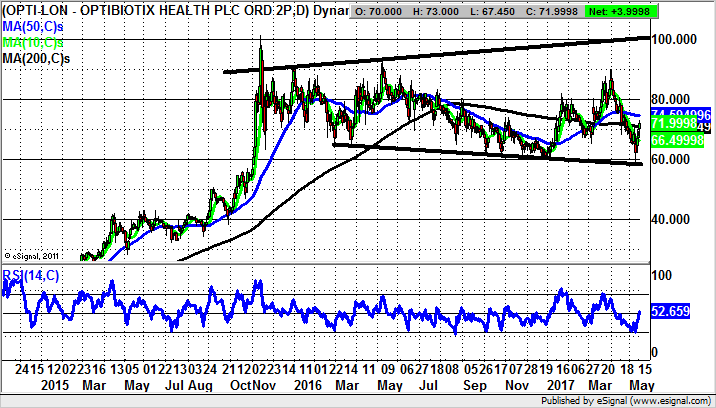

Optibiotix: Broadening triangle still promises 100p while above 60p

I have asked the CEO of Optibiotix (LON:OPTI) to investigate one of the world’s most serious afflictions, male pattern baldness, now that the health supplements area appears to have been cracked…

Given how much has been happening at Optibiotix since the end of 2015, it would appear somewhat churlish of the market not to regard the company as being more valuable than it was nearly a year and a half ago. This point is particularly underlined in the wake of the latest from the company regarding the “exciting” level of interest in its products.

Of course, the name of the game for the life sciences group is to commercialise its offerings and turn revenues into profits. It would appear that while we may be looking at quite a cutting edge company in terms of the science, for investors it is all about the bottom line. However, with the prospect of products such as CholBiome, CardioBiome and a sweet fibre which could be an alternative to the dreaded sugar, Optibiome has plenty of fundamental strings to its bow.

As far as the technical picture is concerned it can be seen how the stock has just bounced off the floor of a broadening triangle, a somewhat frustratingly long lived feature. But at least while we hold above the floor of the triangle at 60p, the top of the feature at 100p could be a viable 3-6 months time frame target.

Comments (0)