Something For The Weekend – No Brussels With Xmas Lunch

Elitism is making a comeback. Don’t worry, it won’t affect most of you. That’s really the state of play at the moment. There’s a huge amount of opportunity as currencies continue to be the playground for investors, and a nightmare for governments and multi-nationals.

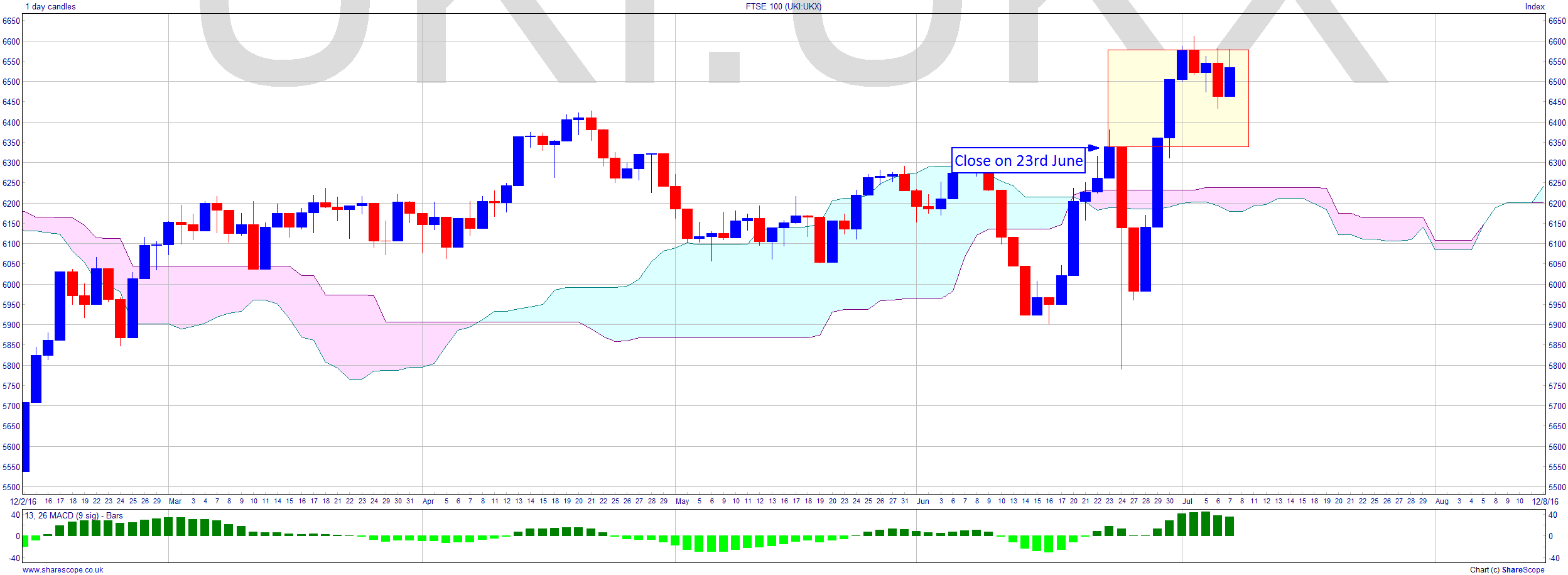

What has really happened since we’ve nearly almost definitely left the EU unless we haven’t, but we probably have? Well the FTSE 100 looks like it’s gone up 10%. It has gone up 10% is the reason. And if you’re spending pounds from a tidy profit on a spread bet then happy days. But if you’re going to be exposed to any cross-currency risk, for example by travelling overseas on your holidays, then it’s not such a rosy picture. It’s also not a realistic one. I doubt many people dived in at the lows of the 24th, the day after the referendum, and realised that gain. Most people were so cocksure that Remain would win, clearly they hadn’t read my prediction of the Leave win on June 17th, and since the close of the 23rd (6338.1) it has hit around 6600, and again, to realise that gain you’d have had to close out just at the top. It would have been a big drawdown for those already in on the 23rd to the spike down at 5800. So the realistic gain was around 4%.

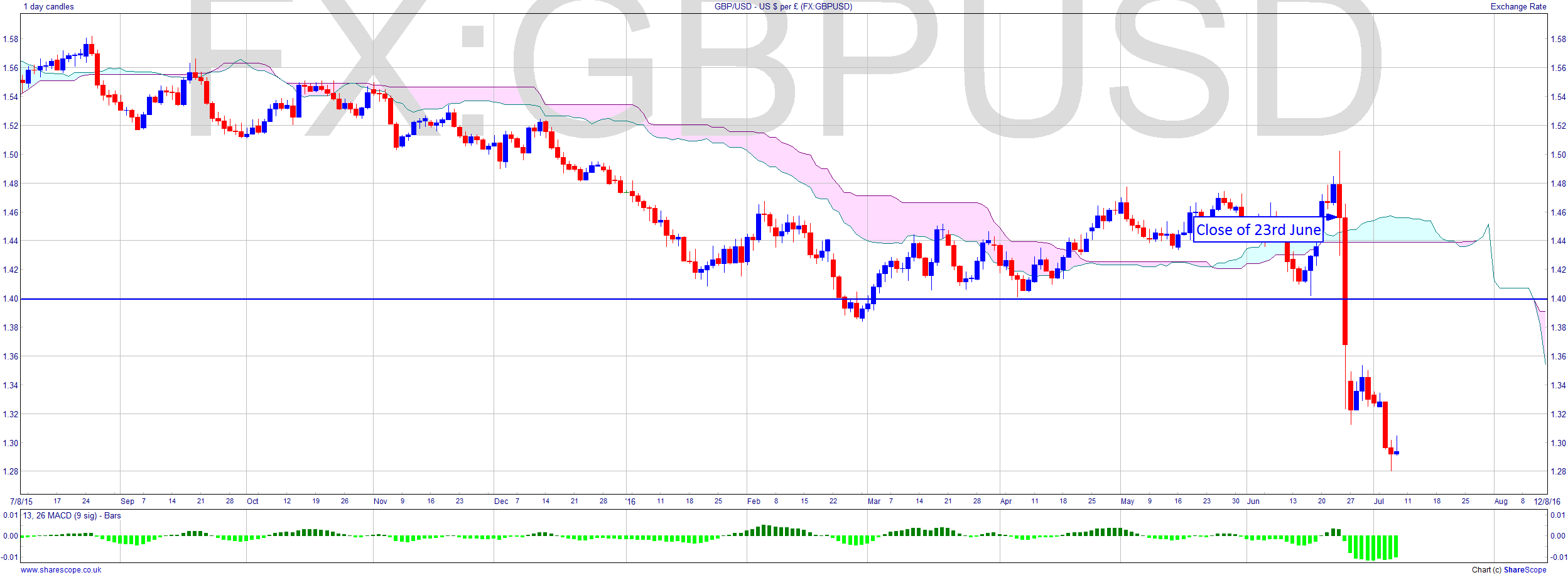

All well and good? No not really. Because this is against the backdrop of Cable falling to $1.28. Let’s be nice and say $1.30. Down from around $1.45 close on the 23rd. That’s a drop of over 11%. So that 4% gain is dwarfed leaving a net loss of 7%. This is important because many commodities are priced in dollars – it’s the global reserve currency. So in the absence of a gold standard, it’s the dollar standard. By the way what’s the difference? Fiat money requires belief just as some pretty useless yellow metal that has little value as a commodity except to represent the value of other commodities.

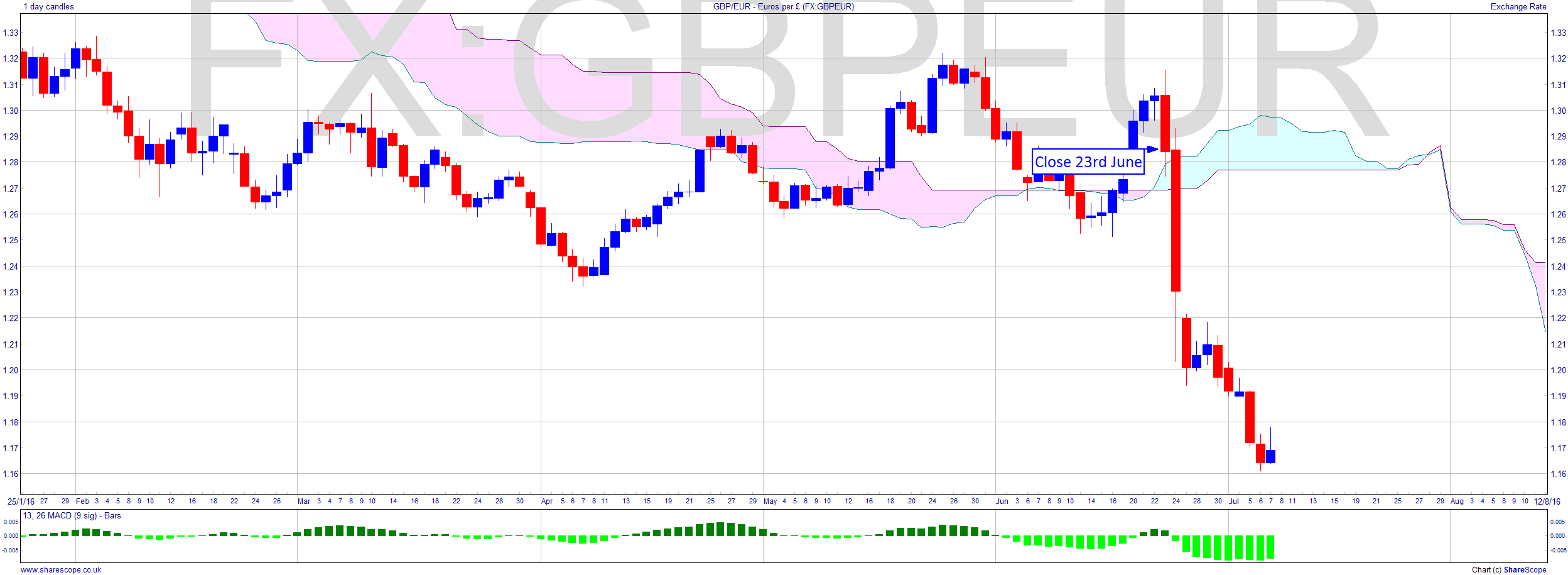

What about the Euro then? Well that’s down 10% so a similar story. I wrote in my July Final Word column in the magazine about how residing and working in the UK means if you also invest in UK stocks you are basically not managing your portfolio risk but exaggerating it. That lesson will have been rammed home this last couple of weeks. Arguably the EU would have exposed one to a similar risk, but of course there’s the currency variable there. DAX down 9% (23rd close 10257, now around 9400) so in fact the difference is hedged out for actual stock holdings (not spread bets of course).

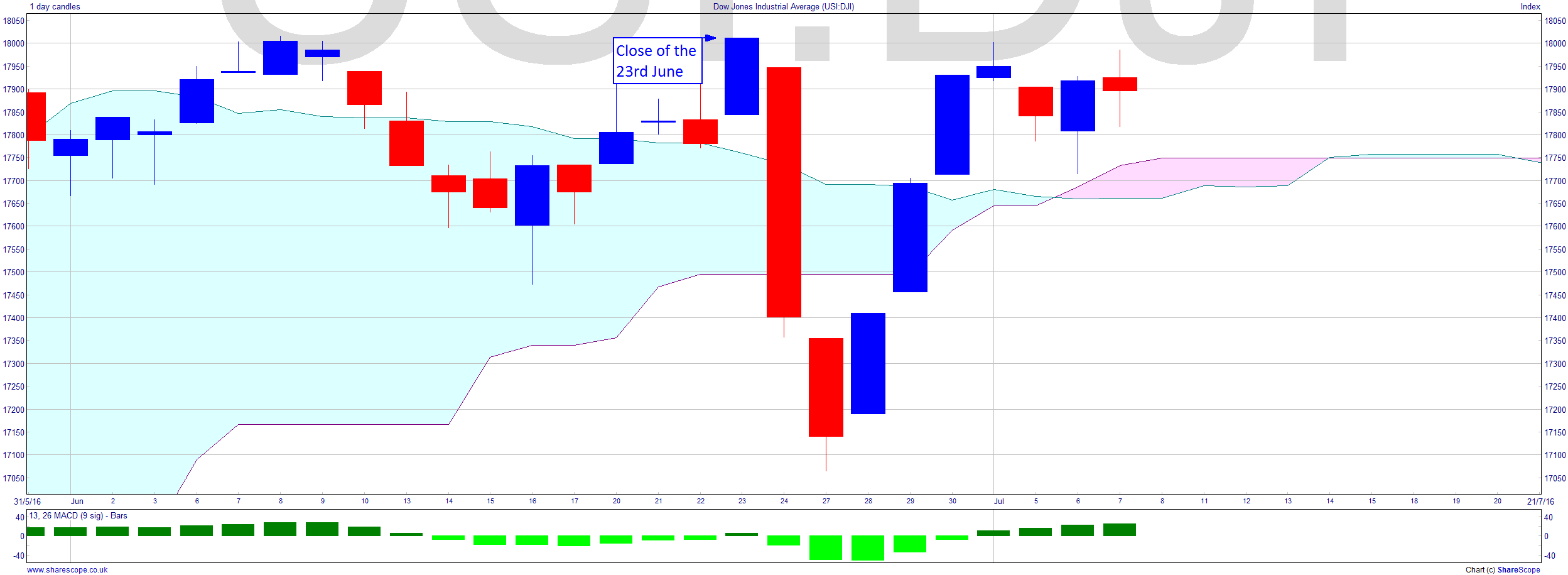

The Dow has done very well since the 23rd, closing at around 18,000 it has now pretty much recovered any short term shock losses there. So, a currency gain of 11% and flat on most stocks. New jobs data out today shows the US economy is picking up nicely. Expect more of the same.

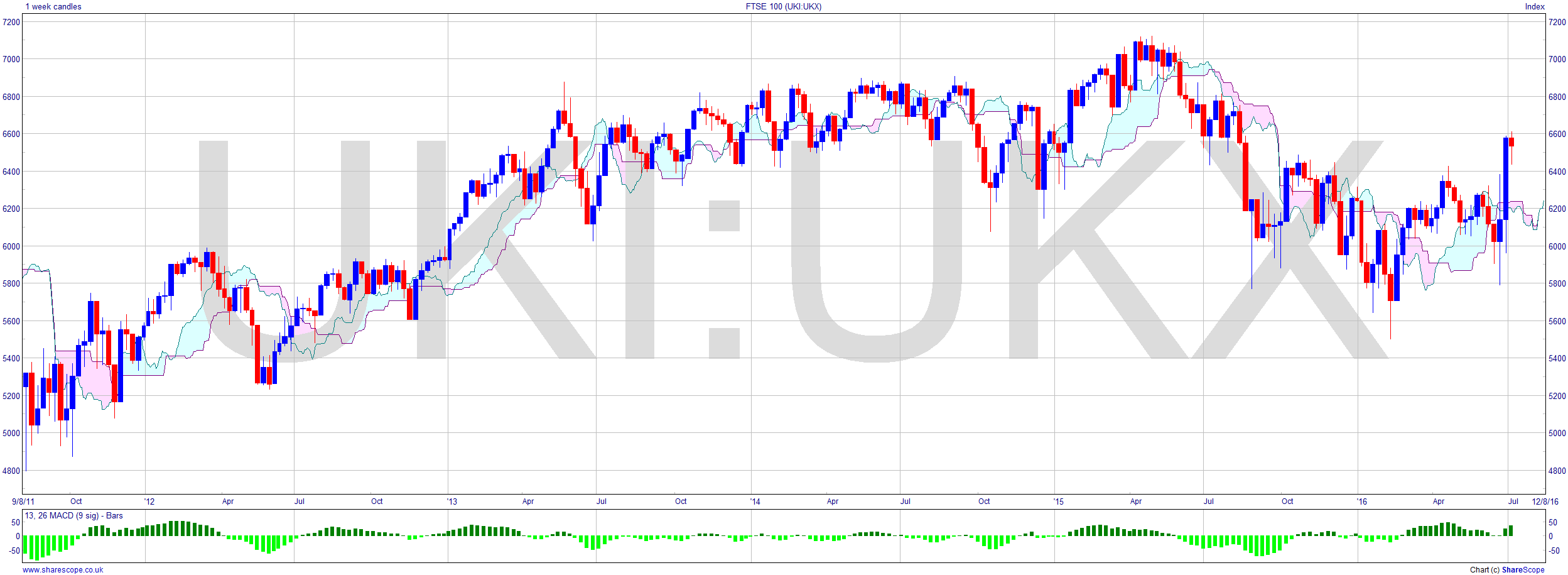

I’ve been trashing the FTSE 100 a lot over the last year or so in many of my articles. And for British investors it’s been nothing short of a money toilet for the most part. I asked Is It Time To Short Cable? In a blog post on Jan 14th, with a target of $1.08. Click HERE to read the post for the full analysis.

Just to give the title of this piece context, I’ve never had Brussels with anything. Can’t stand the tiny wannabe cabbages. The only purpose of putting them on a plate surely is to accentuate how good the rest tastes.

Comments (0)