Three specialist trusts for 2022

The investment trust team at Winterflood have just announced their recommendations for the year and these include three specialist vehicles that are worth considering as part of a balanced portfolio.

Winterflood takes a slightly different approach to the other brokers as it doesn’t produce buy or sell ratings, but instead recommends funds that appear well-placed to outperform their peers on an 18 to 24-month view, either via a narrowing of the discount or through the returns from the underlying assets. These best ideas are then collated into a model portfolio.

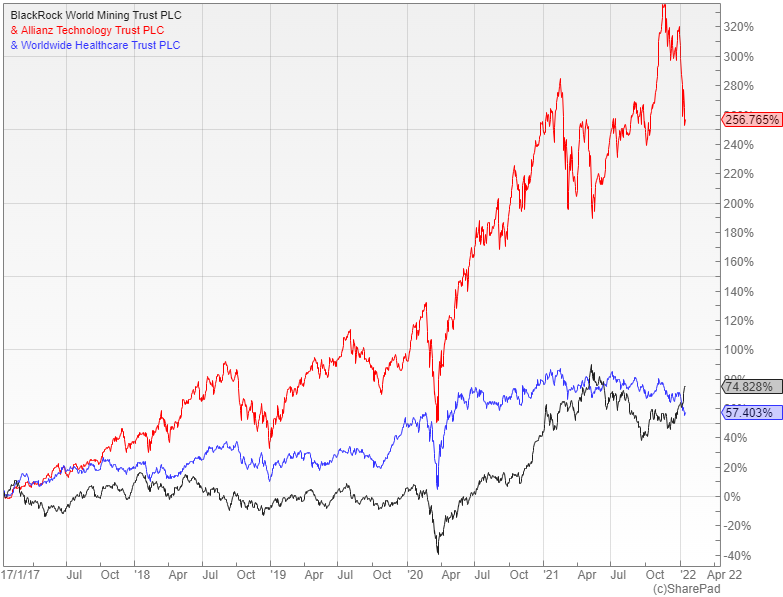

This year they have included three sector specialists alongside their more mainstream recommendations, the most topical of which is BlackRock World Mining (LON: BRWM) that has been receiving a lot of attention due to the fact that it offers a way to protect yourself against higher inflation. It has had a volatile 12 months, although the shares have picked up in the last few weeks.

BRWM offers a diversified exposure to the mining sector and access to a range of themes, including sustainable materials and gold. It benefits from the expertise of the well-resourced natural resources team at BlackRock, which has delivered a decent performance record.

Well-positioned to outperform

The fund is unusual in that it aims to distribute substantially all the available income in any given year with the quarterly dividends for the current financial period likely to exceed those in 2020. If this is the case it would give the fund an attractive prospective yield of between three and four percent, yet the shares are currently trading on a discount of five percent to NAV.

Winterflood believe that BRWM could benefit further from the economic recovery and the increasing demand for certain materials as the world seeks to tackle climate change. It is an obvious beneficiary of higher inflation, whereas their second pick, Allianz Technology (LON: ATT), has suffered a bit of a sell-off with its growth stocks being written down in anticipation of higher interest rates.

They have selected it because they like its unconstrained approach that makes it well-placed to continue to tap into growth opportunities as working practices change and the deployment of new technologies accelerates. Manager Walter Price and his team are highly experienced and have delivered excellent long-term returns from their base next to the action in Silicon Valley.

Long-term drivers of growth

Technology funds like this have had a fantastic run over the last ten years or so and it is hard to believe that they will not continue to generate strong returns, although they may find the next few months a lot tougher as investors price in the likelihood of higher interest rates. Some of the most elevated valuations could really come off the boil, so it really depends on the skill and discipline of the manager to avoid the big blowouts.

Winterflood’s third pick is the Worldwide Healthcare Trust (LON: WWH), which provides a broad exposure to the healthcare sector with a significant allocation – currently around 30% − to the higher growth subset of biotech. It is managed by OrbiMed, a well-resourced firm that specialises in this area.

Healthcare stocks have generated strong long-term performance, yet the sector currently trades on a lower PE ratio than the broader market as a whole. Winterflood are attracted by the secular growth characteristics with the ageing population, high demand and rapid pace of scientific innovation creating a positive backdrop.

Comments (0)