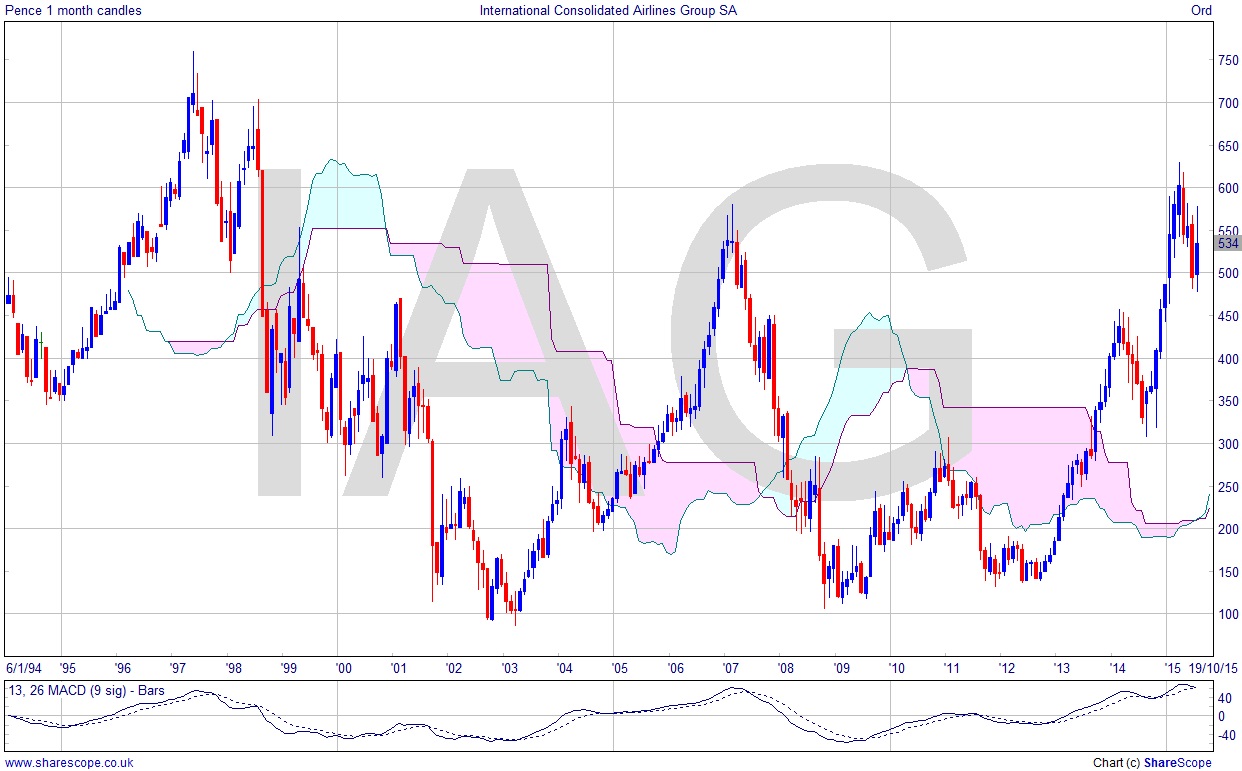

Will the IAG (aka British Airways) ascent continue?

The airline industry should be having a bit of a golden age just now with oil prices so low. This represents a massive windfall, seemingly, on one of their biggest running costs. I used to work for BA and the view inside certainly, and outside usually, is that it’s a superior airline that is a cut above the competition. But I’m surprised they haven’t been at all innovative in pushing their premium brand.

Delta has just introduced a brilliant idea. They already treat their best customers to limos to travel from one flight to another, like most of their rivals. Delta uses Porsches by the way. They are now offering their valued customers an upgrade for $300-$800, not to a better class on their booked flight, but a seat on a private jet. Delta has a fleet of private jets, and it now seems perhaps complacent that BA haven’t got involved in the ‘premium only’ business. Many have tried and failed but BA would seem to be uniquely positioned to take advantage.

For years BA has made the majority of its profits from premium passengers, so to expand that business must be key to their success. And of course they lost Concorde. That really was something – I flew on it from gate 1 at Heathrow, flight BA1 to New York JFK. A spot of Blue Label on board, a bite to eat, and a quick shoofty in the cockpit and there we were in New York, before we even left London. But what have they really added since then? The differentiation of Premium Economy was a great idea, and then I’m struggling to think of anything else. Giving you less to eat and drink springs to mind, which is probably true of all airlines. By the way, do make sure you have some coins on you when flying low cost: surely it’s only a matter of time before they drop down coin-operated oxygen masks if the cabin depressurizes.

I can’t say I feel valued like the Delta customers presumably do. When I tried to spend my expiring BA air miles, or whatever they call them now, it was actually cheaper to book the same flight through a bucket shop, so they expired valueless like poorly judged option contracts. And I can’t think of a time when I was upgraded on BA. Air France yes, Iberia, the old Brazilian airline now part of TAM (Varig), several American airlines and Cathay Pacific I seem to recall. BA? Nope. They’re not making me feel warm and fuzzy. Even when I was working for them I used to get upgraded more on other airlines than on BA.

That said, give me BA over Ryanair any day of the week! BA isn’t just BA any more but is part of the consolidated group including Iberia and low-cost Vueling.

So how is their chart looking? Well it’s quite an interesting one. The high is way back in ’97 and it’s actually looking quite bullish at the moment. With the low oil costs we could be in for a profit/dividend bonanza which could well give the stock a springboard to break further upwards. It’s a chart that in the past has tended to trend so Dow Theory should be useful. I’d be looking for a bounce from the previous high on the monthly chart at around 450. A higher low above that would be bullish anyway. We’re probably looking at the autumn for this because not much happens in the summer. All in all, a good one for the watchlist.

Comments (0)