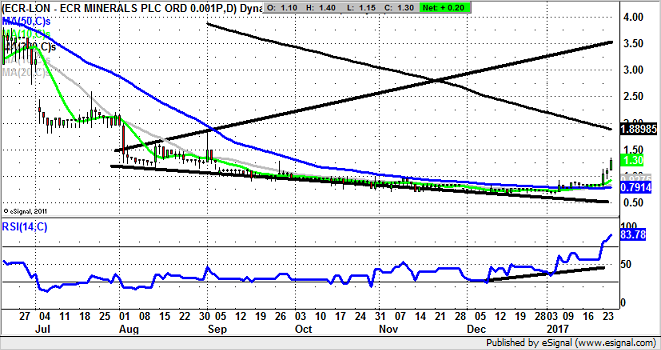

ECR Minerals: Triangle target towards 3.5p

One of the challenges of charting minnows on the stock market is to identify the differences between flash-in-the-pan spikes for a stock and a lasting turnaround. With ECR Minerals (LON:ECR) there are currently a couple of clues.

It has been quite a journey over the past year for ECR Minerals, something which can be seen all too clearly on the daily chart. For instance, having spiked through 9p briefly in February last year, it has been a story of progressive share price declines since then to well below 1p. This comes at a time when many mining plays have doubled and tripled in the interim.

But for this company at least, since the autumn things have started to look up, both on a fundamental and technical basis. Paying off the Yorkville debt in September will have helped sentiment. Since then the bullet points include planned activities in the Victorian Gold Projects, as well as an update on the Dangley Gold Project in the Philippines.

What can be seen in terms of the near-term price action is the way the 50 day moving average at 0.79p has been recovered to start 2017. This 50 day line recovery is a classic sign of a lasting turnaround, with the message at the moment being that provided there is no break back below this feature we should be heading significantly higher within the broadening triangle on the daily chart. This has its resistance line projection running at 3.5p – a decent 2-3 months target.

Comments (0)