Binary Bet of the Week: Eurozone Adds To UK Concerns

As we enter the final month of campaigning for the UK general election, the British pound is threatening to fall to its lowest levels since 2009, and on Thursday made its lowest daily close of 2015.

GBP/ USD Daily Chart

The latest betting odds based on the polls imply an 85% chance of a hung parliament with a market unfriendly Labour Majority now seen as the most likely outcome. That said, this bookmaker favourite is still seen as having a chance of just one in three. There will doubtless be more twists and turns until the start of May, and even then there is the faint prospect of another election in 2015.

It is little wonder that the pound is suffering.

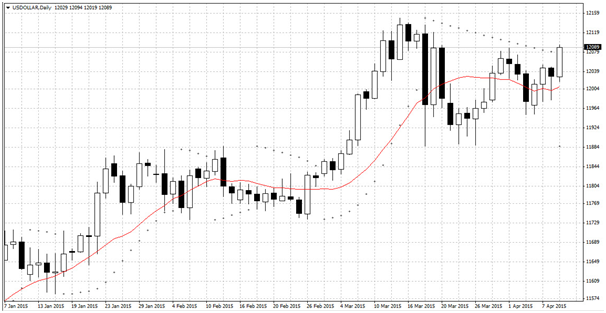

The election uncertainty is the primary but not the only catalyst at play here, however. The US dollar has found its mojo once again after poor Non-Farm Payroll data last Friday and a generally dovish set of Federal Reserve meeting notes.

Investors have not been put off by the prospect of later rate cuts, especially when the likes of the pound and the euro are clearly some way from raising interest rates themselves. The dollar index has regained the 14 day moving average and is now within a day’s session of the 2015 highs.

Dollar Index Daily Chart

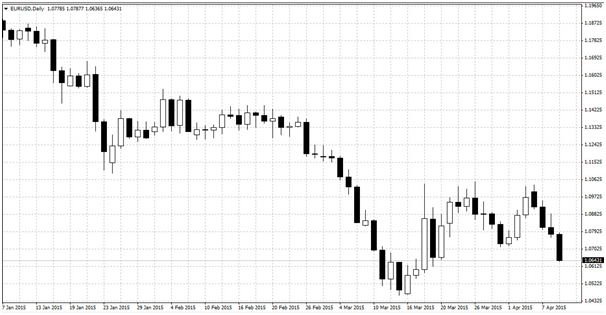

Elsewhere, the has been renewed pressure on the euro this week despite Greece meeting IMF payments to release extra emergency lending. Strong doubts still remain over the end result for Greece as a new deadline of 24th April approaches. The Tsipras government also announced it was resuming the sale of public assets, but so far has been light on details.

EUR/ USD Daily Chart

There has also been the side show of Greece courting Russian cash, though it seems nothing concrete was agreed or even discussed. So far we have seen a familiar cycle playing out again with Greece and the Troika playing a dangerous game of brinkmanship. As the new deadline approaches, it’s likely to be Greece who blinks first, but the only uncertainty is that things will go down to the wire again with another deadlock likely.

With the Eurozone a vital partner for the UK and the largest counter party for the US dollar, there is unlikely to be any let up in pressure for the dollar pairs and the British pound in particular during April.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)