Binary Bet of the Week: Bet On Shy Tories To Boost The Pound

With less than a week until the polls open, the 2015 UK General Election is likely to be one of the tightest elections in living memory.

In 2010, the Conservative reached over the 326 seat threshold (more than half the house) with the help of the Lib-Dems in a coalition. This time around however, not only are the Tories expected to fall short again, the Lib Dems are unlikely to gain enough seats to help them out.

Betting markets are often a more accurate predictor of events than public opinion and currently the odds seem to favour a Labour Minority government as the most likely outcome. A Labour minority is given an implied chance of 35%, down from 45% recently. This has come down since Labour leader Ed Miliband stated that he wouldn’t be entering into an agreement with the SNP whether formal or informal.

A renewed Conservative–Lib Dem coalition is seen as an 18% shot, the same probability as a Conservative minority. The two realistic outsiders include a Conservative minority which is given a 10% chance and a Labour–Lib Dem coalition has an implied probability of 9%.

What outcome would markets prefer?

While traditionally, markets are seen as having a Conservative bias, the biggest thing that markets crave is certainty. This might be a continuation of the status quo, or the prospect of a relatively stable government.

Given the uncertainty leading up to the election, the pound has been displaying a remarkable degree of resilience as the following charts demonstrate.

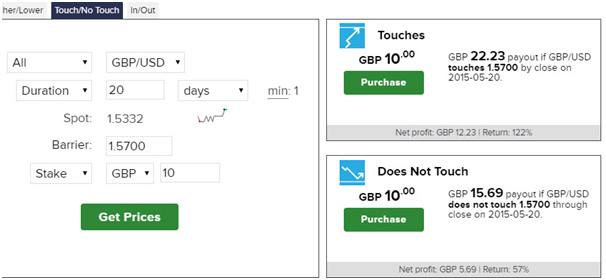

GBP/USD Daily Chart

Against the dollar, the pound has performed well since the start of April. However, this surge has more to do with the weakening US dollar than pound strength.

GBP/JPY Daily Chart

Against the yen, there is a familiar story as the pound rallies throughout the month of April. Again, this is not necessarily down to strength in the pound as there have been very similar rallies in the AUD/JPY and EUR/JPY over the same time period.

EUR/GBP Daily Chart

Looking at the pound versus the euro, we actually do get a sense of out-performance as the euro has dropped in value against the pound since the start of April. The euro has made a fight back in the last couple of days, but at the very least we can say that the election uncertainty has not caused outright panic for Sterling traders.

So what gives?

Are traders too relaxed about the prospect of a tight election, or are they secretly confident that a Conservative government will come through?

The most likely answer is that traders are wary of making any big commitments with the pound right now in either direction and are happy to go with the flow dictated by the general follow of the US dollar. The euro has been dragged through the uncertainty of multiple rounds of Greek negotiations which is hardly helping a counter move against the pound.

There is some scope for keeping an upside bias with the British pound though even with all the uncertainty. A key factor may be the number of ‘shy Tories’ coming out and changing the vote.

Back in 1992 polling was neck and neck between Labour and the Conservatives, but the Tories won easily in the end. It turned out that everyone saying “don’t know” in the polls was either not willing to admit to voting Tory or just ended up voting for who they voted for last time (Conservatives). Opinion polls have been adjusted to account for this quirk, but there’s no way of knowing how accurate these adjustments will be in another tight race.

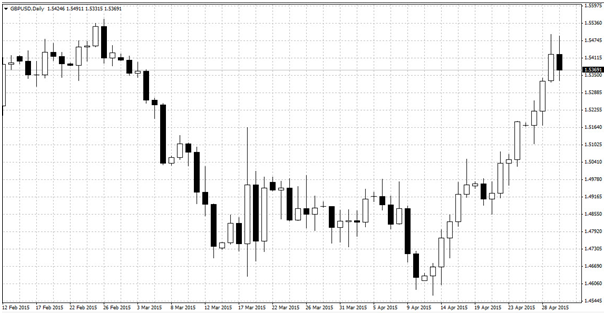

Can the Conservatives do another 1992? It’s highly unlikely that they’ll be able to gain enough votes to form a majority from here, but there is the potential for a stronger showing than is currently anticipated. This may just scrape them over the line for either a minority or coalition arrangement. The result is still entirely uncertain, but betting on higher levels for the pound may just offer the better value right now.

The pound shot higher following the 1992 result and we could see further upside if the shy Tories come out in force again.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)