Little Happening, But A Lot To Talk About

Global uncertainties, commodities weakness, and high interest rates – not to mention lack of bank funding, are making the mining sector look dull and boring let alone risky – none more so than those companies still in development rather than in production. But there are a few companies transitioning to the latter that are not quite as exposed as others.

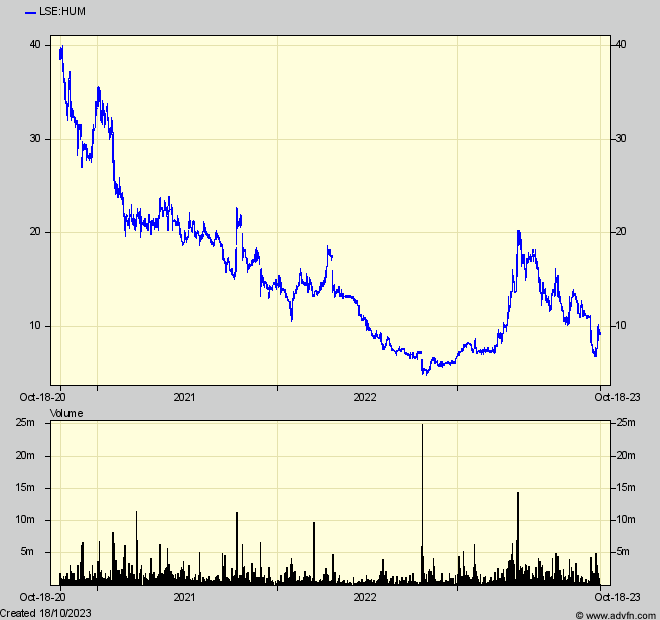

Hummingbird Resources (HUM) is one of them. I did say, after the interims last month showed no debt repayments yet, don’t sell – although some did when HUM announced on Sept 28th a further $20m net loan and repayment extension from long time African backer Ciris Bank, partly to refinance $35m of its existing loan for Kouroussa, and partly to finance further underground development at Yanfolila . Permanently trigger happy Hummingbird skeptics took that to mean trouble, whereas the company sees it as a prudent measure – now the sun is shining – to fix the roof and ensure no risk of falling short of its Koroussa loan repayments starting next year when $77m is scheduled for repayment.

As I also said, with the new Kouroussa still ramping up to designed capacity, and the existing Yanfolila moving to underground mining, forecasting exact production and costs can’t be exact, so Hum isn’t even making forecasts for the 2024 financial year. But, it is on track to have almost doubled gold production to some 200,000 ounces, and to generate substantial cash to begin bringing down the $153m total borrowings which worry the skeptics.

By then, with some £370m revenue at around a 30% net margin, HUM emphasises that it will be one of the biggest gold producers on AIM, fast reducing that debt, and making its current £53m equity market cap look silly. So in relation to Shanta Gold (SHG) who, with double HUM’s market cap (although with far less debt, and so a smaller enterprise value) but only half the gold production HUM expects next year, some are putting forward as a better bet, Hum really looks the one to rebuild the equity component of its enterprise value the fastest.

We’ll see when it reports its 3rd quarter progress next week, but meanwhile the message is that while HUM’s progress is bound to be unpredictable, it seems strongly in the right direction, while capital spending is mostly done. Unlike poor Horizonte Minerals (HZM) who, even though through 2/3rds of the first phase build of its Brazilan nickel project, has been hit – out of the blue – with a 30% plus cost increase for the rest, and the probable need to go cap in hand to its bankers or even to hand over all its equity to them. That is why the shares have crashed – it remaining to be seen what value they might still have, after whatever re-financing is necessary. Anyone who followed my thoughts that HZM was one of the few companies in the attractive phase leading up to production when a reward for shareholders could be expected has my apologies. But they are in the company of some very experienced institutions and banks who have been similarly caught out. The company’s broker seems to think something can be saved – but readers know my views on brokers.

Shades of HS2 and Cross-Rail ? and a warning if need be, for investors in any industry which relies on engineering to build the facilities it needs to make and sell its products.

In HZM’s case, a valid question is why did the news come as such an unanticipated bombshell ? One would have expected some sort of on-going grip on anticipated costs to keep management (and investors) forewarned. Overall however, the fact is (I speak as an engineer – in days gone by -though not as bygone as Brunel) that exactly forecasting the timing and cost of large projects is practically impossible, especially if there is no precedent. It involves trying to make detailed plans, timings, and costings, but where the detail and costs at the time ahead can’t be known until encountered in practice. And trying to tie down for years ahead exact delivery times and prices from myriads of sub-contractors and their own sub-sub contractors and component suppliers who themselves can’t know exactly what their costs will be, what other orders they will be contending with or without, or whether they’ll even still exist.

Yet customers, bankers, and government want to know – exactly ! So to get the job, the prime contractor will err on the cheaper and most confident side. Then, when part way through it becomes apparent that eventual profitability won’t compensate for the amount still to be spent, an agonising decision whether to abandon has to be made. It’s a common story in mining, where a half-built project, abandoned because costs have risen or commodities have fallen, leads to bankruptcy for their owners, and remnants which are later bought up cheaply by new entrepreneurs who raise the cash from equally new (and trusting) investors on the likes of AIM. I’m afraid that, in the current highly inflationary environment, with commodity prices going the other way, not a few of those newbies I’ve covered here might be in that position. No wonder news about them has dried up.

But HUM doesn’t look like being one of them – and neither I think will be Xtract Resources (XTR) who I haven’t mentioned recently because there’s not much to report except of its 23% profit share in the Mozambique Manica Fairbride gold project. There, production has been increasing steadily, but its financial results and prospects are still vague. XTR’s latest six months to June only included 3 months to March from Fairbride, when 4,522 oz produced was worth a net $1.3m to XTR after costs. Projecting the rate of improvement could give an annual $5m to Xtract (current market cap $12m) although I wouldn’t count on that until its full year results next March. If so it could tide Xtract through its next few years spending on the’highly prospective’ copper exploration projects it has entered into in Zambia. (Where have we heard that phrase before ?)

Other Xtract news worth waiting for however is an up- dated economic study being worked on its Bushranger deposit’s 1.3m tonnes of open-pittable copper, where recently tested ore-sorting technology is promising much more efficient mining than the previous one. But while Xtract is ‘excited’ by indications that production itself will be highly profitable (even at current copper prices ?) it is before construction costs, and we’ve seen how those have been rocketing. So the hope is that the scaled down infrastructure enabled by ore-sorting will outweigh capital cost increases and maybe attract a buyer . Its why I think Xtract is worth holding onto for news.

Another share worth holding onto is Barton Gold (ASX:BGD) where a comprehensive drilling campaign (enabled by its strong cash position) has commenced, aimed at expanding the 1.3m oz gold resource I spelled out in my initial coverage last May. Although BGD’s shares have fallen back like most other miners they are still not far below when I flagged them and, spurred by the drilling, showing signs of more life.

It’s worth remembering that while BGD is prioritising exploration at the moment, it could fairly easily recommence producing from its recently active (under previous management) Perseverence mine facilities at Tarcoola in South Australia.

Rather like HZM, poor old Scotgold Resources (SGZ) after many hard-grinding years has fallen almost completely foul of the uncertainties predicting where gold actually is when planning and spending to mine it, and now hovers on the brink of bankruptcy. Except that, at the last moment, a white knight has apparently arrived to talk – not that they’re likely to rescue existing shareholders’ investment.

In Northern Ireland, on the same Dalradian-Scandinavian to Newfoundland gold-bearing trend, Galantas Gold (GAL) is still working hard, although at the moment without much news to excite investors. Some highly encouraging gold and copper finds at its new Scottish Gairloch prospect won’t generate cash before much time and money has been spent, and meanwhile there is little to relate about its existing Omagh mine – still preparing to resume production. The key to revived investor interest would be an updated mining plan, if not a full feasibility study, but all investors have, following the 2021-22 drilling campaign, is an updated resource statement. This shows the two main underground veins being targeted for development and bank funding to contain 168,000 oz gold measured and indicated, plus another 294,000 oz inferred, which the co thinks drilling has shown has potential to be considerably more..

Although a contractor has recently submitted a mining plan, there is no news as to when it might start, and is presumably dependent on bank funding for the `initial Can $12m cost’, which in turn will depend on the updated feasibility study, of which there is as yet no sign. Under the plan, the contractor would take nine months to develop access to those two key gold-bearing veins, before ramp up over the following year to approximately 5,000 tonnes per month of ore and monthly production of 1,200 to 1,400 gold ounces. Further expansion envisages an eventual 30,000 to 35,000 gold ounces annually which would transform Galantas in investors eyes, and is presumably what long-term backers Melquart Ltd with nearly 25%, and well – known mining investors Ross Beaty and Eric Sprott with 12.2% between them. have been (for a long time) waiting for. They no doubt can afford to wait, but maybe private investors might consider GAL for their own bottom drawer, even though more funding and share dilution during the wait seems inevitable.

While investors might stay away from old and new miners while circumstances are unpredictable there are still those who like speculating on explorers for when that nugget might put a rocket under the shares (for a time anyway) and the two I’ve mentioned before (apart from Barton Gold) are very much alive. Wishbone Gold (WSBN) has completed initial drilling at its Red Setter gold/copper prospect with results expected in November and will soon start drilling at its Cottesloe base metals prospect. Empire Metals (EEE), similarly, is in the middle of an expectant news period as its Pitfield ‘multiple copper’ and titanium prospect starts a major campaign to confirm the widespread high-grade titanium mineralisation discovered earlier. Quite when initial results might start showing through is unknown but probably at least a month away.

In the last two cases news can go either way of course.. But maybe watching and gambling on them will be more exciting that a night at the dogs. And I think the long term odds could be rather better.

W.R.T ‘If so it could tide Xtract through its next few years spending on the ’highly prospective’ copper exploration projects it has entered into in Zambia. (Where have we heard that phrase before ?)’

I should hope most Juniors would target highly prospective exploration projects as that is what Junior Mining Exploration is all about.

To be fair to Xtract, Zambia is definitely highly prospective as evidenced by all the recent commitments and MOUs from various governments around the world, its current copper output, its targeted copper output, and the M&A going on in that country.

Generation of money from one asset to fund a potentially much larger target makes sense and limits the downside risk of dilution.