Is gold going mainstream?

Gold, as an asset class, has had many detractors, particularly amongst the institutional community, but is that about to change?

Ohio’s $16 billion Police & Fire Pension Fund is following in the steps of Warren Buffett (Berkshire Hathaway recently took a stake in Barrick) and is making a big statement about owning gold. It has approved a 5% allocation to gold to help diversify the fund’s portfolio and to “hedge against the risk of inflation”, according to Bloomberg.

The question is whether this a blip or the start of a major trend. Right now I think there’s more FOMU (Fear of Messing Up) rather than FOMO (Fear of Missing Out) about investing in a new asset class…. let’s see…

Let me touch on three of the reasons why you should be thinking about gold.

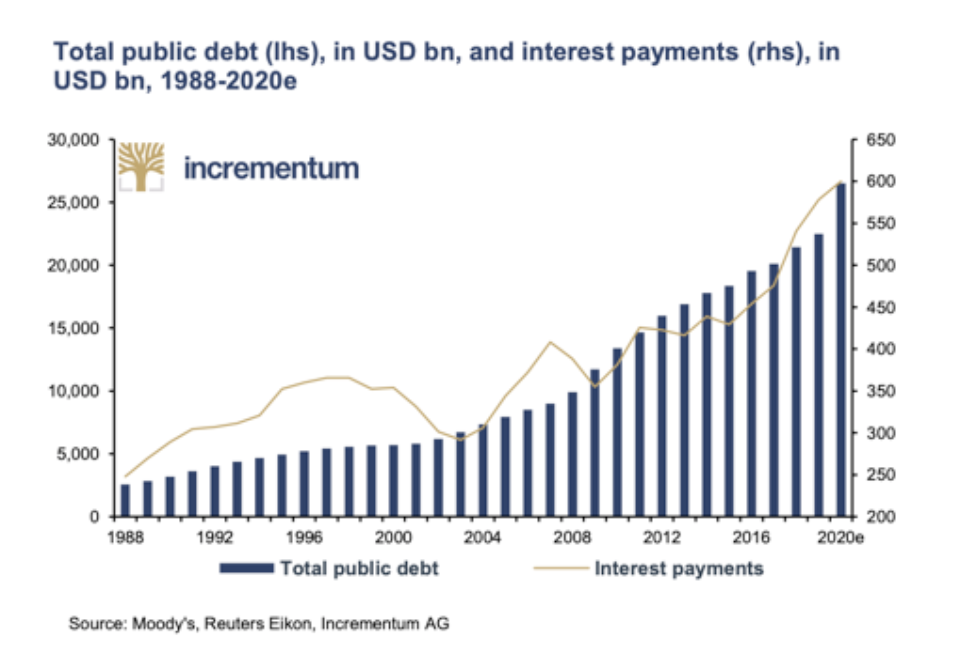

1) Escalating global debt

With global debt going through the roof, the cost of servicing this debt has followed suit. So much so that to achieve this, interest rates need to be low or in many cases negative. Otherwise the interest can’t be paid and then we’ve got defaults. Take a look at this graph…. you don’t need to be a rocket scientist to see this trend.

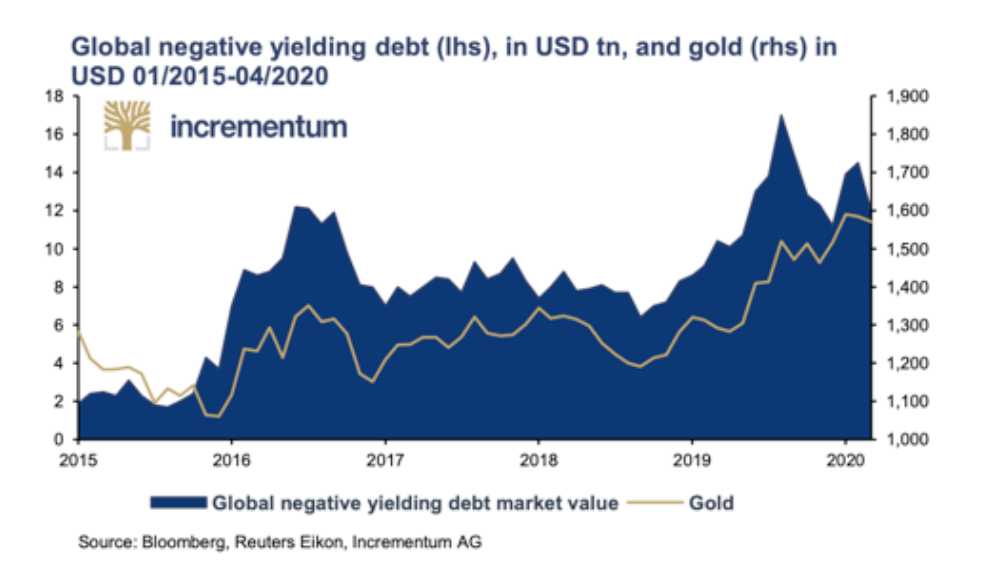

It also looks like negative yielding debt is going to be around for some time….

This has made a lot of fixed income products very unattractive to investors. Particularly institutions, who are often looking for income. They simply can’t get the yield they need.

Many have decided to “chase yield” which has taken them into asset classes which are far riskier than they want. High yield being a case in point.

Others have turned their attention to the equity markets. But with so many companies either slashing or stopping their dividends because of Covid-19, dividends may not be the answer.

It’s also worth pointing out that the main reason for not holding gold – “it does not yield anything” – has now gone out the window, because many fixed income instruments have no real yield either.

2) Strong gold price performance

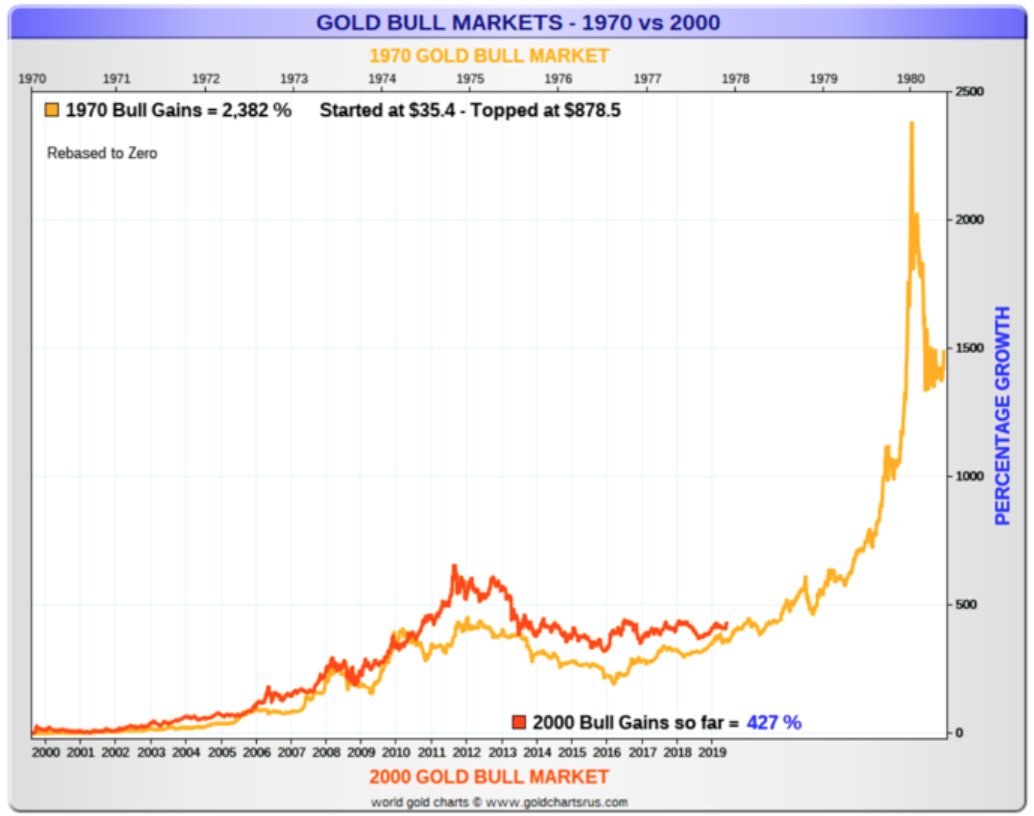

This chart will surprise you. It certainly shocked me.

As you can see, over this 20-year period, gold has outperformed Berkshire Hathaway.

That could well be one reason why Warren Buffett decided to buy into Barrick. We obviously don’t know, but there’s some compelling logic about that.

I appreciate that some investors may feel they’ve already “missed the boat” because the gold price is already breaking records. But if you look at this chart that compares the current bull market with that of the 1970s, then if history were to repeat itself, the gold price could still go a lot higher (look at the red line).

![]() 3) Improving ESG

3) Improving ESG

ESG issues have been increasingly important for institutional investors. I think it’s fair to say that mining may be the last industry many investors think of when considering ESG. A lot would probably view it as a “none starter” from an ESG perspective.

However, there’s a quiet revolution underway that is delivering change. Right now, I’d say it’s on a company-by-company basis. But you could be pleasantly surprised when you take a look at opportunities from this perspective.

The common view is that mining is a ‘dirty industry’ due to a troubled past. But many investors are unaware of the transformation the industry has been undergoing. It needed to clean up its reputation and it seems to be heading the right way.

With the world becoming more resource intensive than ever, the industry needs capital and it now seems to be jumping the ESG hurdles required by many institutional investors.

In recent times, the industry has been making silent but significant leaps due to a change in management culture, the need to embrace new technology and ultimately meet investor demand.

Mining continues to innovate at a rapid pace in each area of ESG with improvements in technology at the crux of these efforts. Advances are being seen in areas such as the use of artificial intelligence in mine planning (reducing mine footprints), improved safety practices and increased use of renewable power sources such as solar.

The main Environmental changes are as follows:

- Mines are now being designed to substantially minimise their environmental impact. It is no longer acceptable for mining companies to find and extract materials without serious environmental, and regulatory, considerations.

- There are plans for building renewable power stations at mine sites to not only supply the mining operations but also the local community with affordable, clean power, a monumental move for any extraction business, creating immediate socio-economic benefits.

Social

Probably the most significant development is the introduction of the ‘social licence to operate’, which each mining firm must obtain prior to extraction. This is a contract between the host nation and the company, outlining the responsibilities of the company to maintain good practices or risk losing the right to extract.

Mining companies are also increasingly hiring indigenous workforces to support local initiatives and boost individual economies. Once a largely dangerous profession, mining companies now have been on a quest for zero harm in the workforce.

Governance

From an investor perspective, governance can be the hardest of the three ESG elements to define. Corporate governance in the mining industry includes treating all minorities fairly, aligning executive compensation with all stakeholders including workers and local communities, and creating strong policies and processes to combat corrupt practices. It also involves such areas as minimising tax avoidance schemes and robust cyber security.

Conclusion

Whilst it’s too early to say whether these three drivers will lead to greater institutional interest in the gold mining sector, there is a certain logic for greater involvement. Personally, in these challenging times, I think diversification is key. If you don’t have any gold in your portfolio, it’s certainly worth thinking about.

Right now, I don’t think it’s ridiculous to have at least 1% of your portfolio in gold.

What do you think?

Simon – was that a typo in the final sentence ? – only 1% ??? – surely 10% as a minimum is quite sensible right now ?

Your ‘gold bull markets’ chart does not take into account this year’s rise. Could you provide an updated version please.