Wood Group – Who even owns this stock?

Lower oil prices have been a mixed bag really. Good for some industries and bad for others. Although to be fair, if oil is a major input cost then the hedging department should be protecting companies from serious downside. It would make interesting reading to see a catalogue of failures in hedging departments over the last year.

When a particular industry is a target for investment it’s often a wise move to look at the peripheral companies in it, the ones that provide infrastructure and services. These can often provide better returns. But with oil prices so low, what we’re seeing is prospecting at a minimum and many oil wells closed down, so the demand for peripheral services is, in this case, severely curtailed as oil producers seek to cut running costs.

Wood Group plc (WG.) are due to announce their results this week and there is trepidation around the numbers, although they seem quite bullish about how not-quite-so-bad things are going to be. The beauty of TA is you don’t have to interpret loaded statements or massaged figures. We’re not interested in what they’re saying and we don’t need to be. We live and die, as investors and traders, by the stock price. So what is said is ultimately of no consequence to us, only what happens to the price action.

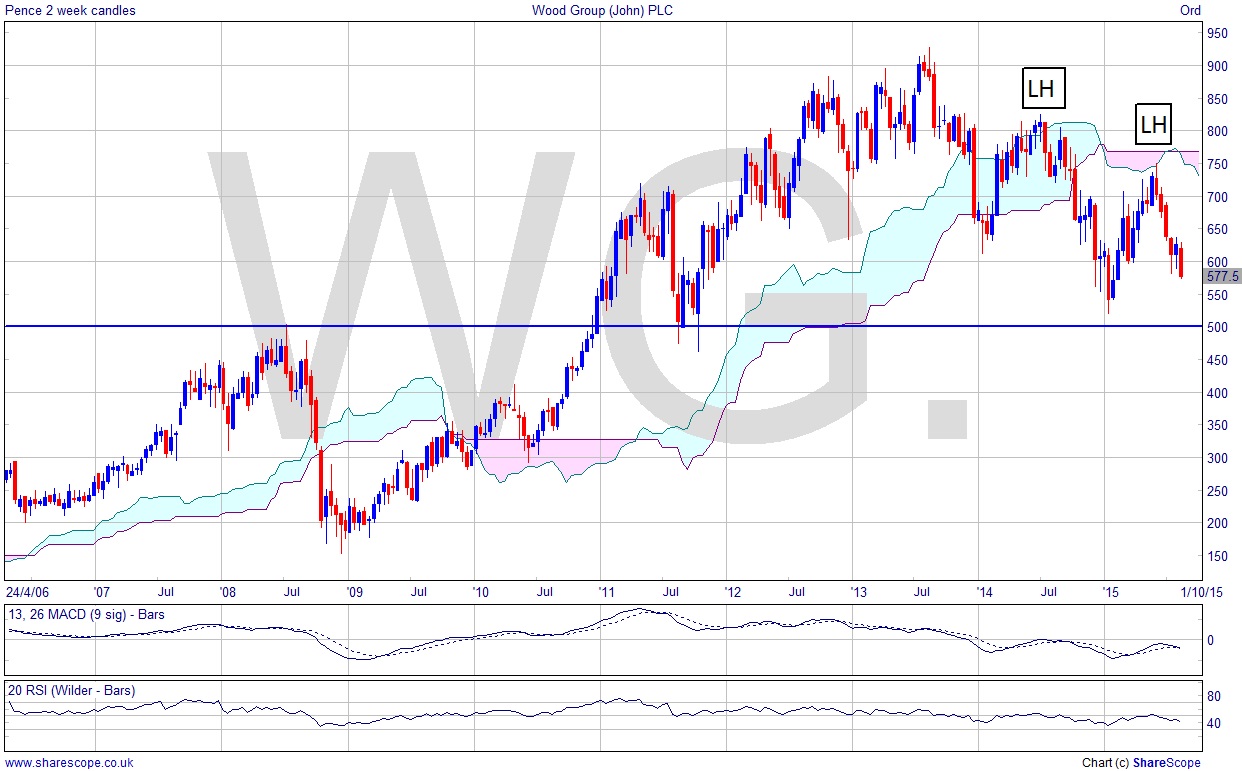

A quick look at the Wood Group chart reveals that the trouble started in 2013. That’s right, back when oil (WTI) was around the $90 mark. They had performed very well, easily out-performing the pre-crash era by almost 100%. But in 2013 there’s a big drop, significantly one that went on to produce significantly lower highs, which I’ve marked on the chart. Who is still in this stock? Just basic Dow Theory highlighting those lower highs is warning enough to sell surely! I suppose if everyone thought like me the market would be a lot more volatile, as people got in and out of stocks. But don’t forget, as private investors we have an advantage over, say, pension funds: we don’t have to stay largely invested. We can be 100% in cash if we wish.

As things look on the Wood chart, I wouldn’t be interested even if they have results above expectations. It would probably just cause a short-lived rally, creating another lower high before crashing through the 2009 ATH level. I wrote off the Banking Sector in 2007 as a bad idea, and since 2008 I’ve called it a ‘damaged sector’ because, as has proved to be the case, every time a bank makes some money a government or other body will take it off them. Trying to extrapolate what effect oil prices are going to have on various companies is a mug’s game. Just trade the oil price!

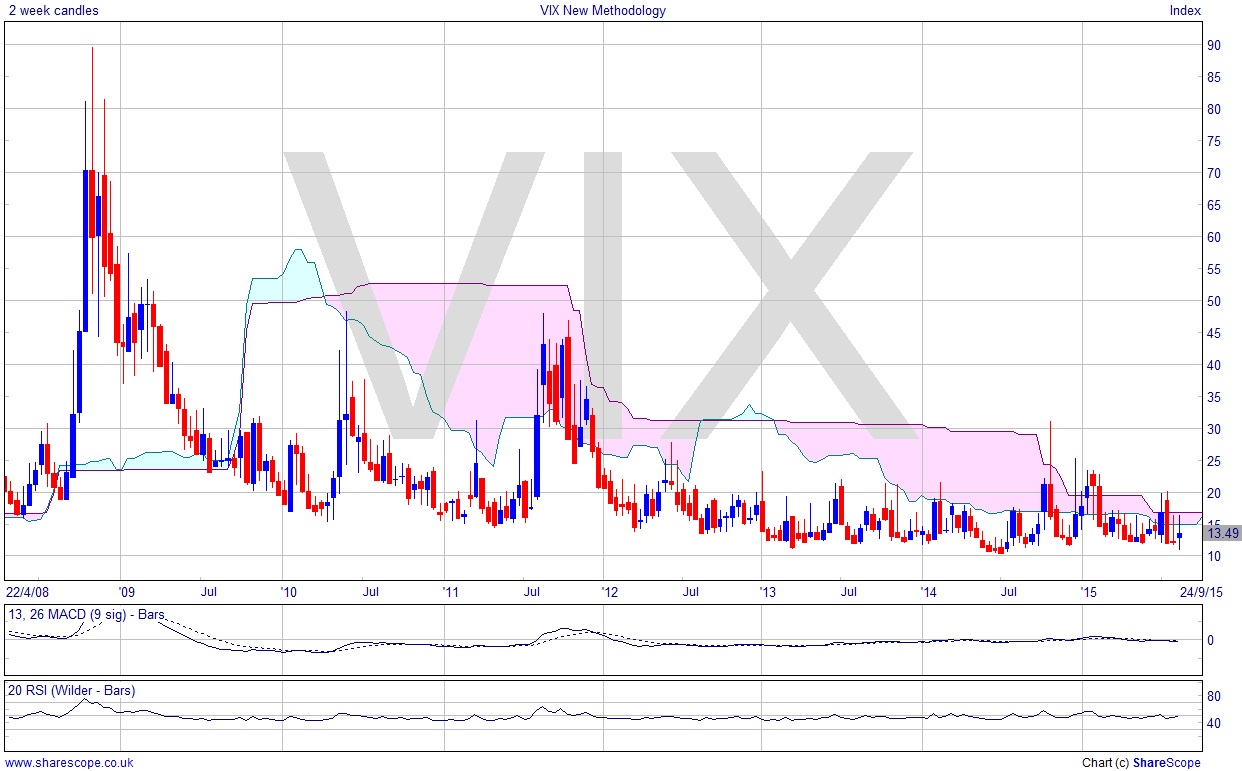

Wood is exactly the sort of chart that is pulling the UK market down. And we are well overdue a proper correction. This is a time for caution and consolidation in portfolios. Perhaps a time to think about profit taking, at least in the UK market. Normally I’d expect to see the VIX index high to make a comment like that, but a lot of companies are giving really bearish signals and we can’t ignore that. We also can’t ignore that the US is not in the same predicament, and I expect to see a recalibration between the UK and US indices over coming months, with the US strengthening as the UK weakens.

Comments (0)