Waiting For Goldot

Almost all – but not quite all – in the mining world seems to be on hold. Most projects I’ve discussed from time to time which looked promising have run into the funding (lack of) quicksand, despite that the long term commodity boom forecast to meet shortages in key ‘clean, green’ materials might already be starting.

Or is it ? It certainly looks stuttering, its strength up to recently caused by the dollar’s weakness over the last four months (showing commodities at world prices to appear strong against it) in contrast to the strength it was showing for 18 months before that. It is now reversing again, with many investors seeming to forget that, for example with gold always quoted in US dollars whereas production is mostly in a foreign currency, movements in gold’s (or other commodities’) dollar price don’t reflect the real demand for it or its mining cost.

So mining is faced with uncertainties from lack of funding and rocketing interest rates at the same time as erratic prices, so even the greatest minds would struggle to predict what happens next. Some fund managers, certainly, are making extremely gloomy predictions of a major world recession.

In addition to a drought in funding, there are stories of frightening cost increases which threaten to overturn all those economic studies which will have supported whatever funding those miners were hoping for.

So are any of them still worth holding ?

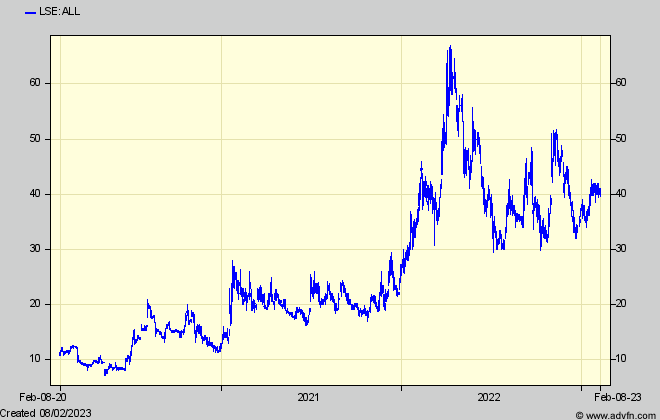

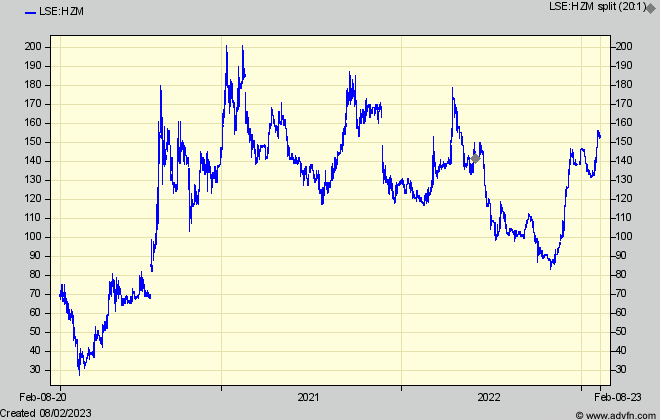

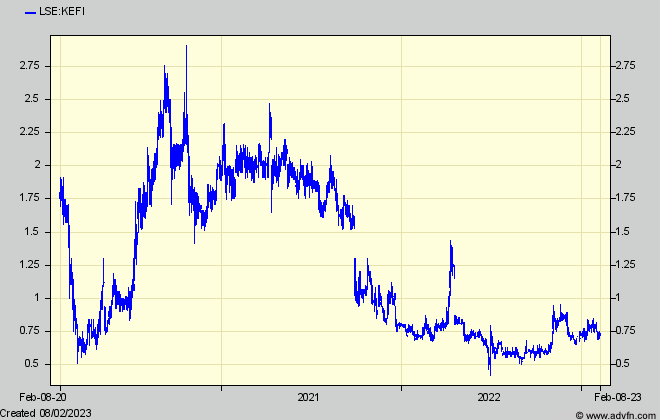

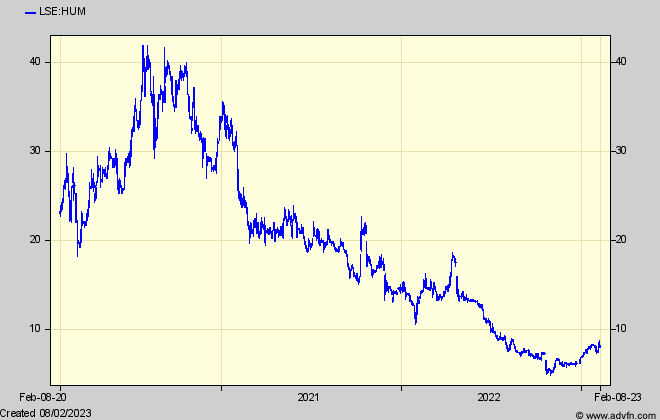

While some investors might fall back on the charts to judge which and when, the more sensible, it seems to me, will consider just how far along the construction or funding route has any miner reached. It would take a really bad crash to stop those who’ve already seen a start. In any case here are some charts for those emerging miners I’ve flagged over the last two years.

Take Atlantic Lithium (ALL) which displays one of the more attractive economics among them all, provided the lithium price holds up. But as I’ve said before, it’s currently doubtful whether it will, what with the Chinese, and now some European car manufacturers, scaling back their expectations for a mass market in the cheaper electric vehicles which lithium’s high price, they say, is making them uneconomic. I suspect it will take some time before the market decides how true that is.

And what about Horizonte Minerals (HZM)? Although I suggested the chart was saying not to chase the shares’ surge from 90p to 140p at the New Year, occasioned by the prospect of production starting later this year, it is actually showing signs of breaking out up to over 150p now. As before, it looks cheap on that production prospect, but sooner or later the market will worry about the large share dilution coming along as warrants, options, and streaming revenues, raised to get that production going, start to be paid. But no doubt investors will ignore that for some time yet.

I hesitate to mention Kefi Gold (KEFI) – having like many observers been wrong-footed so many times by the regular promises that it really will, this time, get its Tulu Kapi Ethiopian gold project going. Kefi says all the funders are ready to sign, but that the Ethiopian Government is proving tardy. Whether this is the usual African ‘it can wait ’til tomorrow’ syndrome, or as conspiracy theorists have it, a dastardly plot to deprive Kefi of its ownership, we can’t know. The latter seems implausible, and when the mine starts the shares should be worth 2-3 times the current 0.7p. Holding the shares back meanwhile (apart from the sign-off wait) is the probability of a share issue to fund Kefi’s head office through to income from the mine. If I were Kefi I’d wait for the sign-off before coming to shareholders, so I can’t see much risk in buying the shares now.

Hummingbird (HUM), too, could well be entering a better era – having taken a good five years to unwind the credibility lost after its (now gone and properly forgotten) brokers’ misleading ‘research’ kept the shares too high for too long before the inevitable crash when the truth (easily foreseen with honest calculations – as I showed at the time) emerged. I’ve commented before on the scope for HUM’s new Kouroussa gold project, but its costs to start have added to poor results to now from its existing operations. Now, Koroussa is closer, while HUM has posted better results from its existing Yanfolila mine. That has just attracted a new cornerstone investor who will subscribe $15m at 7.79p for 8.6% of the company. I’ll take a closer look in the near future once the news spike has settled down.

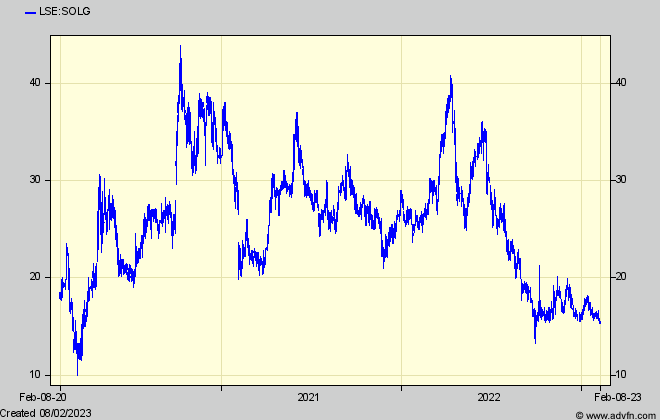

I haven’t mentioned Solgold (SOLG) since I suggested it looked cheap because somehow, surely, its ‘flagship’ Cascabel project (with its 22 million ounces of gold and 11 million tonnes of copper ‘resource’) will deliver some sort of value. But a lot has happened in the last year. The company has shown how, no matter how good a resource a miner has, management decisions can mess it all up.

With so many apparently attractive prospects in its Ecuador exploration portfolio, I suggested some 5 years ago that unless SOLG separated them out for investors, so that the exploration costs for one wouldn’t damage the attractions of those earlier into production, investors would be wary of the resulting drag on the shares. So it has turned out. Solgold’s founder insisted on building a multi-asset miner like the big boys and resisted all such suggestions. Now he has been forced to concede to a new management, which having gone half-way towards promising to spin some projects off separately has now, while merging with Cornerstone to gain its full ownership, effectively put Cascabel (if not the whole company) up for sale.

How much it might fetch is problematic, but it must be more than Solgold’s £375m market cap, given Cascabel’s $5.2bn NPV (lower after current cost rises) and despite its initial capital cost now down to $2.75bn for the latest cut-down 2022 plan.

However, the list of possible buyers is probably slimmer now than once hoped. In line with my constant theme that every ‘NPV’ based valuation should be checked for the detail, is the fact, little appreciated by private investors and unmentioned by the brokers puffing the shares, but almost certainly recognised by professionals and potential buyers, that the overwhelming proportion of Cascabel’s copper and gold will be extracted in the first 12 years. That means the remaining 40 or so years life on which part of the NPV depends, will be far less profitable (on current prices) so won’t be regarded as the long life project that major miners require.

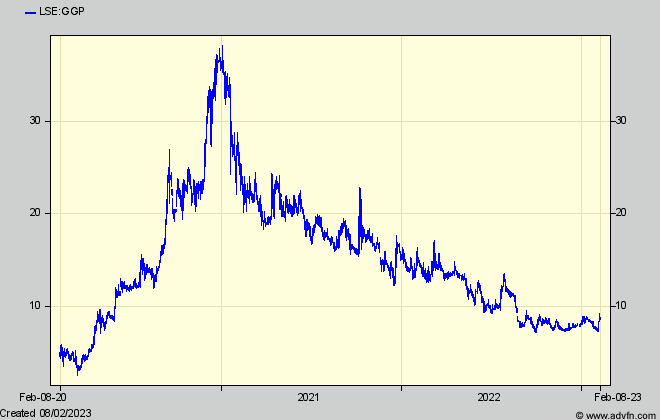

I was about to update my views on Greatland Gold (GGP) when the news broke of a bid for Newcrest, its partner and 70% owner of the Havieron gold project. GGP’s shares had continued their relentless descent, as it became clear it was still too expensive. When last I wrote however, I thought the shares might warrant a re-look around 8p when investors started to anticipate Havieron’s production starting, which a year ago was expected this summer, but now is not until mid-2024 – if that.

Now however, rumours that Newcrest was in any case thinking of selling its Havieron stake, and soon afterwards that Newmont is bidding for Newcrest, has started wild speculation about the implications for Greatland, ranging from itself buying back the 70% of Havieron from whoever ends up owning it, to being taken out itself in some big reorganisation of Aussie gold miners. In all these, the thought is that Havieron’s ‘true’ value will be uncovered, causing (as I write Feb 7th) a big spike in GGP’s shares.

There, I’m afraid my opinion remains, that the ‘true’ value is still lower than thought, with the earlier notion that Newcrest might sell being because the updated feasibility study for a much expanded Havieron now being worked on is showing it not to be as profitable as it wants.

In turn, that stems from my experience of the exaggerated values put on the initial Havieron mining plan – the company’s brokers’ ‘targets’ being based on NPVs inflated by using unrealistically low discount rates, as well as by ‘thumb-in-air’ assumptions for production and costs for up to 30 years ahead from exploiting the newer ores being found from current drilling – the basis for the revised feasibility study now being worked on.

So Havieron’s economics must now be very much up in the air – illustrated by adjusting the now out of date 2021 study for the substantial mining cost increases being seen today. That earlier study showed GGP’s 30% share as having a mere US$150m NPV even at an unrealistically low 4.5% discount rate – (or $267m from production start after the capex has been made) – at a $1,750/oz gold price. Adjusting that study for the mooted 30% cost increases now being seen, even that inflated NPV would disappear.

To improve on those disappointing economics, the mine plan now is to increase by maybe 50% the first 9 years throughput, and to mine over a later and much longer term the additional, deeper, gold being found (and which the brokers’ earlier thumb-in-air estimates justifying a GGP price above 20p relied upon). But the new study has been repeatedly pushed back – to end 2023 – and will bear no resemblance to the previous one, and there has to be a risk that the large cost increases being seen and the additional investment for the expanded plan, might not be outweighed by a sufficient rise in the gold price.

That’s why I think that, far from ‘revealing’ the higher ‘true’ value of Havieron that GGP investors are now speculating about, the probability is that it will be shown to be lower, with more cost to develop. So who knows that early indications of its revised economics didn’t prompt the rumours that Newcrest might sell.

In speculating about any take-out price, private investors don’t realise that an un-built project is always worth more to its owner, than to a buyer who will have to add the price paid to the project’s capex, so reducing its profitability for him. And because NCM and GGP have valued Havieron’s NPV at an unrealistically low, 4.5%, discount rate, the more realistic rate a buyer will almost certainly use will reduce its value to him even further.

Neither do they appreciate that a much better guide to a share valuation than an NPV, is the year by year net income. Making the same adjustment for a 30% cost increase would have reduced GGP’s first 9 year’s net Havieron income in that 2021 study from an average $52m a year at $1,750/oz gold to only $34m. That’s before $43m annual repayments of the $220m bank loan GGP raised in November to part fund its share of the capex. So any hope there was of substantial surplus cash (and a dividend) for GGP shareholders from that earlier plan always was misplaced.

So I believe anyone thinking this new situation will see a higher Havieron (and GGP) value will be disappointed (unless the gold price increases substantially to overcome cost increases). On top, if there is now a realignment in ownerships, the ‘decision to mine’ Havieron could well be delayed. So I think GGP remains best left well alone until everything is clarified, although how high the current speculation will take the shares is anyone’s guess. It is noticeable that dealing volumes are already tailing off, as they do when it’s only private investors chasing a story. It is also being reported that Barrick is standing aside from Newmont’s bid, saying it can’t see why it wants Newcrest.

Very interesting article. In depth.

Can we have an update on Emmerson please?