Something for the Weekend – Working on the BlockChain Gang

There are all kinds of products available to help us achieve things beyond our capabilities. From aeroplanes to recreational drugs. One I became aware of recently is a pair of fake breasts that a father can wear, filled with the mother’s breast milk, to feed the baby, thus creating a bond that fathers don’t normally experience. I suggested it should be called “I can’t believe it’s not mutter”.

There are plenty of surprises in the real world but of course regular readers of my posts and articles will rarely be surprised by financial goings-on. So whilst the technology behind bitcoin, the blockchain protocol, is an amazing piece of code, the value of Bitcoin should be as predictable as any other commodity or financial instrument.

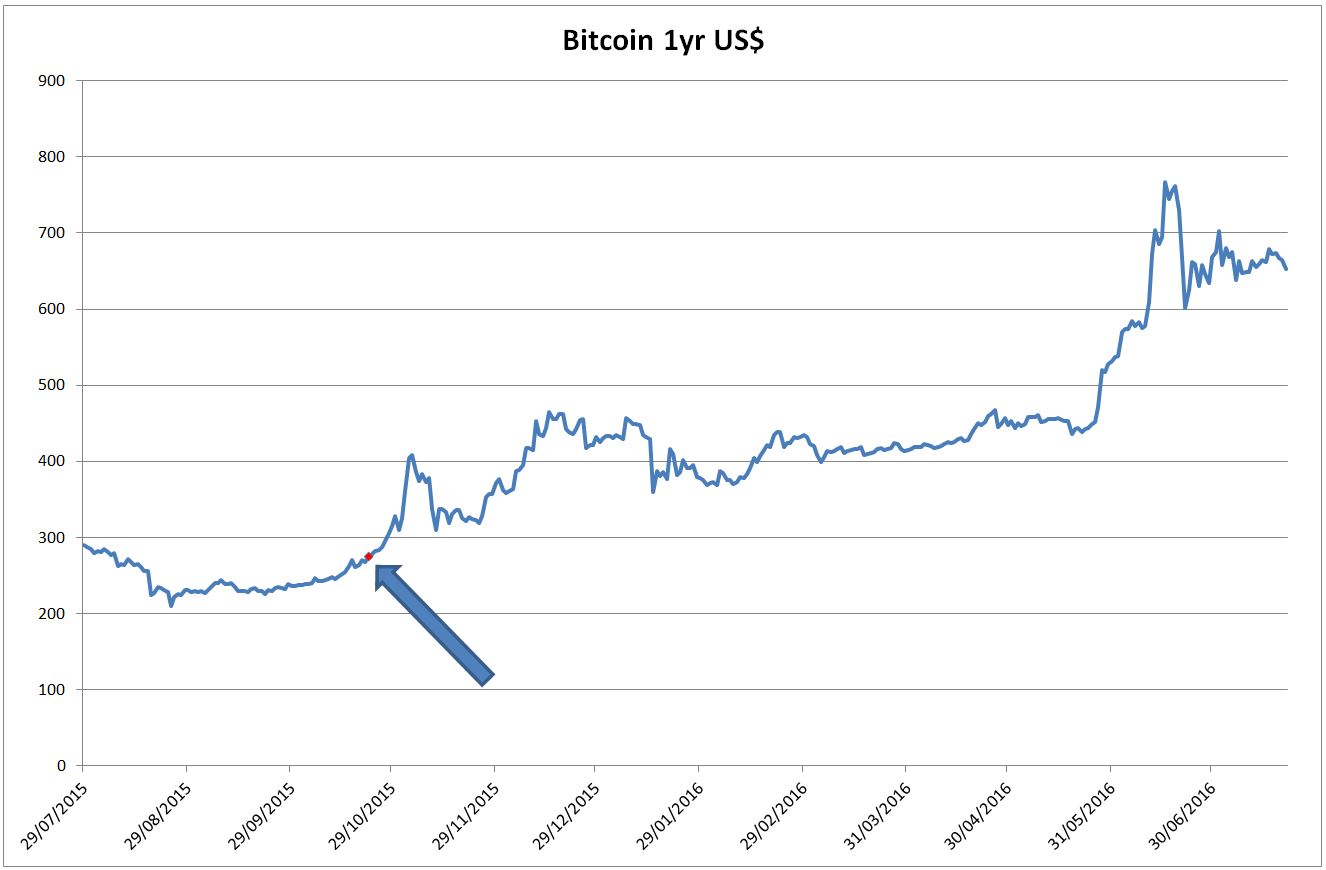

Back in October I wrote about Bitcoin in a piece called “How Many Potatoes to the Bitcoin?”, and back in August I’d been writing about early entry to positions, thus avoiding the crowds, bad fills and so on, whilst often making extra gains to compensate for the longer time invested. Bitcoin was just around $270 then. Although reliable prices for Bitcoin are a bit hazy as there is not the genuine price discovery that we have for stock markets, for example. I wrote that Bitcoin was in a range of $220-$300. In a piece called “Breakouts Are For Dummies” I explained why early entry is so important when a highly visible level is being reached. Everyone knows it’s there, so trading it is foolhardy unless you can avoid the crowds by getting in ahead of them.

This is the key line from the Bitcoin piece: “It’s rangebound which means it should move up to the £300 level whether it breaks out or not.” And the point there was you would have then had a free look at the breakout with no risk buying in around $270, because it certainly did go to $300, actually within a few days. It’s now $650 just 9 months later and has been as high as $768.

You can see on the chart the day my piece about Bitcoin was published, 22nd October, marked in red and with a stonking great arrow in case it’s not so visible, and we’ve certainly seen a strong rally. Now we are faced with the possibility that it could be weakening, but equally we could see a price range developing, which could indicate a measured move up after a breathing space, taking Bitcoin into the $1,000+ region. What you do obviously depends entirely on your risk profile, but I might be inclined to sell half and bank some profit. If another buying signal develops buy into it and conversely, if it fails, sell the other half.

The position is rather an unusual one at the moment, with the uncertainty of the EU and also the UK among others. As a result Bitcoin may be seen as a store of wealth – like gold, except much more portable. It may also be seen as the future of foreign transactions. And what with offshore slowly going under, and banks like Deutsche Bank being rumoured close to collapse, issues in Italian banking and so forth, who wouldn’t want to be more in control of their money. In case you missed it the security provided under the UK Deposit Protection Scheme has been reduced from £85k to £75k. The good news might be that it is supposed to represent the equivalent of €100k due to EU directives which shouldn’t apply for much longer.

Comments (0)