Red Rock Resources: 200 day line rebound points to 1.1p

The latest newsflow regarding Shoat’s Creek reminds us that Red Rock Resources (LON:RRR) is firmly back in favour as far as investors and traders are concerned.

The path to shareholder glory for Red Rock Resources is proving to be a long one. One of the highlights for me in the recent past was forgetting the name of the Executive Chairman Andrew Bell, someone I have interviewed on several occasions. Possible explanations include senility, being in Birmingham for the event, or over preparing. I prefer the last excuse.

But at least the market in the form of private investors does not only remember Mr Bell’s name; it has to a large degree rehabilitated the company, both in terms of the approach and the business model. This is especially the case in the wake of the company’s relationship with small cap star Metal Tiger (LON:MTR). Indeed, Metal Tiger may have somewhat come off the boil, but Red Rock looks to still be in the market’s good books.

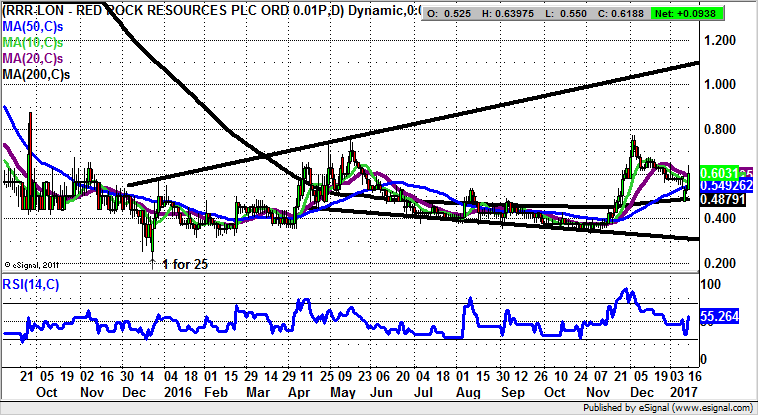

This point was underlined last week in the wake of the relatively disappointing update from its investment in Shoat’s Creek. Shares of Red Rock dipped, but then bounced sharply off their 200 day moving average currently at 0.48p. This is the technical line in the sand between regarding the shares as being in bull/bear mode.

Above this feature one would be looking for a 2-3 month target as high as the top of last year’s broadening triangle at 1.1p. The RSI, now at 55/100, suggests we are currently in the accumulation zone in terms of a possible new leg to the upside.

Comments (0)