Small Cap Catch-Up: Media Buying, Iodine and Defence

Ebiquity (LON:EBQ) – Looking For A 40%+ Uplift In Price

In the world of media investment analysis this £62m group is one of the market leaders.

Over 70 of the world’s top 100 advertisers choose the company as a trusted independent media advisor. It harnesses the power of data to provide independent, fact-based advice, enabling brand owners to perfect media investment decisions and improve business outcomes.

The data-driven solutions company provides independent, unbiased advice and solutions to brand owners helping to drive efficiency and effectiveness from their media spend, eliminating wastage and creating value.

Its clients are served by more than 500 media specialists, covering 80% of the global advertising market.

It has the most comprehensive, independent view of today’s global media market, analysing $55bn of media spend from 75 markets annually, including trillions of digital media impressions.

In the group’s 2022 trading year to end December it improved revenues by 20% to £76.0m (£63.1m) and impressively it lifted its adjusted pre-tax profits by 95% to £8.0m (£4.1m), raising its earnings 98% to 5.4p (2.7p) per share.

Analyst Fiona Orford-Williams at Edison Investment Research is looking for current year sales to increase to £85.5m, taking profits up to £11.1m with its earnings rising to 5.6p per share.

For next year her figures show £96.5m revenues, £13.7m profits and earnings of 6.5p per share.

She has a 73p valuation out on the group’s shares, which are currently only 51p.

At that price I rate the shares as offering an interesting play into the powerful media sector and especially so as they trade on a big discount to peers elsewhere in its sector.

(Profile 05.11.19 @ 43p set a Target Price of 75p)

(Profile 03.02.21 @ 20.5p set a Target Price of 27p*)

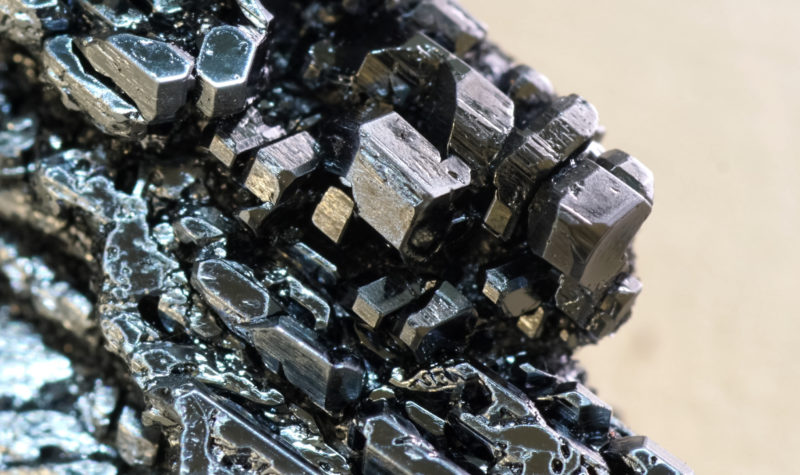

Iofina (LON:IOF) – Heading Higher

This group, which specialises in the exploration and production of iodine and also in the manufacture of specialty chemical products, reported progress in the first quarter of this trading year.

Demand for the company’s iodine has remained strong, while it has been expanding its customer base – helped by a steady iodine spot price of $70 per kg.

It has been a good start to the year in terms of both iodine production and sales of its products.

The company, which is the second largest producer of iodine in North America, remains on track to boost its iodine production in the second half.

Later this month the £57m company should be reporting its 2022 final results.

Analyst Alex Brooks, at Canaccord Genuity Capital Markets, rates the shares as a Buy, looking for a recently raised objective of 40p.

His estimates for last year are for $42.5m ($39.0m) sales with an EBITDA of $11.0m ($6.9m), lifting earnings up to 3.4c (2.5c) per share.

For the current year he sees $47.2m sales and EBITDA of $13.0m, worth 4.2c earnings.

The shares at 29p look to be very capable of rising further in the short-term.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p*)

Ramsdens Holdings (LON:RFX) – Some Good Upside

Earlier this month my eye was caught by a newspaper comment headed ‘One million people turn to loan sharks as bills spiral’.

That is sad news indeed, however it really highlights the prospects for well-managed and law-abiding companies within the money-lending sector.

Based in Middlesbrough, the £73.5m capitalised Ramsdens group is a growing, diversified, financial services provider and retailer, operating in the four core business segments of foreign currency exchange, pawnbroking loans, precious metals buying and selling and retailing of second hand and new jewellery.

It operates from 160 stores within the UK and has a growing online presence.

Ahead of announcing its interims on 7 June, the company recently updated investors on its trading for the first-half year to end March.

During that period, it continued to make very good progress across each of its four key business segments, as well as against its broader long-term strategic objectives.

It reported that it delivered a strong performance across its key income streams and now expects the 2023 year’s pre-tax profits to be not less than £9.5m (£8.3m).

That news certainly perked up analyst James Allen at Liberum Capital, who rates the shares as a Buy, raising his price objective by 20p to 280p in the process.

He is estimating £77.1m of sales this year to end September, against £66.1m last time, taking profits up to £9.6m, worth 23.0p (20.7p) per share in earnings.

With its shares trading at around 232p I do feel that they are offering some good upside ahead of its Interim results in just under two months.

(Profile 07.11.19 @ 204p set a Target Price of 250p*)

Crimson Tide (LON:TIDE) – Looking For More Good News

With a market capitalisation of £20m this company may look massively overvalued.

It has a tiny turnover, just £5.4m for 2022, but that was up a useful 30% on the year.

A bonus point, as far as I am concerned, is that its annual recurring revenue is now running at £5.75m, after the provider of the ‘mpro5’ Smart App Solution, secured a number of significant contract wins in the utilities and retail sectors.

Those ARR contracts cover a 36-month period, many of which are frequently extended.

What is more it has now established a US pipeline, which should enable it to secure even more business for its growing order book.

The mpro5 is delivered on smartphones and tablets, enabling organisations to digitally transform their business and strengthen their workforce by smart mobile working.

Lorne Daniel at finnCap has a 5p price objective out on the group’s shares.

He is looking for the current year to end December to increase sales to £7.1m, while helping to reduce the 2022 adjusted pre-tax loss of £1.6m down to break-even this year.

For 2024 he estimates £10.5m revenues and a significant £2.3m profit, worth 0.3p per share in earnings.

The growth is steady and in due course Daniel’s aim my well be achieved.

The shares closed last night at 3.05p and look capable of edging up through the 4p level fairly soon. Further good news could tip them even higher in due course.

(Profile 08.10.19 @ 2.8p set a Target Price of 5p)

Cohort (LON:CHRT) – A Buy Ahead Of Its Results?

On Wednesday of this week, analyst Mike Jeremy at Equity Development reiterated his opinion about the group of six defence and technology focussed companies.

Following recent contract extensions at a couple of the group’s main subsidiaries, he raised his estimates for the current year to the end of this month.

He is now looking for £190m group’s revenues to lift to £165.0m (£137.8m), with adjusted pre-tax profits improving from £14.7m to £17.5m, taking earnings up to 35.0p (30.9p) and covering a 13.4p (12.2p) dividend per share.

For the coming year his estimates are for £174.4m sales, £19.9m profits, 36.8p earnings and a dividend of 14.7p a share.

At the current 453p the group’s shares have at least a 10% uplift as a possibility before its results are declared in late July.

But before that we may well see a positive Trading Update at the end of next month helping to boost investor action.

(Profile 06.08.19 @ 446p set a Target Price of 607p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Special Note

If you are attending The Master Investor Show please introduce yourself to me so that we can chat.

Comments (0)