about the prospects for the Chinese economy, which is showing signs of a slowdown in its growth rate. Should a higher interest rate cause the US economy to do likewise, it could lead to deteriorating investor sentiment in the near term.

Furthermore, trade tensions between the US and China continue to be relatively high. It would be unsurprising if further tariffs on imports are put in place over the course of 2019. Even if they are not, previously announced tariffs are already expected to reduce global GDP growth by around 50 basis points by 2020. The prospect of this figure increasing may mean that the internationally-focused FTSE 100 experiences continued volatility in the short run, with a bear market being a distinct possibility.

Buying opportunities

Lower share prices, of course, may present buying opportunities over a long-term time horizon. In the case of Imperial Brands, the company’s financial outlook is arguably more opaque than it has been for a number of years. Consumers are becoming increasingly concerned about wellness, which is leading a transition away from cigarettes and towards reduced-risk products such as e-cigarettes.

During the transitionary period, Imperial Brands and its industry peers are likely to see further cigarette volume declines. This, though, is likely to be offset by cigarette price rises, while next-generation product sales could provide a long-term catalyst as they become increasingly popular among consumers. With the company having a P/E ratio of 8.8, regulatory risks now appear to have been priced in by investors following the company’s share price fall.

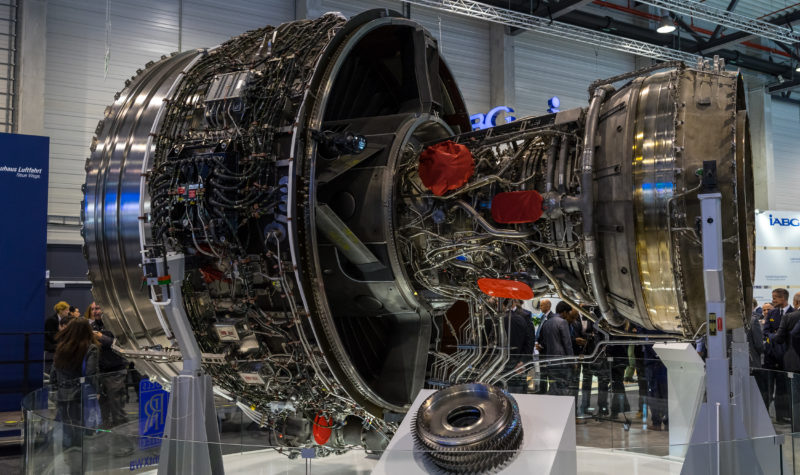

Similarly, Rolls-Royce appears to have sound long-term growth potential. The company is making significant headcount reductions as it seeks to become increasingly efficient. It may benefit from increasing defence spending in the US and across much of the developing and developed world.

The company is also set to diversify its aircraft engine operations over the long run. It plans to eventually provide engines to narrowbodied aircraft alongside widebodied aircraft. This is set to significantly increase its total addressable market at a time when the aerospace industry is experiencing rapid growth.

Although both companies may experience further uncertainty in the short run, over an extended time period they have the potential to deliver successful turnarounds.

Comments (0)