Zak’s Weekend Chart Round-Up

FTSE 350 Stocks

Aldermore Group (ALD): June Gap Floor Target

On the face of it, the so called challenger bank Aldermore has had a relatively easy ride, especially considering the way it was founded in 2009, and has only known the “artificial” ultra-low interest rate environment accompanying QE. Although the traditional view is that ultra-low rates are not necessarily good for banks, offering next to nothing or nothing on deposits, and 2% plus on mortgages rakes up cash. The only issue is whether the exit from this punchbowl financial world will be via a crash that may end in tears, rather like the news about property funds this week. In the meantime, it can be seen on the daily chart of Aldermore how there has been a rebound from the floor of a broadening triangle, one which has been in place since the end of November. Interestingly, since June 27 we have been treated to no less than three clear touches of the floor of the price channel currently at 103p. All of this should ensure that at least for the next few weeks we see decent attempts by the stock at hammering out a floor. In fact, the view at this point is that provided there is no end of day close back below the 10 day moving average at 117p, a journey towards the floor of the June gap to the downside at 160p plus could be forthcoming over the course of the rest of July.

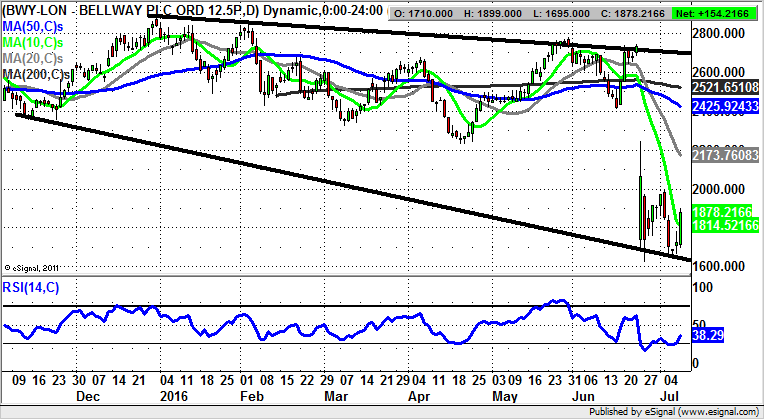

Bellway (BWY): Initial 2,000p Rebound

Presumably, until we get some clarity on the fate of the property funds issue which blew up during the week, as far as its possible effect on the housing market, we will not know the impact of the recent share price jolts for housebuilders such as Bellway will be. At least it can be seen how shares of Bellway have found the floor of a broadening triangle which can be drawn in on the daily chart from as long ago as November. The support line of the formation is currently pointing at 1,610p, after a higher low so far for July versus June. This is a positive point, as is the way that we have been treated to a weekly close back above the 10 day moving average at 1,814p. Provided there is no end of day close back below the 10 day line we could see a reasonable run up for Bellway, with the favoured destination over the rest of this month regarded as being the initial July resistance at 2,000p. But only sustained price action back above this neckline resistance would really suggest that a robust recovery was actually on the horizon.

Dixons Carphone (DC.): Higher July Support Targets 350p

Given the commanding position that Dixons Carphone has on the high street, and indeed, in many duty free spots at airports, it was somewhat surprising that the post-Brexit vote shock impacted so hard on the share price. However, the stock market is famous for “throwing the baby out with the bathwater” with “good and bad” companies very often getting marked down equally at times of uncertainty. The charting position to end this week with the much higher support above 250p versus last month’s 242p floor implies that there is bona fide interest, and that some further gains are to be had by bargain hunters. This is especially the case while there is no break back below the 297p intraday flow of Friday. While above this on an end of day close basis one would be looking to a retest of the late June resistance at 350p as soon as the end of this month.

Small Caps:

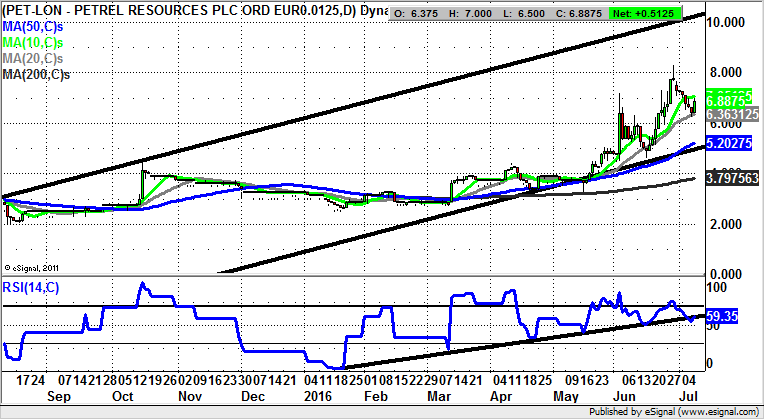

Petrel Resources (PET): 10p 2015 Price Channel Destination

All three of today’s small caps contenders have been charted quite recently here, but it seems appropriate to revisit them after the stock market upheaval of late. As far as Petrel Resources is concerned, we are looking at progress within a rising trend channel, one which has been in place since August last year. The floor of the channel currently runs level with the 50 day moving average at 5.2p. But at least while above the 20 day moving average at 6.36p we can pencil in a target over the next 6-8 weeks as high as the 2015 resistance line projection at 10p. Ideally, there is no intraday break back below 6p in the meantime.

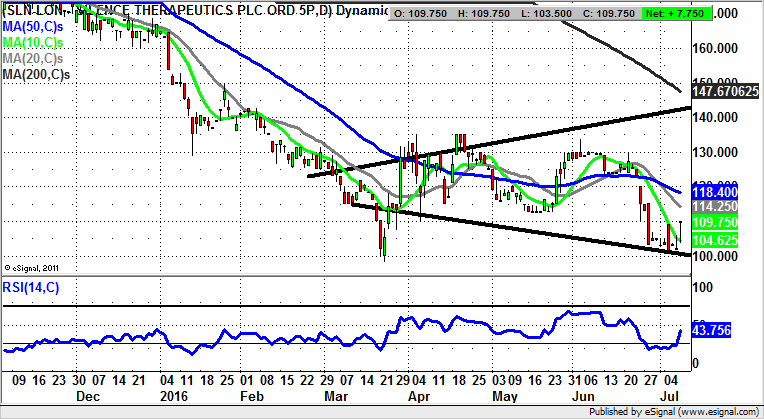

Silence Therapeutics (SLN): Floor Above 100p

On the face of it, one could argue that shares of Silence Therapeutics have disappointed over recent weeks, with the dip back towards the 100p level. However, it’s noticeable that even in the darkest days of July to date we have seen the shares hold above the former March 2016 intraday low at 98p. This is significant and suggests that provided there is no break back below this number there could be a squeeze higher over the next few weeks. The favoured near term target is the area of the 50 day moving average at 118p. But this really needs to be conquered in order to imply a sustained recovery is under way.

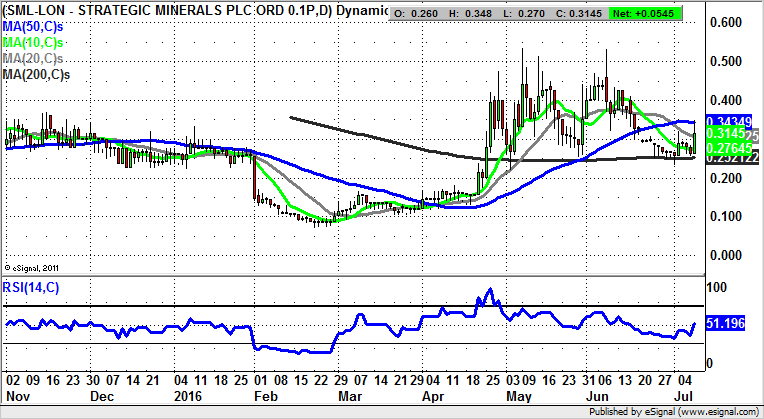

Strategic Minerals (SML): Above The 200 Day Line Targets 0.5p Plus Again

It rather goes without saying that while technical analysis in general is something of an inexact science, for the more illiquid small caps it can be regarded as more of an art. This is especially the case with regard to mining stocks, which are traditionally very volatile anyway. The present position at Strategic Minerals shows how there has been good support at and just below the 200 day moving average at 0.25p over the past couple of months. The message remains that provided there is no end of week close back below the 200 day line, we would be looking to a retest of 2016 resistance at 0.5p plus over the next 1-2 months.

Comments (0)