Vacant Shops – Yippee!

It’s a strange existence when you’re focussed on trading. Rather like a soldier has to dehumanise his enemy to be effective, we have to distance ourselves in a similar way to be objective. I got all excited yesterday about seeing some shops closed because it’s another brick in the wall of market failure. If you want to be ‘human’ about it, or as I prefer to say in this case, namby pamby: [said in a pathetic whining tone] that’s someone’s livelihood and some people’s jobs and maybe even dreams that have gone there. On the other hand, and which people never say, probably unrealistic businesses that hadn’t moved with the times and employees who, if they didn’t see the writing on the wall, should have been more circumspect. We have to stop thinking of schadenfreude as a bad thing when we’re observing markets.

I’ve moved recently to the very edge of London and I went to explore one of my new local towns, Walton-on-Thames (population 22,834 according to Wikipedia). It’s a very prosperous place and therefore a good test of failure. I walked around the shopping area and I found 4 prime location shops and a pub empty! This is what I would expect to see as we go into my predicted downturn, but somewhat ahead of the interest rate rises we might imagine will be the catalyst.

I read yesterday that some building societies are starting to offer 95% mortgages again, which I imagine is a considered move to keep their lending at constant levels as the housing market cools off at the top end following the recent rises in stamp duty. This will appeal to the first time buyer and the lenders are now prepared to lend without the safety net of the government’s guarantee scheme, which is due to end next year anyway. It’s good money after bad. Their risk is poorly timed as we face interest rate hikes, and their balance sheets are already weak because they’re not allowed, thanks to the cockamamie FCA idea of banning them, to lend non-status.

Lenders playing fast and loose – how could that possibly go wrong? Am I excited about the failing housing market? Well I’ve got a semi. The really exciting bit though is a downturn in commercial property lettings. That is exciting. Or das ist geil as they say in German.

Let’s face it, the fake economy we’ve been enjoying for the last seven years has been based on homeowners with small mortgages improving their properties, and the multiplier effect of the billions parked here as a hedge against the Eurozone. The FTSE is a disaster area, we have no real growth because inflation hasn’t been 0%-1% over the last few years; it’s been 8%-10%, which also means we’ve been permanently in recession since 2008.

I saw lots of busy restaurants on a Tuesday night, which, oddly enough, is a bad sign too. As hard times loom something makes people go out for dinner.

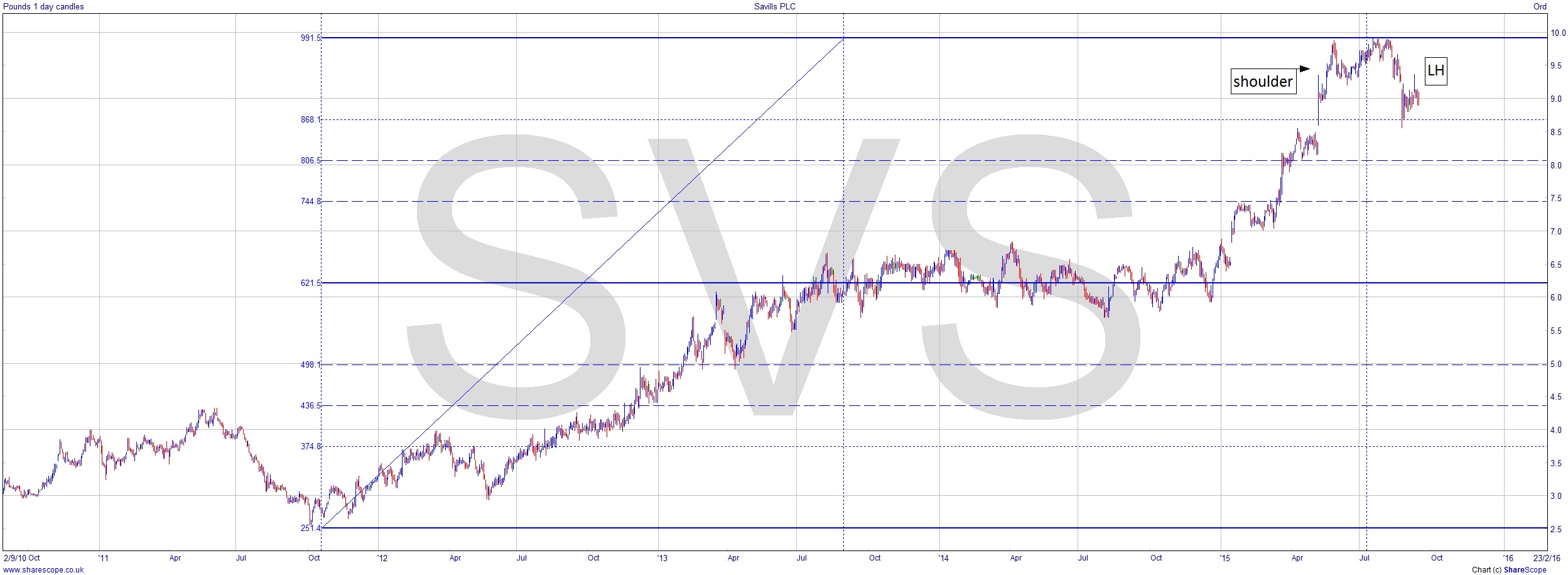

The star pick? Well it has to be Savills plc. And what a classic example of a measured move. You can see the 18-month long congestion area around the 50% level (thick line) on the Gann retracement grid I’ve overlaid, and then it’s obviously gone up just as far as it did going into the congestion area. Classic. And now it’s failing. 50% retracements are very common, so with the H+S made with the Lower High I’ve marked, this looks like a good one for your Short Watchlist. This could also be an island reversal if it gaps down at what will be the neckline.

Comments (0)