Small-cap bargains

Over the 12 months to the end of April, the 50 or so funds in the IA UK smaller companies sector lost an average of 12.2%. Many of the equivalent investment trusts have fared even worse and are now trading on unusually wide double-digit discounts to net asset value (NAV).

Mick Gilligan, portfolio manager at Killik & Co, says that small caps tend to be more credit sensitive than large caps and so tightening credit conditions tends to lead to small-cap weakness:

“The concerns about a ‘cost-of-living’ squeeze and possible recession within the next 18 months is a poor backdrop for small caps, which are normally more domestically oriented than large caps.”

Smaller companies tend to be more aligned with the economic cycle and are frequently less developed and less diversified than larger firms. This means that in a rising interest-rate environment some of these businesses could be more vulnerable.

Rob Morgan, spokesperson and chief analyst at Charles Stanley, points out that while many smaller company funds are growth oriented, current market conditions are having an impact:

“Earlier-stage businesses, those yet to make a profit and companies that have funding or borrowing requirements may have strong growth prospects, but they look risky in a slowing economy with rising interest rates.”

For some stocks the outlook might not have changed that much, but the mood is much more pessimistic and sceptical than a year ago. This is borne out by the wide discounts on various investment trusts:

“The average equity trust has rarely crossed the 10% discount mark, only doing so in recent years on the referendum outcome and during the Covid-induced turmoil at the start of 2020. It crossed this level briefly again in May, while the discounts on UK smaller companies trusts are even higher with an average of 13%,” explains Morgan.

Outlook for small-cap stocks

Given their sensitivity to the domestic economy, there is an understandable worry that a possible recession will hit smaller companies hard: it isn’t beyond the realms of possibility that some could go under if there is a prolonged slowdown. The heightened uncertainty inevitably means that there will be much volatility in the months ahead:

“All of the above has led to a material sell-off in small caps. However, the longer-term growth prospects are quite healthy. The MSCI UK Small Cap index has consensus earnings growth of 40% this year, 10% next year and 30% the following year. Even if those estimates move down, current valuations of 13.3 x P/E this year, 12.0 next year and 9.3 the following year look very undemanding,” says Gilligan.

Smaller companies as a sector are sentiment driven, often bearing the brunt of investor selling pressure. The flipside is that they tend to rebound quite vigorously:

“Global stock markets are not expected to regain significant ground until improvement is seen in various issues, including the war in Ukraine and the economic bottlenecks in China. Investors also need to be confident that inflation has peaked and the risk of an enduring period of economically damaging stagflation has receded,” warns Morgan.

In normal market conditions when stock indices are going up or sideways, small caps usually do better than large caps, particularly over the long term. This is because smaller companies have room to grow and are often easier to manage and control.

Darius McDermott, managing director of Chelsea Financial Services, says that in the short term, the outlook is not great because uncertainty is increasing, but current valuations are a lot cheaper and small-cap funds should do well over time:

“There are fewer financial analysts that cover small caps and thousands to pick from, so it’s a fertile ground for a good active manager. UK smaller companies in particular is one of the few sectors where the average fund consistently beats its benchmark – the good ones smash it.”

Why invest in a small-cap fund?

Ryan Hughes, head of active portfolios at AJ Bell, says that the fortunes of small-cap companies are often more determined by their own decisions than ‘big-picture’ macroeconomic factors and that they can therefore improve overall diversification when used alongside more traditional, large-cap holdings, with some caveats:

“They can be more volatile and experience significant drawdowns, so a long time horizon and patience is often needed to really see the benefit. Smaller companies investment trusts have in the past traded at large discounts when out of favour, which can provide some interesting opportunities to enter new positions for those prepared to be more adventurous.”

Small-cap equities typically deliver some of the best long-term returns, but they are also higher risk. If you are a moderate or balanced -equity investor you might want to consider an allocation of around 10%, whereas the more adventurous may want to go beyond this.

When it comes to picking a particular fund, McDermott says that it is important to make sure that it is well diversified. The fees are also critical, so investors should avoid those charging excessive amounts and be prepared for periods of volatility:

“Look for a manager with a good long-term track record. Avoid funds which are too large or too small. Large funds are at a disadvantage as they will find it hard to quickly get in and out of small caps, which can be illiquid.”

If a fund is too large, it may end up with significant positions in companies that may be difficult to exit, or with a greater number of positions because it can’t get enough stock to make the allocation meaningful. This means that it is probably better for a smaller-companies fund to be below the billion-pound mark.

Investors should also check that there is a decent-sized, experienced in-house research team, as small caps are not well covered by external analysts. The team needs to undertake company meetings and have enough people to be able to do so, effectively:

“It’s really important that investors understand how the fund manager invests as there are different types of small-cap funds and trusts ranging from high growth to value and from core small cap to micro cap. Each of these comes with a slightly different risk and return profile that will dictate how it performs in different market conditions,” advises Hughes.

The best small-cap investment trusts

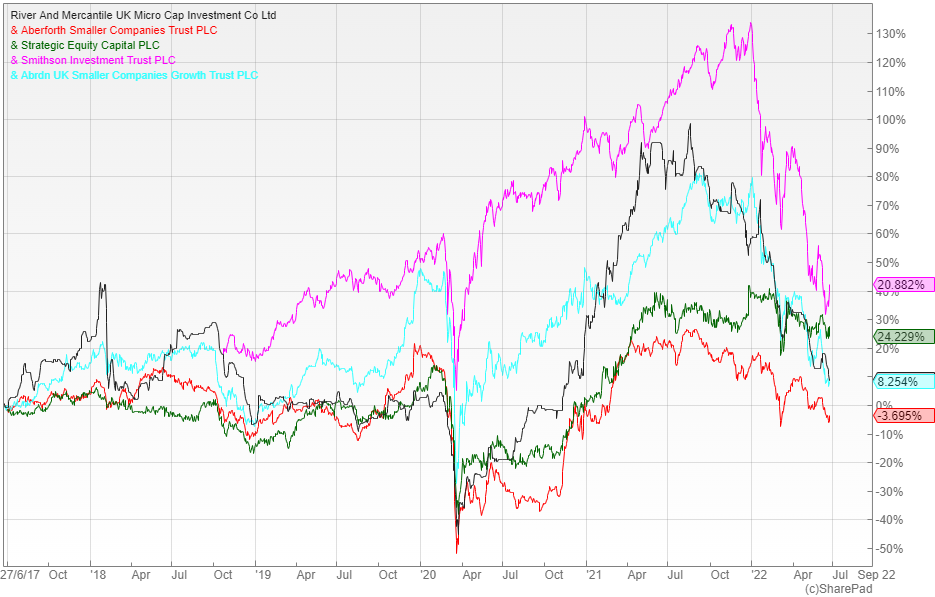

Gilligan says that the very smallest end of the market tends to produce the highest returns over time, which is why he recommends the £80m River & Mercantile Micro Cap Investment Trust (LON: RMMC), currently available on a 15% discount to NAV.

Alternatively, he suggests the £1.4bn Aberforth Smaller Companies (LON: ASL). It has a value approach that is better suited to a rising rate environment. At the moment, it is yielding 2.9% and trading on a 14% discount.

Another option that he likes is the £190m Strategic Equity Capital (LON: SEC) which holds a concentrated portfolio of highly cash-generative niche businesses with good scope for M&A. It is currently available on a 14% discount.

Morgan prefers the £2.5bn Smithson Investment Trust (LON: SSON), which provides exposure to a global portfolio of small and mid-sized companies and is trading on a 14% discount. It invests in high-quality, resilient businesses that compound their earnings over time to produce superior growth. This is a similar approach to that adopted by the firm’s large-cap Fundsmith open-ended fund. He says:

“The trust is run by Simon Barnard and Will Morgan, who aim to identify true long-term ‘compounders’ and avoid those that find their returns are eroded by competition or a shrinking market. The dominant driver of performance will be stock selection, although the process means there will be a bias towards growth-oriented businesses, which is why the returns have suffered over the past year.”

Hughes suggests the £590m Abrdn UK Smaller Companies Growth Trust (LON: AUSC). This has a clear focus on companies that are growing and have earnings momentum:

“It is a process that has been tried and tested over many years. Recently, however, the performance has suffered due to its focus on growth and the market’s preference for value, but that shouldn’t deter investors who have a long time horizon, particularly given that it is trading on a 13% discount.”

UK small-cap funds

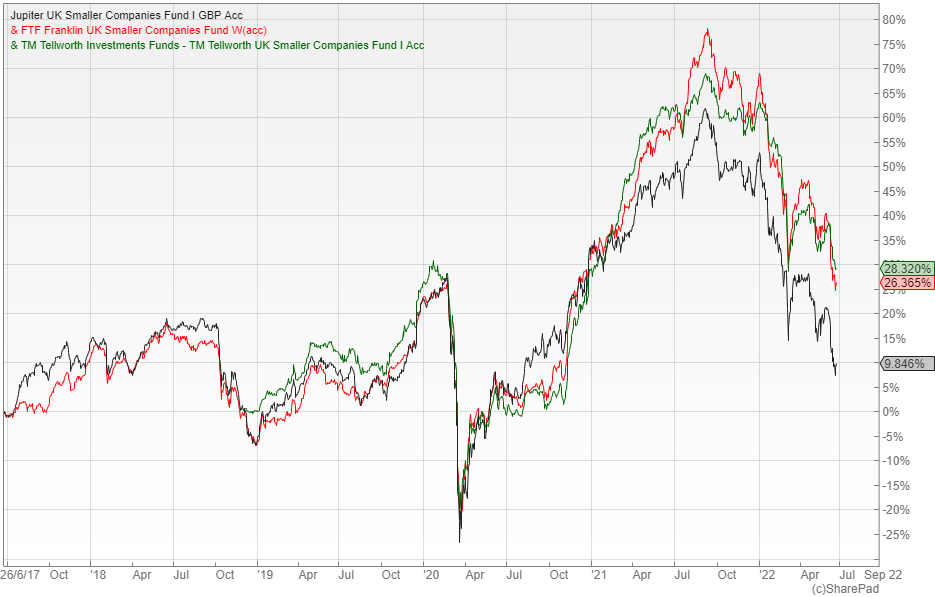

When it comes to open-ended funds, McDermott recommends Jupiter UK Smaller Companies, which offers investors access to a broad range of themes across the UK’s smallest stocks. He says that manager Dan Nickols is a ‘safe pair of hands’, consistently outperforming rivals over the past decade and more.

Morgan prefers FTF Franklin UK Smaller Companies. This fund is managed in a disciplined but pragmatic fashion with a bias towards good-quality businesses, encompassing both faster-growing companies and less-expensive value stocks:

“Given the neutral style, I would expect the performance versus its index to be primarily driven by stock selection, with the fund having the ability to perform well in relative terms throughout a market cycle, especially given the concentrated portfolio that allows high conviction ideas to have a significant impact,” he says.

Hughes likes the £400m Tellworth UK Smaller Companies. Itis less than four years old, but its managers and founders Paul Marriage and John Warren are experienced and know the small-cap universe very well:

“They have a sensible approach, shunning unprofitable and ‘blue-sky’ companies, preferring those with sensible management teams and established businesses. Capacity management is very important − the managers are clear that they will close the fund when they feel it has become large enough.”

Alternatively, he suggests TB Amati UK Smaller Companies, managed by Paul Jourdan. He has built a good team over the years which includes a healthcare specialist, given the number of small companies operating in this space.

Overseas small-cap funds

Adding overseas exposure will improve diversification. McDermott recommends Janus Henderson European Smaller Companies, which he describes as a pure small-cap fund that has a ‘style-agnostic’ approach to investing:

“This means the managers will buy growth companies at a reasonable price as well as looking at neglected areas of the market. They are also willing to invest in the smallest of companies, allowing them to find a number of hidden gems that are often ignored by their peers.”

Another option that he likes is ASI Global Smaller Companies, which provides exposure to a concentrated portfolio of both UK and overseas small-cap stocks:

“It is a textbook fund from the Abrdn equities team. Based around their powerful screening tool ‘Matrix’, which co-manager Harry Nimmo helped create, it identifies smaller companies from all around the globe − including emerging markets − that they believe to have the best growth prospects,” he says.

Morgan suggests the less well-known Kempen Global Small Cap fund, which invests in stocks with quality characteristics trading at a valuation discount. He says that the managers have an impressive hit rate that illustrates their research-intensive process and high levels of constructive engagement with company management:

“They have built an excellent long-term record, overcoming a longer-term headwind from their value style. The team, based in Amsterdam, try to avoid taking major bets in terms of geography and sector in order to maximise the influence of their stock picking. It’s a welcome diversifier from the more growth-oriented strategies available.”

Comments (0)