Miton Global Opportunities offers contrarian diversification

Miton Global Opportunities (MIGO) could make a useful diversifying holding. The policies followed by the world’s most influential central banks have distorted large parts of the market and left many areas looking vulnerable. This has made it difficult to find pockets of value and uncorrelated sources of return, which is where Miton Global Opportunities could come in handy.

MIGO is a £52m investment trust that aims to outperform the three-month London interbank lending rate (LIBOR) plus 2% over the longer term. It does this by targeting undervalued opportunities and by exploiting inefficiencies in the pricing of closed-ended funds.

Nick Greenwood, the manager, is highly experienced in this area and invests in a range of uncorrelated, top down global themes. He uses a contrarian approach in order to profit from changes in investor sentiment and other catalysts that could lead to a revaluation of the out-of-favour investment trusts that he holds in the fund.

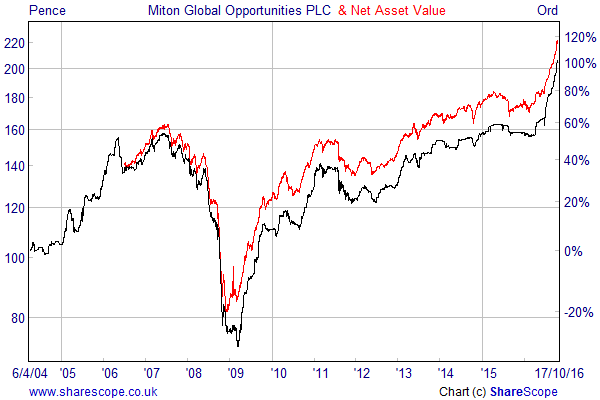

Miton Global Opportunities has a good track record and is the second-best performer in the Flexible Investment sector over five years, with a share price return of 62.9%. It offers a diversified exposure to different asset classes and is trading on a discount to net asset value (NAV) of 7%.

The underlying portfolio

The largest exposure at the end of September on a look through basis was the 35.7% allocation to equities, followed by property at 22.4% and private equity at 19.7%. Its geographic weightings were divided fairly evenly between the UK, Europe and Global regions, with smaller positions in the US, Asia-Pacific, India and elsewhere.

In his latest monthly update Greenwood said that the main theme in the fund is private equity. He pointed out that there is a vast amount of cash committed to this area which is yet to be invested and that the specialist investment trusts that operate in the sector have exactly the right type of unlisted companies that this money is going to target.

Greenwood suggests that the managers of private equity funds have a seller’s market to exploit and that the published NAVs don’t reflect this, yet many of these funds still trade at large discounts due to the lack of investor confidence following poor performance in the wake of the financial crisis.

MIGO’s largest holding in this area, Pantheon International, is trading at a 21% discount to its published NAV. The extent of the opportunity is likely to become clearer once activist investors begin targeting the hidden value in these portfolios, as evidenced by the recent billion pound hostile bid by Harbourvest for SVG.

Other interesting areas

The second largest theme in the portfolio is the residential property market in Berlin, with the Taliesin Property Fund and Phoenix Spree Deutschland accounting for a combined weighting of 11.1%.

In a recent commentary Greenwood said that Berlin remains dramatically cheaper than other German cities such as Munich, but that the values are starting to converge. In addition to this, both funds are in the process of ‘privatising’ their estates, which involves converting the apartments into what we would recognise as leaseholds. This should help to increase the value of the properties, especially as they have both gained permission to convert the vast bulk of their portfolios.

Taliesin is in the process of selling the converted apartments and returning the proceeds to shareholders, but both funds have done really well. This is partly due to the weakness of the pound against the euro, with the recent gains helping them to move close to their NAVs, which in Taliesin’s case is higher than the latest published figure.

The fund’s other main theme is India, with the India Capital Growth Fund being its largest holding at 8.1% of the portfolio. Greenwood likes the fact that the Indian Central Bank still has available the normal policy tools like lower interest rates that have already been exhausted in the West. He has chosen this particular fund because it focuses on medium sized Indian companies that are less correlated to the main global indices and because it is trading on a 21% discount to NAV.

There are also a number of other interesting holdings in the fund including Alternative Asset Opportunities and Private Equity Investor that have both recently accepted offers for their portfolios at levels well above the price paid by MIGO.

Greenwood has kept the portfolio away from the mainstream equity and bond markets, which is where he thinks the central bank policies have created the largest risks. By concentrating on investment trusts he is able to take advantage of structural changes that should narrow the discounts and to benefit from attractive alternative asset classes with the potential to deliver uncorrelated returns.

Of course it is impossible to completely escape the wider trends and a large scale market sell-off would inevitably affect the price of the fund in the short term, especially in view of the leveraged private equity holdings. Investors also need to be aware of the significant impact of the exchange rate, with the recent fall in the pound helping the value of the international holdings and propelling the recent performance, but it is still an unusual and useful way of adding diversification to your portfolio.

Comments (0)