Stanley Gibbons: Above 10p could lead back towards 18p

Stanley Gibbons (LON:SGI) was founded in 1856, but it would appear that the troubles at the stamp collecting group in the recent past have been worthy of a Dickensian novel.

In a documentary about the eponymous founder of the company, it was revealed that he became a womaniser some years after setting up shop. It would be interesting to know how one set up shop, so to speak, in his new career in the 19th century as opposed to nowadays.

However, the matter in hand is the tale of woe that is Stanley Gibbons, and how it managed to post a £29m annual loss due to accounting issues. This is a problem which should be impossible in the day of modern computing and apparent transparency.

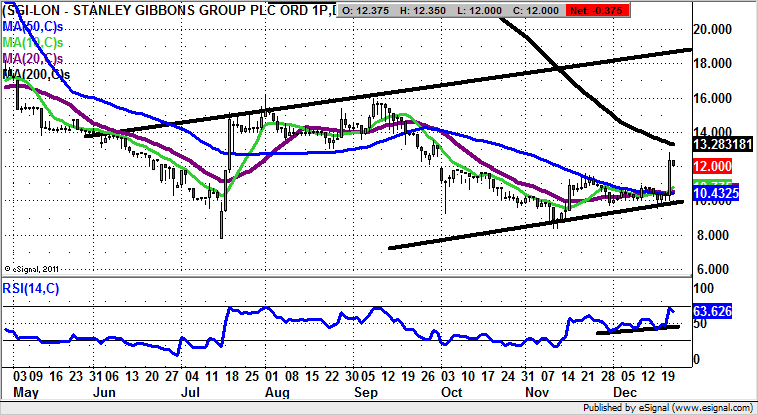

Getting on to the charting position, it can be seen on the daily chart that there has been a decent basing at and just below the 10p level, after a horrific breakdown at the start of the year. This zone has come in several times to help out the stock in recent weeks, with a clearance of the 50 day moving average at 10.43p backed by a triple RSI bounce in the oscillator window.

All of this should be good enough to deliver a rally to the top of a rising trend channel from June at 18p plus over the next 1-2 months. Only a weekly close back below 10p really upsets the recovery argument.

Comments (0)