Twitter is the stock to own for 2016 for me

Summary

– Twitter still provides unique offerings over other social networks.

– While the MAU and revenue growth have been declining, 300m+ MAUs is already a strong base, and 30-40% revenue growth is respectable. Twitter has declined 40% over the last year and 70% over the last two years. This sell-off seems unwarranted.

– I do have some concerns though – a part-time CEO, poor curation of tweets, automation on the site, and relationship with app developers.

– At an EV of $14bn and let’s say with a 30% premium to the stock price, the company is a good takeover candidate, especially for Google, Microsoft and Alibaba.

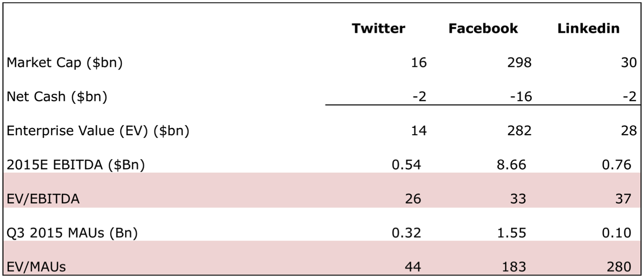

– The stock is available at lower EV/EBITDA and EV/MAUs ratios than those of Facebook and LinkedIn. My target on the stock is $35 in 12-18 months.

– You can track real-time financial news and tweets for free at CityFALCON.

I use Twitter several times a day as a user; my team and I use their APIs; we license financial tweets from GNIP, and we market our products through their advertising platform. So, I don’t just analyse their products and numbers; I live them.

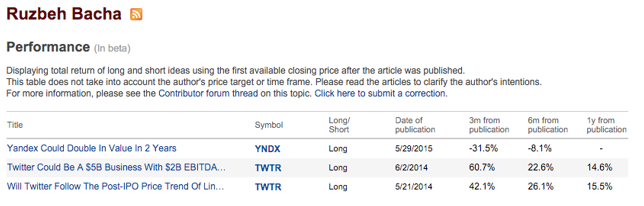

In my June 2014 article on Seeking Alpha, I had explained why I believed Twitter could be a $5bn business with a $2bn EBITDA by 2016. The stock had performed well after publishing the article with a 61% gain in three months, but as you can see today, I was wrong in my projections. However, I do remain optimistic on the business.

Source: Seeking Alpha

Twitter still provides unique features over other social networks

Analysts have been comparing Twitter with not only Facebook and LinkedIn but also with SnapChat and Instagram. While there is some target segment overlap, I believe Twitter provides some unique features:

– Twitter is used as a broadcasting medium by politicians, celebrities, influencers, etc., and just one tweet from any one of these people drives fans back onto the site. While Facebook allows you to do the same, the consumption of content is not as easy as with Twitter.

– Twitter is rethinking its 140 characters limit, but I believe that it works well as tweets are succinct compared to stories on, for example, Linkedin and Facebook. There are more stories per screen on Twitter than on other social media platforms.

– You can follow not only people but also topics and hashtags. While other platforms have adopted hashtags, they have struggled to affect Twitter’s leadership position.

– Cashtags, e.g. $AAPL for the Apple stock, are widely used not only by the financial community on Twitter but also by major publications like Financial Times, Wall Street Journal and Seeking Alpha.

– There is tremendous interest from financial institutions and businesses in Twitter’s data; this should help the growth of their licensing revenue. Tweets from Carl Icahn, Elon Musk, Tim Cook, Hillary Clinton, etc. have had a significant impact on stock prices. Bank of England analysts believe “Twitter could help predict a bank run, early signs of unemployment data and market movements”. Even the ECB says that “Twitter can predict the stock market”.

What concerns me about Twitter

– Part-time CEO – As someone who runs his own start-up, I can’t imagine a CEO running two companies. Why not have Jack Dorsey as an advisor and hire a full-time CEO?!

– Product – They have significantly improved the new user onboarding process and added analytics (which I love!), but they still have a lot to do to improve the overall user experience on the site. Also, their advertising product needs to improve significantly when compared to Facebook. As a marketer, I get more value out of Facebook than from Twitter and Linkedin.

– Curation of tweets – Twitter needs to help users make sense of the firehose of tweets. There are on average 500 million tweetsa day, and your timeline can get busy after following only a few accounts!

– Automation of tweets and direct messages is affecting the experience on the platform. Twitter offers feature rich APIs which allow users and developers to automate tweets and messages. This may result in, for example, a direct message every time you follow someone or auto-favourite of tweets based on content, etc. Also, there are several fake profiles created to monetise automated behaviour on the site. As an app developer, I can see that Twitter is already working on fixing this.

– Twitter’s decision to cut off Meerkat after the acquisition of Periscope has affected developers’ enthusiasm about building apps on top of Twitter. After Jack took over as CEO, he has been trying to improve relations with the developers.

Twitter’s user growth has declined but MAUs of 300 million is already a strong user base to monetise

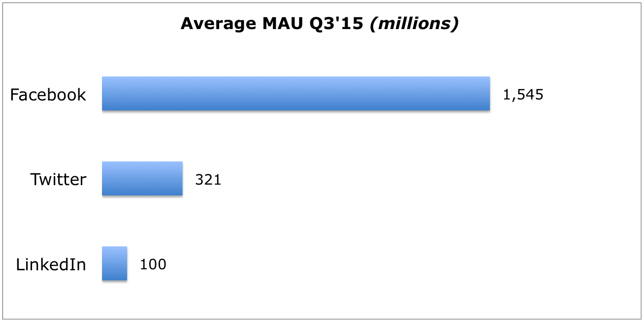

It’s easy to look at Facebook’s MAUs of 1.5bn and expect every social network to reach that number, but it’s not going to happen. It’s difficult to grow at a strong rate when your userbase is already 300m+.

Source: Published Results

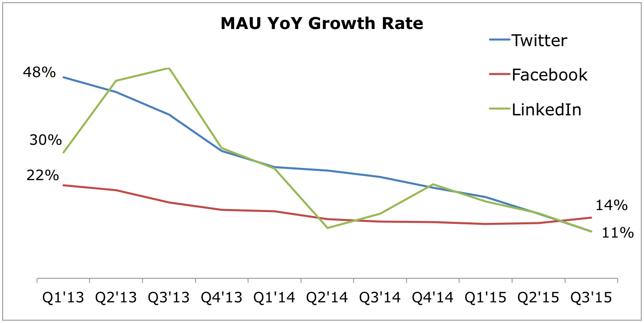

Source: Published Results

I expect Twitter to grow at a slightly higher rate than the growth in internet penetration. Periscope and other engagement features could fuel higher growth. At this stage, I’d focus on retention and monetisation of existing users.

Advertising is a comparatively under tapped market for Twitter

On a TTM basis, Twitter generated $1.8bn in advertising revenue compared to $15bn for Facebook and $60bn for Google. Twitter has a massive opportunity to increase its share of the advertising pie by monetising its userbase of 300m+.

Revenue = Number of Users x Average Revenue Per User (ARPU). We’ve already looked at users, so now let’s look at ARPU.

ARPU

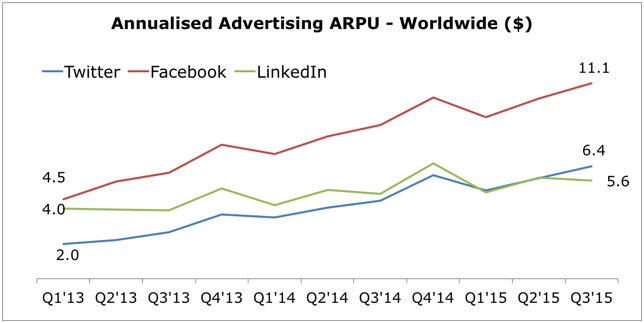

Facebook and Twitter primarily rely on advertising revenue, while LinkedIn also generates revenue from its “premium subscription” and “talent solutions” services. However, since our primary focus is Twitter, we’ll be looking only at advertising revenue in this article.

When you look at the worldwide annualised ARPU in the chart below, you can see that Twitter’s ARPU is similar to that of LinkedIn’s but only half of that of Facebook.

Source: Own Analysis, Published Results

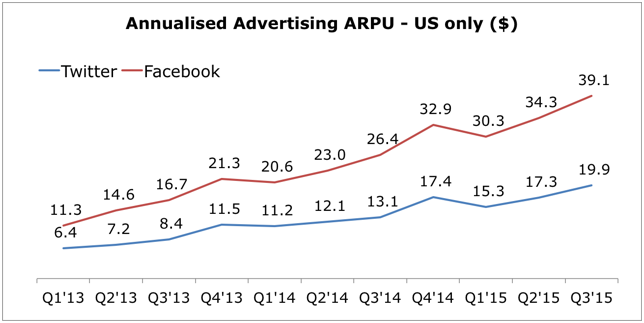

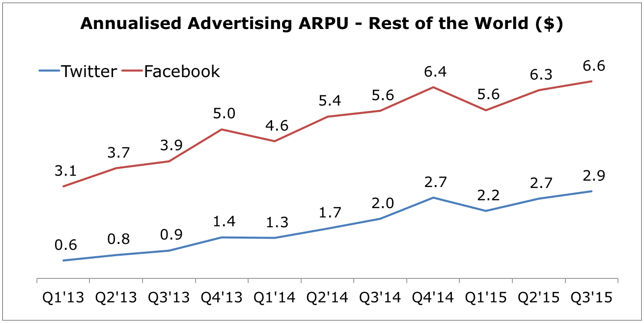

If you further break down the ARPU charts by US and the rest of the world (ROW), you can see that Twitter has a bigger gap with Facebook in ROW. Note that LinkedIn does not provide a similar geographical breakdown.

Source: Own Analysis, Published Results

Source: Own Analysis, Published Results

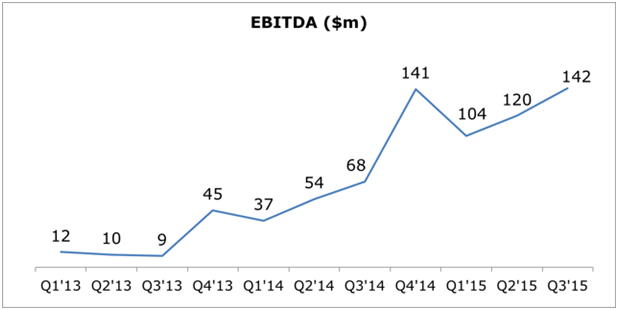

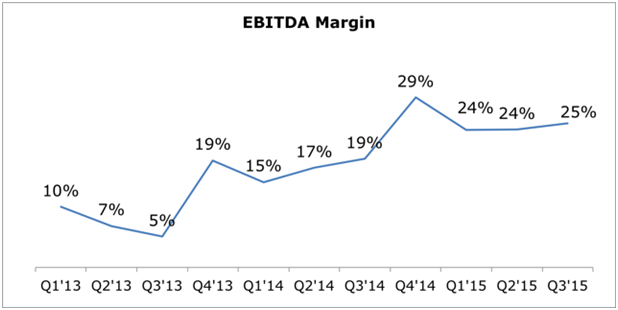

EBITDA growth is encouraging

EBITDA has been growing steadily to $142m in Q3 2015 with YoY growth of 109% and margin of 25%. Due to semi-variable costs in the income statement, any growth in revenue should result in a much higher growth in EBITDA.

Source: Published Results

Source: Published Results

Twitter’s valuation is tempting when compared with Facebook and LinkedIn

Twitter has declined 40% over the last one year and 70% over the last two years. The stock is now quoting at an EV of only $14bn which is half of that of LinkedIn. Even when compared on trailing EV/EBITDA and EV/MAUs metrics, the stock is much cheaper than Facebook and LinkedIn.

Source: Own Analysis, Published Results, Google Finance

Twitter could be a takeover target for Google, Microsoft or even Alibaba

Even though Google may claim good growth of Google+, I’m not too optimistic on the product. I believe that most of their growth is coming from forcing their big userbase to use Google+ from their other successful products such as Gmail. Moreover, integration of tweets in search results is already a good start for Google-Twitter relationship.

Other suitors could include Microsoft (it desperately needs a social network) or Alibaba (it wants to expand aggressively outside of China). At an EV of only $14bn and let’s say a 30% premium, the purchase in cash + stock is affordable for most of these companies.

Better monetisation of data could provide further upside to the stock

Integration of tweets in Google results, monetisation of logged-out users, licensing of content to financial institutions and business could provide further upside to revenue and EBITDA.

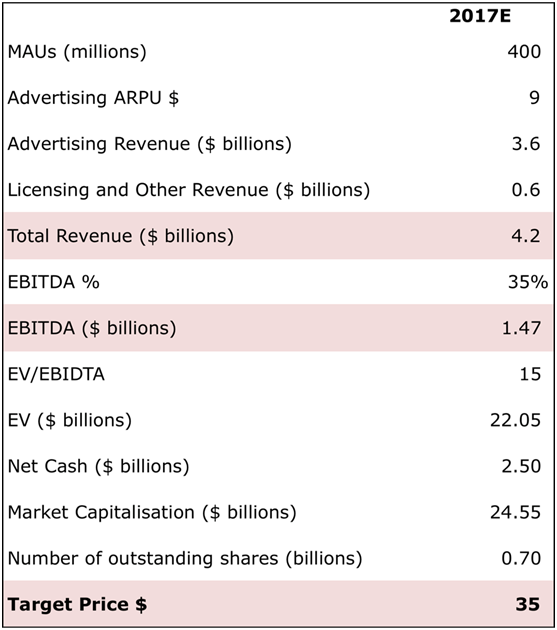

My target on the stock is $35 in 12-18 months

Below is my target price computation. I’ve assumed that MAUs will grow at a 9% CAGR, EBITDA margin will improve to 35% (most internet companies generate EBITDA of 30%-50%) and the stock will quote at 15 times EV/EBITDA which is much lower than its TTM EV/EBIDTA of 26 times.

Source: Own Analysis, Published Results, Google Finance

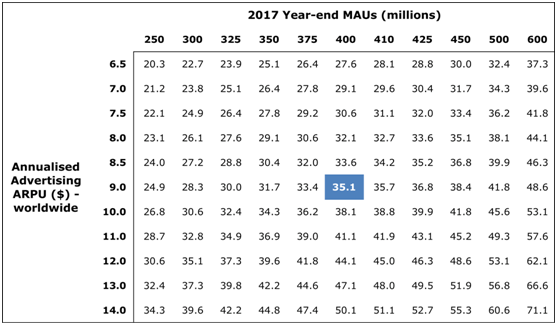

The sensitivity table below shows the target stock price based on your expectations of MAUs and ARPU in 2017.

Source: Own Analysis

Conclusion

“I would run the business in such a manner as to create the most value over the next five or ten years. You can’t run a business to try and run the stock up every day. Berkshire has gone down 50% four times in its history. When that happens, if you’ve got money you buy it.”

– Warren Buffet

We have seen Apple and Facebook decline significantly due to not meeting analysts’ expectations but subsequently making new all-time highs. Apple fell from $100 in Sep 2012 to $55 in April 2013, and currently quotes at $105. Similarly, FB fell from $38 in May 2012 to $18 in August 2012, and now quotes at $105.

I’m not sure if Twitter will reach its all-time high of $69 anytime soon, but I’m hoping for a 50% upside in the stock with a target price of $35 over the next 12-18 months.

Have a fun, productive and profitable 2016!

Disclaimer

I’m Long Twitter, and I have a business relationship with Twitter through my FinTech start-up CityFALCON.

Limitation of Analysis

Data has been accumulated from different sources, which may have different definitions of metrics, and hence, this analysis should be considered as indicative, and investors should do their own due diligence before making any decisions.

I used to be suggested this blog by means of my cousin. I’m

no longer certain whether this put up is written via him as nobody else

understand such detailed approximately my trouble. You are amazing!

Thank you! fodboldtrøjer

I go to see daily a few sites and blogs to read posts, however this weblog provides quality

based articles. fotballdrakter