Pan African Resources: Digging in during tough times

Pity anyone trying to write about any stocks at the moment. But especially mining shares in the face of commodity price falls like copper 23% off its March peak; nickel 40% down; zinc off 15%; iron ore down 34%; and gold 12% down – but only 7% in sterling terms, which is what counts for UK investors.

Even for the very largest and cash strong miners it is said that you can get a 16% yield – as from the biggest, BHP , with 9% from Rio Tinto. But look at their share charts, which have been much more volatile than even commodity prices (Iron ore the most significant for Rio, and Copper for BHP).

And while BHP’s latest dividend was double the previous year on the back of a then high copper price, it’s likely to be slashed back again this year.

Pity also those early stage miners I have tended to favour so as to try to catch the surge in their shares that usually accompanies their move into production. More easily said than done of course, with investors having to risk the final stages of the funding for their projects, which has apparently now dried up.

So to get the best of the above average returns that are available in a mining share – it goes without saying that timing is all. But not only for the early stagers with just one project, but also for the majors as their multiple projects come and go and commodity prices go up and down. Usually however those majors don’t depend on the benign funding environment that the start-ups and explorers need.

In that volatile environment then, how about a relatively stable looking, reasonable, and increasing, yield from a medium sized and well funded gold miner already in production ?

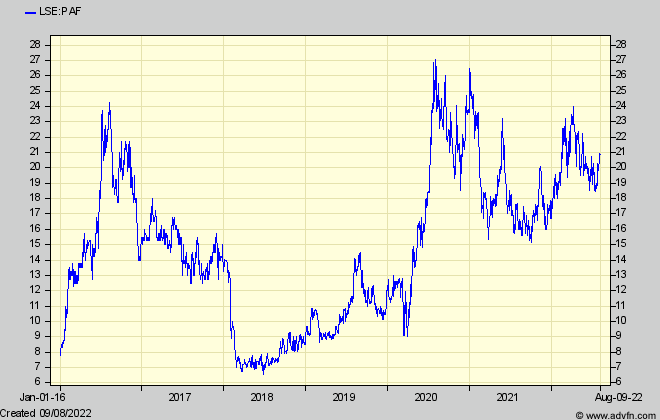

Back in January 2016 I put forward Pan African Resources (PAF) when then 9p, on the argument that, after a disappointing period, its dividend was likely to show a sharp recovery, so that investors could look forward to an even better return than its then historic 6%. And along with that, an increasing share price.

That increase turned out to be 150% over the next six months, before the inevitable profit-taking and yet another unforeseen disappointment wiped it all out. Lesson for all mining investors. Big profits don’t last. Take them when you see them, which is as useful a mantra of course, as ‘When in life’s road you come to a fork. Take it’!

I obviously hope nothing similar will happen this time. In 2018 woes came all at once, with a change in the South African Government threatening nationalisation, on top of major labour disputes at the Barberton mine whose long stable life has been underpinning PAF’s other projects. Annual profits collapsed by 2/3rds and the dividend was missed.

However, for those who like the reassurance of a hopefully recurring dividend, I think a repeat of 2016 (without the 2018 relapse) is now on the cards for PAF. Its current historic 4.9% yield is based on last financial year’s to June 2021, since when the interim dividend has been increased by 21%, while the final which will be declared in September should increase by at least the same and possibly more. With the mix of its various projects trending to lower cost operations from tailings as opposed to underground mining, cash flow has been increasing markedly – such that net borrowings to last December reduced from $65.2m to $28.2m, and are predicted to be almost nil now. With cash building up the prospect is for an increasing dividend over at least the next few years.

In the view of Edison Research, who I have always found to be a better mining forecaster than any broker, the dividend in 2023 could rise by another 50% to where the yield (at 21p) would be 7%, and that scale of dividend increase should be reflected in the share price, especially since Edison points out that PAF is now historically cheaper on any measure than its peer group.

As to timing a purchase I’m no better than anyone else at predicting the global investment environment over the next six months. But I saw a glimmer in the press today, of the suggestion that the long US bear market might, just, be bottoming. And PAF’s year end report in September might highlight its future more clearly.

Here is a table of the last few years key measures, and of the next two forecast by Edison. Production volume only increases markedly after 2024 and meanwhile lower costs and lower interest charges keep profits growing.

| US$’000s | *estimated | |||||

| Year to June | 2018 | 2019 | 2020 | 2021 | 2022* | 2023* |

| Revenue | 145,829 | 218,818 | 274,107 | 368,915 | 371,949 | 365,271 |

| Gross profit | 38,689 | 65,838 | 115,650 | 160,100 | 173,871 | 195,685 |

| EBITDA | 38,131 | 65,484 | 115,176 | 156,646 | 167,603 | 191,000 |

| Operating profit | 14,985 | 59,852 | 65,079 | 111,753 | 124,790 | 156,703 |

| Net interest | -2,222 | -12,192 | -12,881 | -6,919 | -2,344 | -298 |

| Profit before tax (FRS 3) | 12,763 | 47,660 | 52,198 | 104,834 | 122,445 | 156,405 |

| Tax | 2,826 | -8,174 | -7,905 | -30,141 | -34,152 | -51,818 |

| EPS (c) | 0.87 | 2.05 | 2.30 | 3.87 | 4.59 | 5.46 |

| Dividend p share (c) | 0.00 | 0.15 | 0.84 | 1.27 | 1.18 | 1.76 |

This is for a level gold price from now on, and no changes in the Rand, not to mention other possible variations from the production plans for each project. But the trend is clear.

I will try to comment on my other mining list over the next few weeks, including on Xtract Resources, whose shares have suffered not only from the drastic fall in copper prices, but also from relatively disappointing drill results so far (good volumes but lower than hoped grades) in the run up to revised calculations of a maiden resource at Bushranger and possibly at the new discovery at Ascot. News on when that will be announced might come at the AGM in two weeks time (Aug 23rd).

Looks like wild west in mining shares. Antofogasta slashing it’s dividend. Prefer to avoid myself…