Harvey and Irma: A message for investors

Hurricane Harvey brought biblical floods to Houston. Ten days later, Hurricane Irma devastated the Caribbean. Were these freak storms the direct consequence of man-made climate change? What lessons can we learn to prepare for extreme weather events in the future? Who will be the key players in a world of freak weather? And can the insurers cope with this new level of risk?

Harvey: a biblical flood

Hurricane Harvey was one of the wettest storms in recent meteorological history. In a matter of hours it dumped some nine trillion gallons (41 trillion litres) of rain on Houston and south eastern Texas. In a single day 24 inches (61 centimetres) of rain fell. Over the six days of the storm from Saturday, 26 August to Thursday, 31 August one rain gauge recorded 50 inches (127 centimetres).

Houston is one of the wealthiest cities of the world’s richest country yet the level of flooding was unprecedented. The good news was, however, that there were “only” about 38 fatalities because the city and its people were better prepared than ever – many fewer than the 1,500 or so souls who perished in Hurricane Katrina when it hit Louisiana in August 2005, and fewer fatalities even than Superstorm Sandy which struck New York in November 2012 with the loss of 75 lives.

Houston is flat and low-lying with sprawling suburbs. Its highways turned into torrential rivers – exactly as they were designed to do as, in a flood, they serve as massive drains. The city has a network of 2,500 waterways, drainage channels and sewers. Water had to be released from the two reservoirs which overflowed for the first time.

Texans are now clearing up the mess. But rich countries are less at the mercy of the weather gods than poor ones…

Meanwhile in the Brahmaputra basin…

While Harvey raged in Texas, north eastern India, Nepal and Bangladesh were hit by unusually severe monsoon floods. At least 1,200 people died and millions were left homeless. 2017 has proven an unusually wet year in the Brahmaputra basin. Parts of the Indian state of Meghalaya have received over 11 metres of rain over the last year – making it the wettest place on the planet.

Some estimates claim that 12 million people may have abandoned their homes in the Indian state of Bihar alone – and another 11 million people in Bangladesh. 6,000 square kilometres of crops were damaged. And on the other side of the sub-continent on, 29 August, 33 centimetres of rain practically shut down Mumbai for a day.

Sadly, natural disasters on this scale are not infrequent here. In 2007 floods killed 3,300 people in India and Bangladesh and in 2013 6,500. In the last half century Bangladesh has experienced catastrophic floods in 1974, 1987, 1988 and 1998. Strangely, in recent decades most monsoon rains have been below average in quantity; this year was more of a return to “normal”.

Some estimates claim that 12 million people may have abandoned their homes in the Indian state of Bihar alone.

A study by Indur Goklany, a scientist of Indian heritage who works for the US Department of the Interior, analysed 8,500 extreme weather events – droughts, wildfires, storms and floods -over the last century. He found that in the 1920s there were nearly 500,000 deaths annually from extreme weather events.

Since then, the world’s population has nearly quadrupled yet global deaths from freak weather have plummeted by 93 percent and from flooding by 99 percent. The cyclone that hit Bangladesh in 1974 killed between 300,000 and 500,000 people. The most recent severe one in 2007 killed “just” 4,234. Even developed countries experienced severe loss of life until relatively recently. The North Sea Flood of January 1953 took over 2,500 lives in the Netherlands, England and Scotland.

How has this reduction in fatalities been achieved? Governments have constructed effective flood defences in the form of levees, ditches and shelters. And, of course, the development of modern communications systems, better weather forecasting and education have facilitated risk management. As economists like Dr Goklany see it, the real killer is not Mother Nature but poverty.

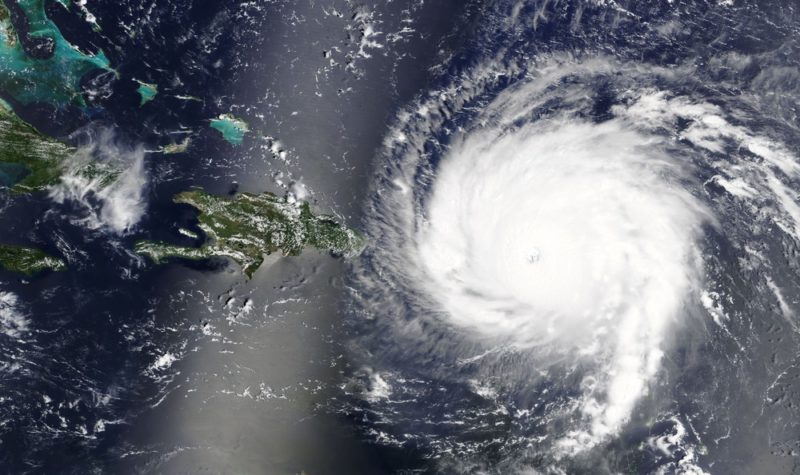

Irma: the wrath of Gaia

According to Météo France, the Category Five super-storm generated winds averaging 295 kilometres per hour (183 mph) for more than 33 hours, longer than any cyclone of comparable power ever recorded. In fact, Irma reached Category Five in the mid-Atlantic before it even arrived in the Caribbean, which is unheard of. Its only rival is Typhoon Haiyan, which left more than 7,000 people dead or missing in the Philippines with winds of nearly 300 kilometres per hour for 24 hours in 2013.

To grasp its deadly scale and scope, take a look at the Guardian’s video about Irma’s path of destruction.

The cost

Various estimates have been advanced for the amount of damage rendered by Hurricane Harvey. The Governor of Texas, Greg Abbott, announced on 31 August that the State will need US$125 billion to recover from the disaster, including disaster assistance payments to be offered to more than 90,000 people. More than 100,000 homes were destroyed. America’s largest oil refinery at Port Arthur was closed down for several days causing the price of fuel to rise across the nation. And on 12 September the Financial Times put the cost of damage wrought by Irma in Florida alone at over US$100 billion.

As countries get more prosperous so the cost of storm damage increases. Those executive homes in down-town Houston were full of designer furniture, advanced appliances and up-to-the-minute smartphones; the shacks destroyed on the outskirts of Kathmandu contained few valuables.

Should we blame climate change?

Man-made global warming, on account of CO2 emissions from burning hydrocarbons, has almost certainly raised the sea temperatures over much of the planet. That, in turn, has caused more water vapour to be held in the atmosphere through evaporation. More water vapour means more storms. The Clausius-Clapeyron relation states that, for every one degree Celsius of warming, the air will hold seven percent more moisture.

Moreover, rising sea levels – tangible in the Gulf of Mexico – reinforces sea surges during storms. So there is a strong scientific argument to say that global warming has caused extreme or “freak” weather events to take place more frequently; and that when they occur, they are more extreme. In statistical terms, there is greater variability: technically the probability distribution has longer tails.

Having said that, it is just not possible to say with any scientific integrity that Harvey and Irma were caused by global warming. Extreme weather events occurred long before mankind made much difference to the amount of carbon dioxide in the atmosphere. Harvey and Irma might indeed have happened without man-made climate change.

The Earth was never a safe place to live on. Hydrologists tell us that, historically, gargantuan floods on the Nile[i] and the Colorado River were more common than we once thought. There is simply insufficient data to link specific weather events with long-term trends. Interestingly, according to one estimate, Harvey was only 15th in strength out of all the hurricanes that have hit the USA since 1851.

But we can say with good reason that it is probable that the frequency of such extreme events will increase as time goes by. So that, a once in a century event before, may occur four times in a century now – though we cannot make any such precise assertions with any degree of accuracy. Houston has now experienced three once-in-500-year floods in the space of 40 years: 1979 (Claudette), 2001 (Allison) and now Harvey. To adapt the FCA (Financial Conduct Authority) cliché: past rainfall is not a guide to future flooding.

It is not meaningful to compare, say, weather data recorded over 2010-15 with weather data recorded over 1960-65. Forecasting future flood events with any accuracy is therefore virtually impossible. Just to confuse the debate further: America has actually experienced fewer storms than is historically “normal” over the last decade.

What do the insurers make of it all?

One insightful view is to be obtained by looking at how insurance premiums respond to these events. An insurance premium is the price of getting insurance cover against a particular eventuality, based on the insurer’s estimation of the probability of that eventuality over a given time frame (normally one year).

An economist would say that an insurance premium is not purely the cost of risk because it is influenced by exogenous variables. These would include the state of competition in the insurance market; the cost of doing business (labour rates, taxes, overheads and so forth); and the minimum necessary return on capital required by insurance companies. (The latter will be influenced by the overall level of investment returns in the economy – complicated by the fact that insurance companies are also investment companies).

Claims data has been garnered by the reinsurers (the uber-grey suits who insure the insurance companies themselves). According to the German re-insurer Munich Re (BIT:MUV2) the number of extreme weather events has increased from about 200 in 1980 to over 600 last year. Rich countries like America have deep insurance markets: but developing countries are under-insured. Swiss Re (VTX:SREN) reckons that of the US$50 billion of losses attributed to extreme weather events in Asia in 2014, only about eight percent were insured (as compared to an estimated 40 percent in Texas).

And America has a counter-intuitive flood risk insurance regime. The National Flood Insurance Programme (NFIP) – now US$25 billion in the red – subsidises the insurance premiums of homes at risk of flooding. Everyone living in a flood plain with a one percent chance of flooding annually and holding a mortgage guaranteed by Freddie Mac[ii] is obliged to purchase NFIP cover. That incentivises house builders to construct new homes on flood plains and discourages home-owners from investing in flood defences. In the US, one percent of homes that regularly flood account for 25-30 percent of all flood insurance claims.

According to the German re-insurer Munich Re the number of extreme weather events has increased from about 200 in 1980 to over 600 last year.

Nearly 20 years ago, the US National Wildlife Federation issued a report on this subject, Higher Ground. It argued that federal flood insurance was amplifying the impact of storms by encouraging Americans to build and rebuild in areas prone to flooding. Higher Ground identified a home in Houston that was valued at $114,480, but which had been flooded 16 times and had received $806,591 in federally subsidised flood insurance payments[iii].

Government subsidies distort markets. It might be better for all if home-owners in the USA paid market rates for home insurance as they do in the UK. But in Britain until recently many of those who live in flood hot-spots, like the residents of Yalding (a village on the River Medway in Kent), could not get insurance cover at all.

Because flood risk is concentrated on specific areas it is more difficult for insurers to spread the risk. That is why the UK government set up Flood Re in 2016. This scheme is designed to keep flood insurance affordable, financed by a levy on all insurers. Flood Re excludes flood-prone houses built after 2009, thus concentrating the minds of house builders.

Flood risk is notoriously difficult to model. Many of those who were inundated by Harvey lived outside the flood plain. Hence the rise of specialist risk modelling firms such as Risk Management Solutions, and JBA Risk Management, both fascinating private British companies the websites of which are well worth a visit. Aon PLC (private) is one insurer that has set up its own climatic modelling department.

What we can and can’t do

What we can do is to adapt intelligently to climate change while trying to develop the most efficient forms of energy permitted by the constraints of physics. Climate change is an energy problem: all activities which create carbon emissions – transport, aviation, agriculture, industry, electricity production and so forth – consume energy.

And cities that are at risk of flooding should have flood defences at least as good as those of Houston. Our benchmark should be the Netherlands. The Dutch have been reclaiming land from the sea since the 13th century. Since the calamity of 1953 the country, much of which is below sea level, has built an unrivalled flood protection infrastructure with around 3,000 kilometres of outer sea-dikes and 10,000 kilometres of inner river dikes and canals. Satellite technology and remote water-level sensors have been deployed in order to improve forecasting. A major player in Dutch flood risk management is VBA, a joint venture between Volker Stevin (private), Royal Boskalis Westminster NV (BMV:BOKAN) and Atkins (OTCMKTS:WATKF).

Some will say: But Bangladesh cannot afford Netherlands style flood defences. That is precisely why we should support policies that are conducive to economic growth in developing countries. And the best way “to aid” developing countries is to buy their products.

On current trends, by 2050, the people of Bangladesh, who had a GDP per capita of US$1,538 last year, will enjoy levels of prosperity comparable to some south European countries. As such, they will be able, year on year, to invest in better flood defences. In the same way steady investment in sanitation has slashed the number of deaths in Bangladesh from communicable diseases over the last 30 years or so.

As I have been arguing in these pages, what we can’t do is to cut our carbon emissions to zero – even over the 50 years envisaged by the Paris Accord – without drastically reducing our living standards and blighting the chances of people in developing countries of ever getting out of poverty.

There is no need to panic. The most important message from Harvey, Irma and the south Asian monsoon is that we must not allow extreme natural events to turn into man-made disasters.

[i] For statistical theorists, Benoit B Mandelbrot’s ideas about market behaviour set out in his classic book The Misbehaviour of Markets (2005) drew extensively on the work of the early 20th Century English hydrologist, Harold Edwin Hurst. Hurst spent most of his career studying Nile floods. Mandelbrot’s ideas have greatly influenced Nassim Nicholas Taleb (The Black Swan etc.).

[ii] Federal Home Loan Mortgage Corporation. Also, Fannie Mae – the Federal National Mortgage Association. These are US federal agencies which act to help home-buyers obtain mortgages.

[iii] See: https://fee.org/articles/how-the-government-turns-natural-disasters-into-catastrophes/?utm_source=FEE+Email+Subscriber+List&utm_campaign=f459569ff2-MC_FEE_DAILY_2017_09_12&utm_medium=email&utm_term=0_84cc8d089b-f459569ff2-108421105

What nonsense that burning fossil fuels has warmed up the oceans. The Gulf is supposed to be 1.8 degrees warmer than normal and you would have thought would that would have triggered a whole series of Hurricanes one after the other so far we have only had 4 and in 2005 15 hurricanes were created, Man’s energy usage globally in one year only equals globally one hour of sunshine. Man has no impact on climate. It is the Sun.