FIFA Isn’t The Only Game In Town This Week – Check Out Greece

While the latest twists and turns of the FIFA corruptions scandal have been an interesting distraction for market traders this week, the ongoing Greek drama has continued its own exciting storyline.

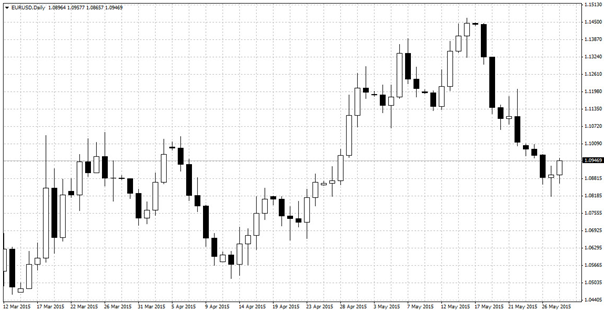

The euro enjoyed strong counter trend gains this Wednesday and Thursday as hopes were raised for a deal between Greece and its creditors.

EUR/USD daily chart

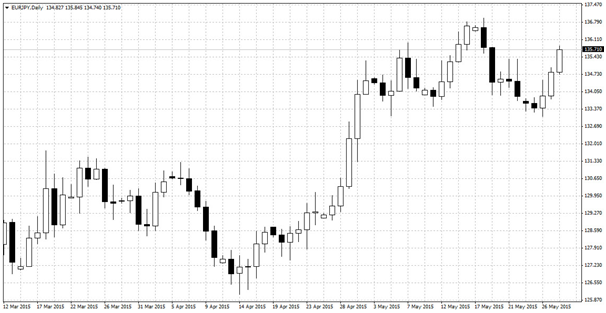

The euro’s out performance this week is best seen against the British pound, which has been more of a neutral counterparty compared to the dollar.

EUR/GBP daily chart

Wednesday saw reports from Greek government officials that a ‘staff level’ accord was being drafted with counterparties. However, it has been noted by many a keen market watcher that Greece has consistently ‘gilded the lily’ throughout the negotiations, or at least has been quick to put out a positive spin.

By contrast EU/IMF partners have been more down to earth, with the IMF’s Christine Lagarde admitting that a Greek exit from the Eurozone is a possibility, with a deal on Greek debt unlikely before the end of the month. Similarly, German finance minister Schaeuble warned that when it came to substance, the parties “haven’t got much further in the negotiations”.

Since its inception, the Greek crisis has been a game of claim and counter claim with brinkmanship unashamedly used by both sides. In this case it seems Wednesday’s Greek leak was designed to head off a bank run in Greece, but there are some signs for genuine optimism.

A deal before the end of May is extremely unlikely and the IMF is unlikely to receive the hundreds of millions of euros that it is owed on time. However, there is increasing market confidence that Greece has or will have access to funds in the near future.

Going forward, the situation is still murky to say the least and paying creditors is all well and good, but if government salaries and pensions are left unpaid, who knows where it could lead.

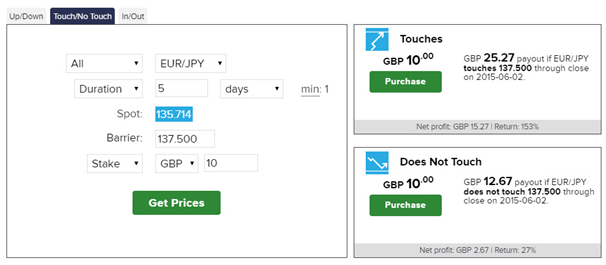

In the short term, however, there’s still scope for some upside, as goodwill momentum remains with the euro going into the end of the month. The EUR/JPY could be the best vehicle to play this as the strong dollar continues to force all yen pairs higher.

EUR/JPY daily chart

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)