Something for the Weekend: Dating Meets Investment Research

A few years ago a friend of mine invited me to a speed dating party. Dating in the UK is a minefield. Many people at speed dating events are there with their mate and aren’t even single themselves, but having cajoled their single mate into going, tagging along was the deal breaker. Traffic light parties are a nightmare too. The idea is that the coupled up wear red, those not looking but single wear amber and those single and looking wear green. Sounds simple enough. But it’s not. The spoken for often wear green to get some attention and flirt with danger; and single people, particularly women, wear red so as not to be set upon by hordes of single men. In the end you have no idea who anyone is.

So, back to this speed dating event. My friend was not the most confident of men, and not the best looking, nor in the best shape. But hats off to him: at least he was trying. He’d even gone as far as to learn close-up magic as an ice-breaker, and he was pretty good. I mean, credit where credit’s due, right? So, a couple of girls mingle over to us and we introduce ourselves. John gets out his pack of cards and fans them out, smiles and says “pick a card” to the first one. She says “I’d rather not”. OK. So he turns to the other, a little ruffled, and says “will you pick a card?” “No” she says in a very derisory tone. There was a tumbleweed silence then I said to the girls “no wonder you’re single!”

Given that even dates themselves are usually failures, and a complete waste of time, how can we use this time to do investment research, so at least we’ll get some reward for the time invested?

If you’re at a dating event consider where it is. If it’s in a privately booked bar on a Saturday night in a business district find out if they do lots of that sort of business. If it’s in a busy part of town find out why they host events, as surely they could just be busy anyway? Get a feel for the attitude of the staff. The PMI, which I wrote about in October, is an insight into how business thinks business is going. Asking people who are at the coal face is equally valid if you do enough of it. Often staff will be only too eager to tell you far more than they should about how business is going if you take an interest in them. There’s always information a few sentences away if you just engage in conversation.

If you’re on an actual date, suggest meeting somewhere you want to check out. Maybe you’re looking at buying shares in the seemingly ever popular coffee shop arena. Go to one that’s on your watchlist. If you want to have a real laugh though, there’s one in Bermondsey Street SE1, actually called Fuckoffee! The irony of suggesting that for a first date is priceless. Maybe inappropriately named venues are the new black no sugar! You can see the shop front on Google Street View if you don’t believe me, or just go there on your next first date.

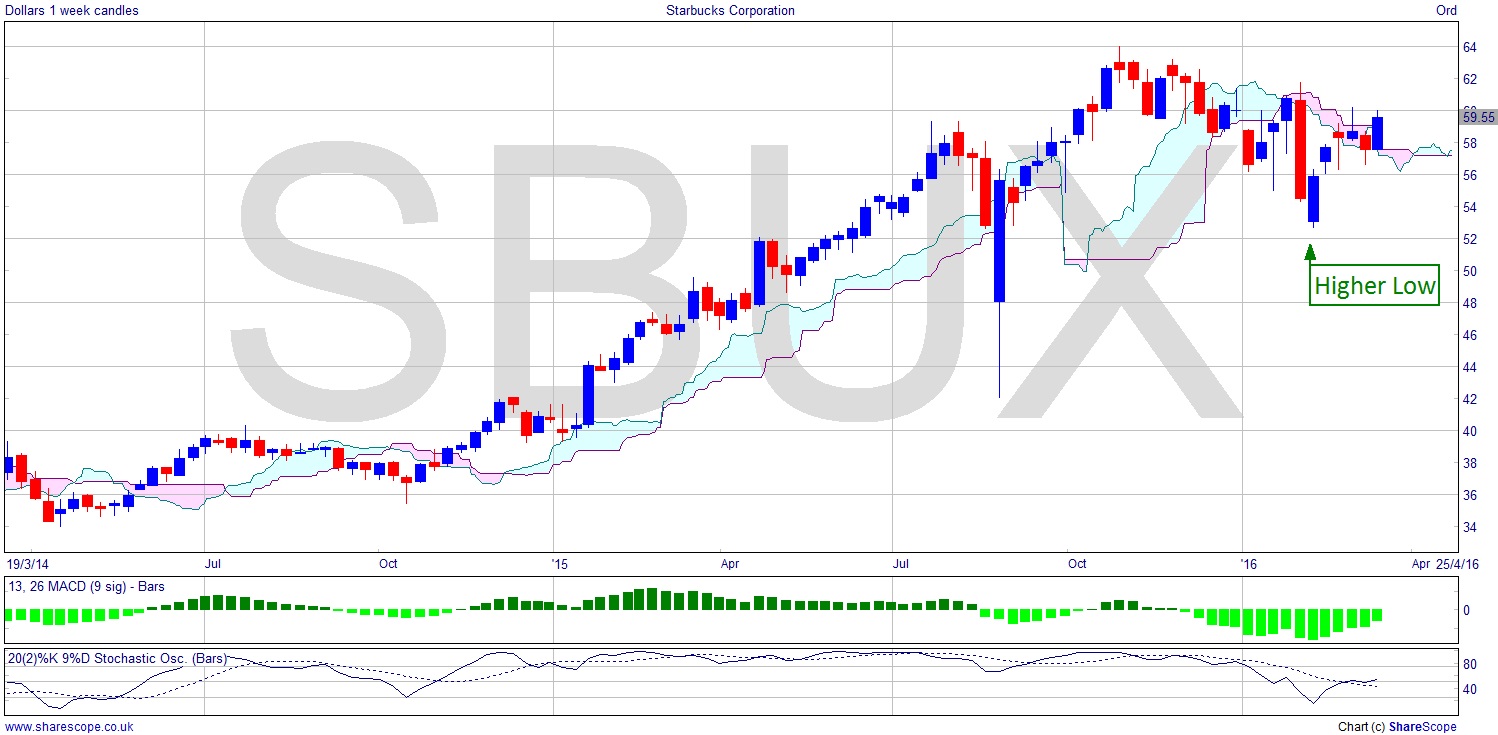

If you want a pointer for coffee shops, most of the High Street brands are part of groups of companies making it hard to target risk on coffee shops specifically. Starbucks (NYSE:SBUX) is an obvious choice though. So go to Starbucks on your date. The chart is at a pivotal point, like so many shares and indices at the moment, having broken above the cloud and made a higher low, in part made easier by the big blip low from last August. Not far to the ATH either. The MACD is also looking helpful. Ask them how business is when you get there early and quiz the staff.

I wrote about dating in October too. There’s basically one company listed that is dating focussed. The owner of match.com, IAC/InterActive Corp (NASDAQ: IAC). It’s found support at the low of ’13. This is an exciting chart. Like many stocks, just now on the weekly, it’s nudging the cloud bottom. Usual rules apply. If it goes sideways it’s even looking bullish as it will enter the cloud and we should expect to see the price cross to the cloud top. Of course the cloud top may have dropped by then so timing is everything, but we may see some highly manageable entry signals. Working around a decent sized cloud gives a lot of useful points for stops and trade management. And ones that not everyone will be aware of, which is critical, as you don’t want to follow the masses.

A word to the wise, though. If you do get into the habit of double dating investment research with a real life date, under no circumstances – probably not even if you get married and have kids together – tell them about doing investment research on your first date. It won’t go down well!

Comments (0)