Supermarkets Sweep: Morrisons, Sainsbury’s, Tesco

It would appear that judging by the financial press and various other “informed” sources, we are all apparently experts on the groceries sector, if only on the basis that we all shop there. Therefore armchair opinions of all varieties are offered to the ether in terms of how Tesco should turn itself around, or how the old supermarkets should compete with upstarts Aldi and Lidl. Presumably this state of affairs is set to continue for quite some time, or at least until another perennial topic of conversation – the housing market, perhaps? – takes over.

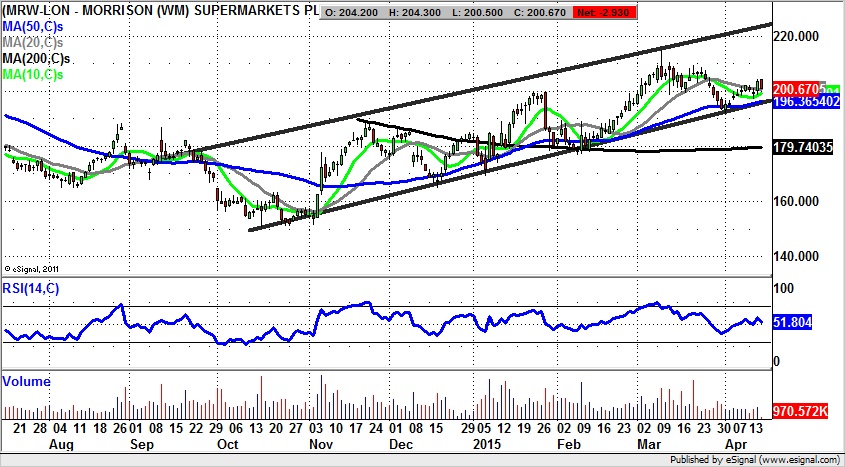

But the focus today as far as the supermarkets are concerned in this article is not like for like sales or ever squeezed margins. Instead it is the charting position of the main protagonists of this mini sector. I start off with arguably the company which has the most to prove it terms of being able to join the ranks of the largest players: Morrisons (MRW). Here we seem to have had the problem that this company has fallen between two stools fundamentally. It is too big to be a niche player, and too small to have the firepower and competitive edge that the likes of Sainsbury’s or Tesco might have. Hence the group is in something of a no man’s land, and it shows. From a technical perspective it can be seen how the stock has actually made decent progress within a rising trend channel from September. The floor of the channel currently runs at 196p – level with the 50 day moving average. This would suggest that even after all the progress of recent months, while there is no end of day close back below the 50 day line, the upside here should be towards the 2014 price channel top as high as 220p over the next 1-2 months or less.

Next up is Sainsbury (SBRY) where it can be seen how there has also been reasonable progress for the stock over recent months, albeit in a rather less satisfactory way than at Morrison. The problem from a technical perspective is that this month’s spike through post November resistance in the 280p region gives all the impression of being a bull trap. The trade on offer to aggressive players would be to short the stock on any strength towards 280p, with only an end of day close back above this week’s 286p intraday peak delaying the prospect of a least a test of the December price channel floor at 260p over the next 2-4 weeks.

Tesco (TSCO) is of course “the big one” in terms of supermarkets and is the benchmark in terms of performance. The latest newsflow regarding the sale of executive jets rather says it all as far as what those trying to get a take on the fundamentals have had to grapple with over the recent past. But getting back to the technicals and it is evident that the recent past has been dominated by progress within a rising October price channel currently based at 241p. This zone should come in as support for the shares over the next few sessions, and we are helped along in making such an assumption by the way that the 200 day moving average, now at 221p, was cleared in February at the first time of asking. Therefore, the expectation is for a push towards a best case scenario target at the top of last year’s rising trend channel at 280p, a destination which if the 240p zone holds could be hit over the next 6-8 weeks.

Comments (0)