UK employment off the grid

Some geezer has been pinged into space. Why should I care he’s from the UK, let alone be proud? Do I know him personally? No. Did I have anything to do with his training or the decision to send him into space? No. Did I contribute anything at all to the exercise? No. So should I be proud because he lived somewhere not that near where I live? I mean that’s all I’ve got here to be proud of. Someone who didn’t live that near me has done something fairly routine in this day and age. Pride in things you’ve not been involved in is pride by proxy. Pride is a good thing. At least it is when it’s justified because you yourself have achieved something. But I don’t see any connection between me and this guy going into orbit, any more than I see a connection between me and a sports team doing well. It’s misplaced.

Similarly, if you’re simply investing in the UK because you think it’s patriotic, it’s not patriotic: it’s idiotic. I have trashed the FTSE 100 a number of times over the last few months so look away if you think it’s a family member, or you are having a close personal relationship with it.

Unemployment is an interesting economic indicator. I’ve said before that I spotted the tsunami of unemployment denied by the politicians in 2008/9 because I saw all the South Americans and Poles going home for holidays and not returning because there was not enough work. They didn’t appear in official figures, so you had to look deeper to anticipate the inevitable, on which note never listen to politicians with your investment hat on! Well we have a new ‘off-balance sheet’ employment problem now. I have written in my Final Word article in the magazine about both the main protagonists: minimum wage and migrants. They are both key factors in the extension of the black market in labour.

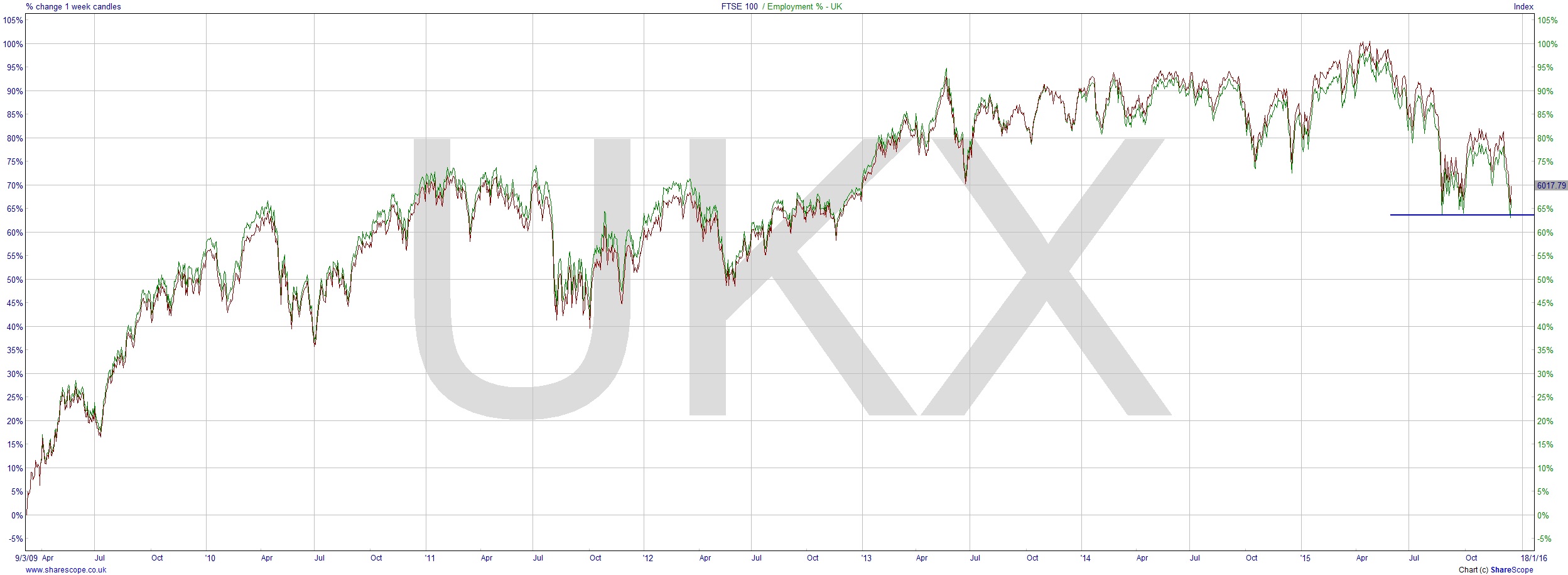

I’ve shown in the chart UK Employment against the FTSE 100. As you can see the FTSE 100 relative to UK Employment is a leading index as markets rise but once it goes back below the FTSE 100 then it’s bearish. And it’s a leading indicator. Just look how long ago it moved under the FTSE 100: before the market highs back in early ’14.

With the prospect of rising interest rates we are likely to see more companies go to the wall and a further fall in employment. The Black Market in people is growing well if you’re in that line of, er, work. This time it is hitting the employment figures because many citizens are out of work officially, thanks to policy. Those migrants arriving, as I wrote in my ‘How To Solve The Migrant Crisis’ article in the October issue of the magazine, will be working to pay off their debt for being ‘brought’ to Europe, i.e. slaves. I’m against ID cards here in the UK, but not having them probably does make Britain a fairly attractive place to set up shop illegally, though the need for them doesn’t stop them doing it all over the EU.

What it means for us is we should already be net short in the UK market. Not to say that this slavery phenomenon won’t be affecting other countries, of course it will. In fact it will probably stem the tide of social unrest. Trafficked and black market workers aren’t turning up at demos or lobbying their MPs. Nor even voting. They are off the grid. Supporting the economy at the lower levels legitimate companies can’t afford to, by providing labour at market rates rather than minimum wage – services legitimate companies have been forced out of by the minimum wage. It’s a landscape for more corruption and ultimately a much stronger organised crime.

That’s a triple bottom there on the chart which, with the series of lower highs since April, is certainly not a scenario I’d be buying into.

Comments (0)