Small Cap Catch-Up: On The Move Again

TClarke (LON:CTO) – The UK’s Leading Engineering Services Group Doubles Its Order Book

The latest Trading Update, issued last Thursday morning, from this specialist electrical and engineering services provider commented upon how its Management saw the balance of the trading year in its last month.

It was actually very impressive, especially on the Order Book front, boasting of its high-quality contracts that have doubled in the last year.

As at the end of October its forward bookings totalled over £1.1bn against the £555m as at end December 2022.

Understandably orders were some 10% lower from its residential sector customers, however its facilities management business was 18% higher, its infrastructure sector business is 38% better, while the two sectors really piling in the new business were from engineering clients up 117% and its technologies orders, taking in data centres, was a massive 220% higher.

That good news was improved by the group stating that it is currently tendering for another £1bn of potential business.

The contracts and the pipeline should give investors a clear signal that the group’s turnover will be on the rise over the next couple of years or so.

Set up in 1889, this group has expanded well over the years.

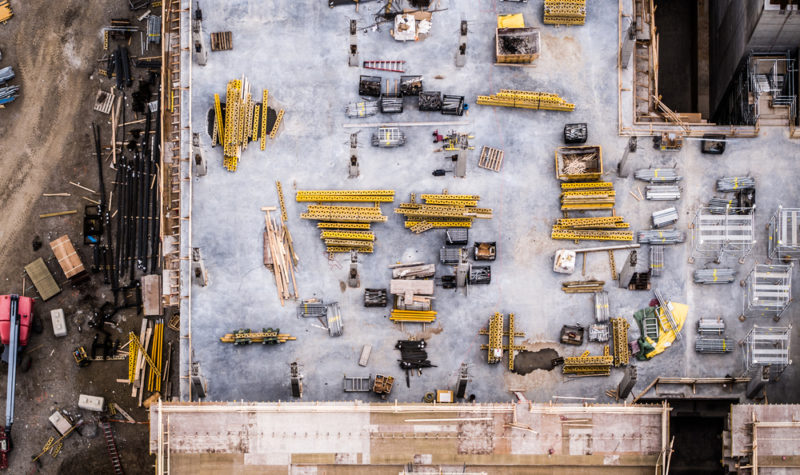

Today it engages in the design, installation, integration, and maintenance of the mechanical and electrical systems and technologies in the UK.

The company also provides mechanical and electrical contracting and related services to the construction industry and end users.

In addition, it offers engineering services, such as offsite prefabrication, preassembly, and design standardisation; smart buildings technologies and data centres technology solutions; infrastructure services in the areas of healthcare, education, defense, and public sectors; hotels, affordable homes, private residential, and student accommodations; and facilities management services.

Despite the strength of the forward order book, the company’s Management is cognisant that the turbulent prevailing construction sector environment is impacting a number of market participants.

It has, therefore, made strategic decisions to preserve the business’s strong market and financial position, including putting together a number of early contract agreements, while also changing of some of its supply chain partners mid-contract in order to protect project completion dates.

Reflecting the contents of the Update, analysts Andrew Gibb and Guy Hewett at Cavendish Capital have eased back their current year operating profit estimates, from £12.2m to now between £9m-£10m.

For the next year to end December 2024 they look for £600m revenues (£500m est), generating some £18.6m EBIT, worth £17.1m adjusted pre-tax profits against some £7.2m estimated for this year.

Those estimates would see 12.7p of current year earnings, more than double covering a 5.9p dividend per share.

For next year they work out at 24.1p earnings and 6.5p dividend.

Jumping ahead to 2025 the analysts have £650m for group sales, £20.6m EBIT, £19.1m profits, worth 26.9p earnings with a 7.1p dividend per share.

The analysts consider that the valuation of the group’s shares is materially underestimating its long-term potential, its market and its financial position.

They have a Price Objective of 197p on the group’s shares, which closed at 121p.

I really like the shares of this group, I would like to think that they are capable of rising from these current levels to at least 150p over the next few months.

Even at that price (150p) they would be trading on 6.2 times 2024 estimated earnings, then only 5.6 times those for 2025, while paying out well over 4% in its yield at 150p.

I now set a new Target Price of 150p for 2024.

(Profile 10.12.19 @ 120p set a Target Price of 165p*)

Vertu Motors (LON:VTU) – An Extremely Easy Task?

Interesting to note that Cinch Holdco UK is still adding to its share stake in this multi-franchise motor retail colussus.

They peaked at 88p this year, with the group’s shares closing last week at almost 85p, on the back of some nosey buying.

Having jacked up its holding by 50% in the last week, Cinch now holds 20.69m shares in Vertu, representing some 6.07% of its equity.

I wonder why?

(Profile 12.10.20 @ 30.5p set a Target Price of 40p*)

Costain Group (LON:COST) – 69p Looks Easy But Not 250p!

Well, they have done my 2023 earmark, closing at 63p on Friday night.

Now the next attempt must be to penetrate the 2021 aspiration of 69p, which actually looks very achievable in the close-term.

However, I am afraid to say that I may never see my 2019 Target Price being achieved.

Even so there is still some upside left in the share price of this infrastructure construction group, which is not to be ignored.

(Profile 05.09.19 @ 155p set a Target Price of 250p)

(Profile 02.08.21 @ 55p set a Target Price of 69p)

(Profile 24.08.23 @ 50p set a Target Price of 62p)

Time Finance (LON:TIME) – Ticking Slowly Over The 40 Barrier

After having touched 37p subsequent to my latest Profile (at 32.5p) on the company, the shares eased back to 33p ahead of some much busier trading.

They closed the week at 36p.

This really does have the feel of a 40p plus price being achieved very shortly, even then they would still be cheap.

I still think that they could offer a useful Christmas punt.

(Profile 23.12.20 @ 21.5p set a Target Price at 30p*)

(Profile 07.01.22 @ 23.5p set a Target Price at 30p*)

Cohort (LON:CHRT) – A More Than Defensive Investment

Stand by for the Interim Results being announced on Wednesday 13th December from this defence-sector supplier.

With an order book of close to £400m, it has recently been picking up some useful new contracts and is said to be trading ahead of market expectations.

The £213m capitalised group saw its shares close the week at 514p, while the consensus Price Objective is over 675p.

(Profile 06.08.19 @ 446p set a Target Price of 607p*)

Billington Holdings (LON:BILN) – Moving Higher In A Tight Market

Just look at them go – the shares of this structural steel products group have enjoyed a very good run up over the last couple of weeks or so.

Rising from 280p just over a month ago, they hit a useful 420p late last week, probably accentuated by the fairly tight market in the group’s equity.

I have already clearly stated that this is one of my favourite companies in the small cap sector – its share are an excellent Hold.

(Profile 02.04.19 @ 266p set a Target Price of 314.5p*)

(Profile 13.06.22 @ 217.5p set a Target Price of 295p*)

Frasers Group (LON:FRAS) – Is His Plan Coming Together?

They are halfway there!

On the 28th July this year I Profiled this retail empire, despite it being way out of my normal self-imposed research remit,

” Even with the shares closing last night up 20p on the day at 798p, I really do feel that they are wrongly priced and more than capable of driving ahead above the 1000p level and soon. That is my Target Price.”

The shares hit 903.50p last week, which although having shown a useful 13% advance already, it is still only halfway to my Target Price.

They closed the week up 15.50p on the day at 899.50p

I remain convinced that this aim will be achieved within the early part of 2024, still being impressed by Mike Ashley’s share stake build-up programme in other retail sector notable names, like Currys, ASOS, AO World, Boohoo etc.

Could 2024 be the time for him to pull his various shareholdings together?

(Profile 28.07.23 @ 798p set a Target Price of 1,000p)

Journeo (LON:JNEO) – Moving Well

The shares of this transport solutions group really have got the taste.

They closed 1.35% better, up 26p on Friday at 255p, after hitting 260p.

That was on the back of over four times the average daily dealing volume being transacted.

(Profile 07.04.21 @ 95.5p set a Target Price of 120p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)