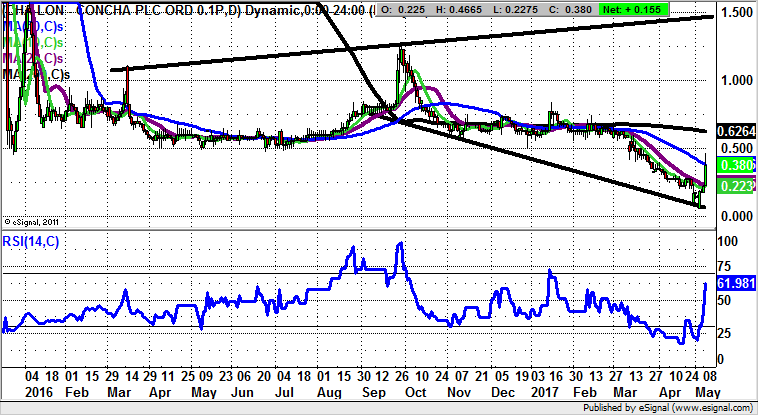

Concha: Best case scenario triangle target at 1.5p

I seem to remember (although my memory may be playing up) commentary regarding Concha (LON:CHA) being a stock to avoid. Since then the stock has doubled in the space of a week.

Concha was a private investor favourite not so long ago. I have to confess I was caught up in the hype, helped along by the fact that the shares soared from around 0.3p to 6p to make them one of 2014’s best performers. This also made anyone who backed the stock from a technical perspective something of a hero too – by association.

As far as the fundamentals are concerned, the aim of the company is to invest in technology, media, communications, and related industries. Call me old fashioned, but since 2014 we have been in the greatest ever new economy boom in history. A portfolio of Apple, Google and Netflix might have worked. Even 86 year old Warren Buffett has got with the groove and bought into new fangled Apple – Concha could have hoovered up a few shares too.

Further down the food chain, there are an infinite number of fantastic Internet of Things and biotech companies to go for. Perhaps I will phone up the company as it suggests on its website and provide them with suggestions. For instance, at the weekend there were at least half a dozen companies worth investing in at the Imperial College London open day.

As for the present charting position at Concha, it can be seen how there is a possible broadening triangle formation on the daily chart which can be drawn from as long ago as the beginning of last year. If this kicks in well – as the equivalent triangle on the MySquar (LON:MYSQ) chart mentioned on Friday has – one would expect a target for Concha as high as 1.5p over the next 2-3 months. Only back below last month’s support at 0.22p questions the recovery argument.

Comments (0)