Something for the Weekend – How Are Pubs Looking Now?

My local pub has a movie night on a Monday. I saw a zombie movie there and I don’t want to ruin it but everyone dies at the beginning.

I wrote last June about the phenomenon that was making the pub business very lucrative for those that were getting it right in terms of marketing mix. Basically, pubs that are everything to everyone: sports on the silent big screen, pub quiz, poker night, live entertainment, a garden for the smokers and sun worshippers, welcoming to children, and so on. They were looking good here in the South East, with the demographic of young high earners still living at home and the general affluence of the region afforded by the trickle-down/multiplier effect of foreign property investment.

Ironically, government is like a greedy pub landlord, in that they will cane something to death rather than nurture it, when there’s a chance of some quick cash. Of course they will argue that it was just a fad, and since they’ve all but killed off whatever it was, it’s pointless debating the issue.

The first shocker I suppose was the sugar tax. A man named after a sweet biscuit (Osborne) decided to put paid to the super profits pubs have been making for years on soft drinks. I always thought if there was a health angle then there should be a limit on soft drink prices to encourage people to drink them. Instead successive governments have simply forced up the price of alcoholic beverages which soft drinks simply equalise with. Then there was the minimum wage change that created a price shock for all leisure companies.

Pubs are taking a broadside from government and from other areas, but perhaps in some cases they’re doing it to themselves…

A West London landlord I was talking to about an unrelated matter may turn out to have some very flappy gums indeed when, and if, I hear back from Fullers HQ about his comments. He claims the Managing Director at Fullers (LON:FSTA) says Brexit will take us into recession by November, and as a result, he says, Fullers are cutting back on entertainment and other controllable costs. In reality we have some post-Brexit extra tourism as a result of the low pound. Fullers aren’t really exposed to currency risk, being a domestic business, so this would be a net gain for them. We have been in recession, as I frequently point out, since the financial crisis, as real inflation has well outstripped GDP growth. At a time when they should be making hay, they’re removing a lot of the things that encourage people to go into their pubs.

I called their PR department to check on the company’s post-Brexit stance and a Fuller’s spokesperson responded with this:

“We are seeing a more uncertain economic and political environment at the present time and while individual managers will take operational decisions in relation to their particular pubs, as a Company we have exciting plans in place and will continue to invest in our people, our premium brands and our pub estate.”

This neither confirms nor denies what their publican said but does attempt to distance the company from it. Make of that what you will. Also for a domestic company I would say these are not uncertain times economically speaking, and with a majority government set for the next four years, neither politically.

Actually, one of the biggest threats to the brewing industry these days is from cancer charities. Having failed to get the government to tackle this class of disease head on with the taxes we’ve already paid them, they flail around having people run around pointlessly and make the place untidy with moustaches. A word to the wise: I’m not sure it’s worth the risk of growing a beard or moustache just on the off chance that they ever come into fashion again. The latest charity nonsense is to discourage people from drinking and pretending they get a medal at the end of a month. First it was January, and now it’s being rehashed for the second time this year.

Timeline:

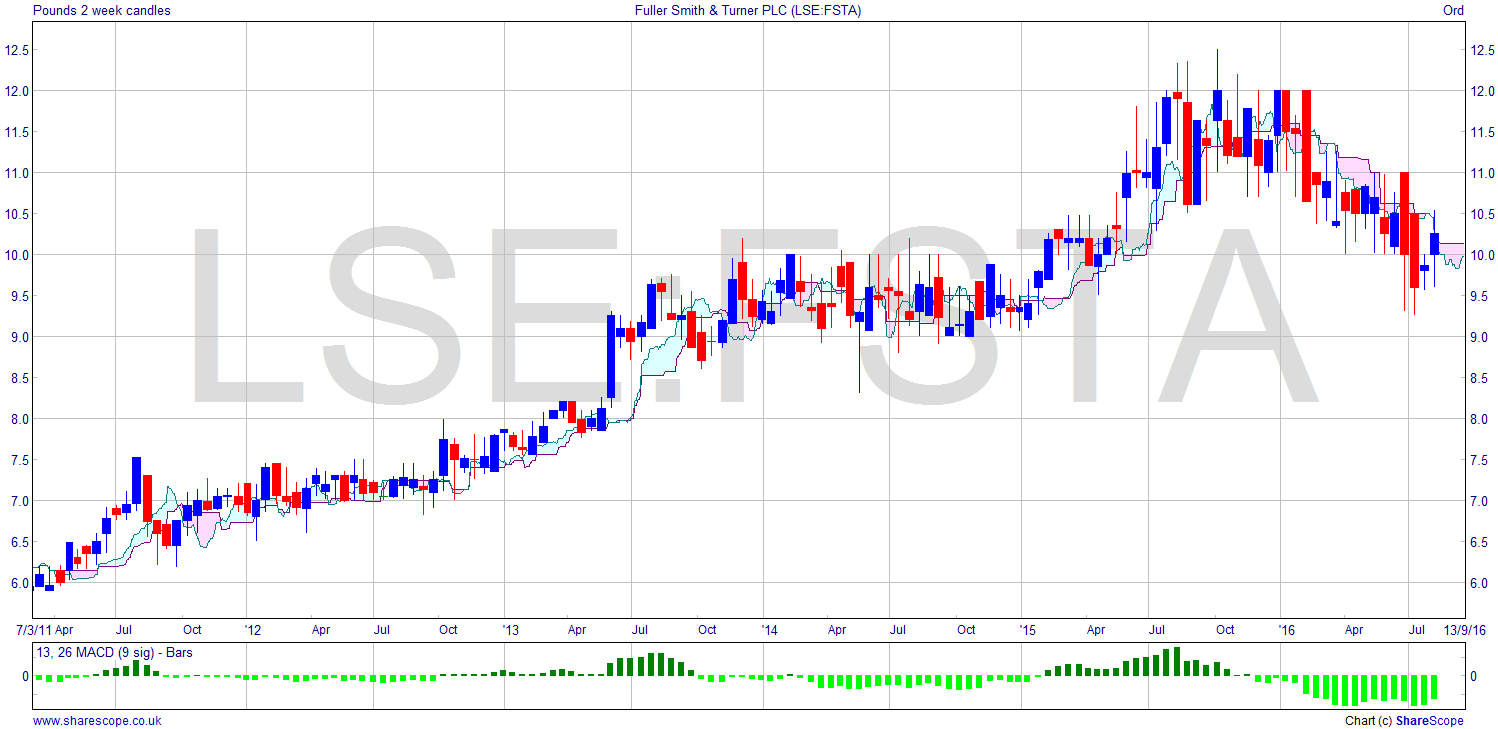

June 2015: I wrote “Very strong upward trend, and what I like about this chart is the long congestion area that has just been broken.” The price then was around £11. Indications were a possible measured move up to £16.

August 2015: Fullers at around £12 when I wrote this: “Up from around £11 to around £12 since my post and making nice headway out of the lengthy congestion area.”

March 2016: The party was over thanks to the sugar tax, inter alia. At worst a scratch trade (one where no significant money is made or lost). “Fullers (LSE:FSTA) moved up nicely out of the congestion area and up 20% above it at £12. I suggested a possible upside to £16, but it’s certainly met resistance at £12. It’s not necessarily curtains though.”

August 2016: Well it is curtains now, for that measured move trade idea at least. However, if Fullers really are winding down their entertainment budget then it may simply become a self-fulfilling prophecy. If this cancer charity dryathon has any effect they may even think they were right in cutting costs. But really, with a low pound, every London-based pub should be leaning into the punch, not hiding behind the couch. In any case Mr Managing Director, Fullers shares were faltering long before Brexit, or even the announcement of the referendum date. Where’s my £16 measured move, eh? That’s what I want to know. Maybe you should focus on that and stop blaming the future for the recent past.

If this “post-Brexit recession” attitude is widespread in industry then are we in for a bumpy ride! An industry led recession in a near-zero interest rate environment. Imagine that.

Ultimately, the important thing with trading is not to lose money. Forget all these people who tell you losing is part of trading. There are plenty of decent trade ideas, like this one, where you could have at worst hit breakeven. If your trade management is sound then you should be breaking even when ideas don’t work, not losing money.

Comments (0)