GKN driving ahead

GKN at 327p after last week’s good news on UK motor production figures…

The GKN (Guest Keen & Nettlefold, as it used to be properly known when a steel production company) share price last seen was 327p. That is now 16% down on this year’s earlier peak of 389p.

What prompts me to give it a further inspection are the reports of UK car production numbers looking strong; an event which, incidentally, tells us something bullish about the state of demand in the UK economy. The UK vehicle engine sector seems to be doing robustly, as it has been since earlier this year. It is reported that more than one million engine units were produced in May. That was down 4% but that seems to be due to new plants gearing up for new demand for low emission engines, which seems to be driving (no pun intended) stronger European demand through UK exports. In the UK, domestic demand (as opposed to total demand) for cars was up a reported 2.3% in May with exports generally seeming to hold level whilst demand from Europe specifically seems to be recovering strongly.

Naturally, we need to give a glance towards the Greek problem because of the knock-on effect for mainly Eurozone banks, which hold Greek so-called sovereign debt. In my case, to repeat the argument, there are two considerations here. First, I think that a deal will be done for reasons of geo-political self interest. Second, because the Greeks want to stay in. Third, because the Germans know the EEC is the best thing that could have happened to their ability to export. Four, because governments in Eurozone Europe want to avoid the aforementioned damage to Eurozone banks and GDP growth, which has started to show a bit of colour in its sickly cheeks after a period of decline.

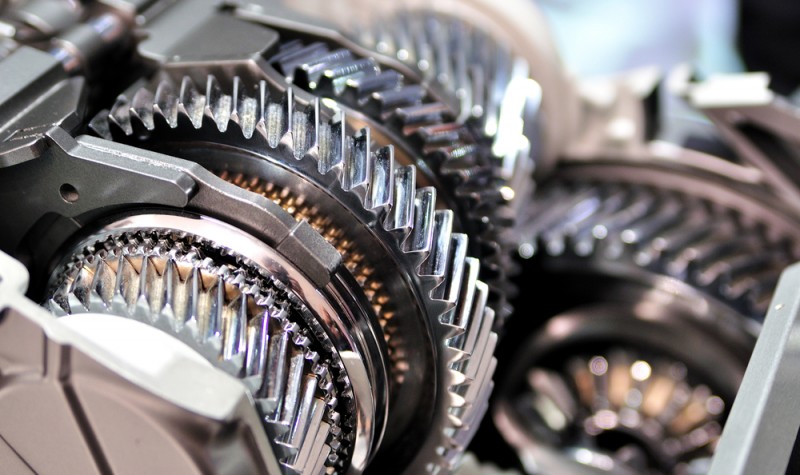

Turning to GKN (GKN), although it is by diversification as much an aero aviation engineering company as it is a specialist motor vehicle system designer and producer, the motor side is still very important to its performance and to investment perceptions.

The share price (last seen) was 323p, having fallen 12.5% over a month and nearly 8% over a year. The share price this year peaked at 389p. “Technically” speaking, the chart may be approaching a three year support level; the same picture appears in a five year chart also. (Have a look.) Shorter term, since January 2015, the share price appears to have just bounced of a downward sloping support level. Because technical charts depend on individual interpretation have a glance at that as well.

So what value at this price? Looking at the recent published statutory accounts, there is on the face of things much to celebrate. Top line sales revenue last year to December 2014 was down 2.2%; not helpful when the debt equity ratio is 62%. In any event, bottom line net profits handed in a decline of more than 50% last year. However, in the undergrowth of the accounts one finds something more encouraging amidst the greenery of cash and cash flow. Despite the massive fall in reported net profits, the business remained healthily cash flow generative.

Operating cash flow last year fell only 7% to £658 million and that was enough to finance £391 million of investment and an annual dividend payout of £133 million (an increase of nearly 10%) and leave a surplus to help raise the year end company cash reserve by 55% to a reported £317 million.

The company has evidently been investing in an innovative drive line product for the US market and a new regional HQ for the ‘Americas’. Some analysts are looking for a surge in this segment.

Overall, the market consensus estimates that for the group as a whole, in contrast to the reported statutory figures for last year, comparable earnings fell only 1% last year. However, it also estimates a drop of 9% in earnings this year with a recovery of 9% next year. With a decline for the current year already discounted, an improvement in car production looks positive for the GKN share price after its fall. At the moment, the market consensus puts GKN shares on a PER of 11.8 times this year’s estimated earnings and 10.7 times next year’s estimated earnings. Dividends are also forecast to rise so that the prospective estimated annual dividend for this year of 2.8% and next year 3.0%.

To conclude, GKN exhibits an interesting technical situation supported by good industrial news and valuation.

Comments (0)