The best and worst alternative investment trusts

Last week I looked at the best and worst performing equity investment trusts of the first half of the year, where positive returns had been hard to come by. It is in this kind of environment that the alternatives come into their own with their niche areas of focus having the potential to really add value.

Recent analysis by the broker Numis identified the best and worst performing alternatives over the first six months of 2022 with a starting market cap of at least £50m. Given everything that has happened it is no great surprise that there is a massive dispersion in the results, with the gap between top and bottom being just over 100%.

Inevitably the winners include a handful of special situations where the big gains are unlikely to be repeated. For example, Tetragon Financial (LON: TFG) was re-rated from an extremely wide discount (that still stands at 65%), after an undersubscribed tender offer; while some of the aircraft leasing funds such as Doric Nimrod Air 2 (LON: DNA2) and Air 3 (LON: DNA3) have recovered some of their heavy losses.

Renewables off to a powerful start

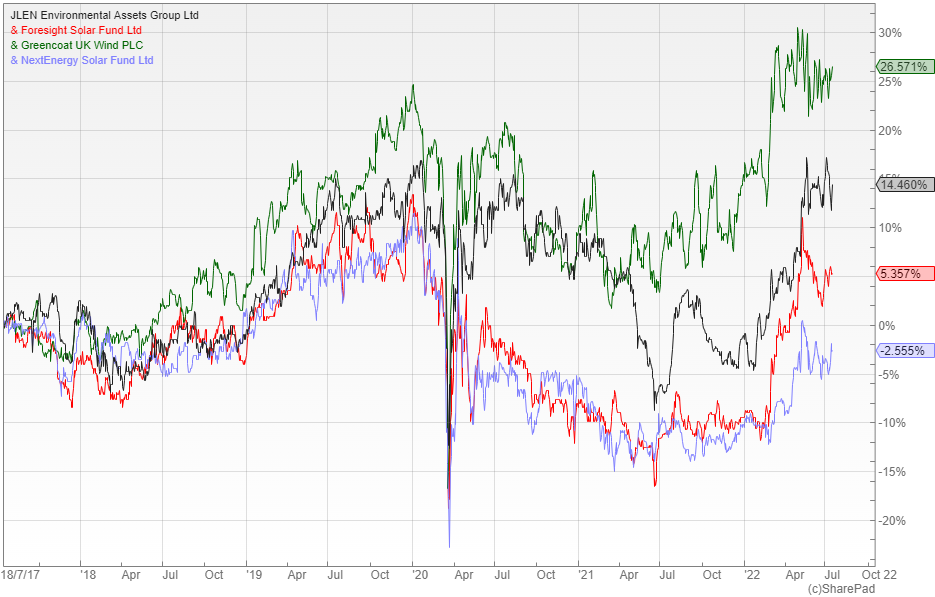

Many of the strongest performers are renewable energy trusts that have benefitted from the surge in power prices. These include: JLEN Environmental (LON: JLEN), Foresight Solar (LON: FSFL), Greencoat UK Wind (LON: UKW) and NextEnergy Solar (LON: NESF) with gains of between 20.8% and 11.5%.

PLEASE INCLUDE CHART 1

There have been other big winners in this area as well, most notably Gresham House Energy Storage (LON: GRID) and Harmony Energy (LON: HEIT) that have profited from the volatility of power prices, along with Riverstone Energy (LON: RSE). Other than that it has been a real mixed bag, although BH Macro (LON: BHMG) has again proved its worth as a diversifier with a gain of 15.8%.

Taylor Maritime (LON: TMIP) alsodeserves a special mention. This specialist shipping trust has recently released its inaugural results showing a massive 81.3% NAV total return between its IPO in May 2021 and the end of March 2022, although the gain in the first of half of this year was a more modest 14.1% following a sharp recent pullback.

Private equity takes a kicking

Without doubt the weakest performers were trusts with exposure to private assets, with investors concerned about the impact of rising interest rates and the changes to equity market valuations on the unlisted holdings, where there is normally a sizeable lag in updating the data. Of these the worst by far with losses of 61.8% and 60.8% were Chrysalis (LON: CHRY) and Molten Ventures (LON: GROW) that both offer a VCT-type exposure.

Other casualties in this category were the space tech trust Seraphim Space (LON: SSIT) that has crashed to earth with a loss of 57.7% and Baillie Gifford’s Schiehallion Fund (LON: MNTN) that has plunged 50.8%. Even the more traditional private equity funds have taken a hit with HarbourVest (LON: HVPE) and Pantheon (LON: PIN) down 28.2% and 26.9% respectively.

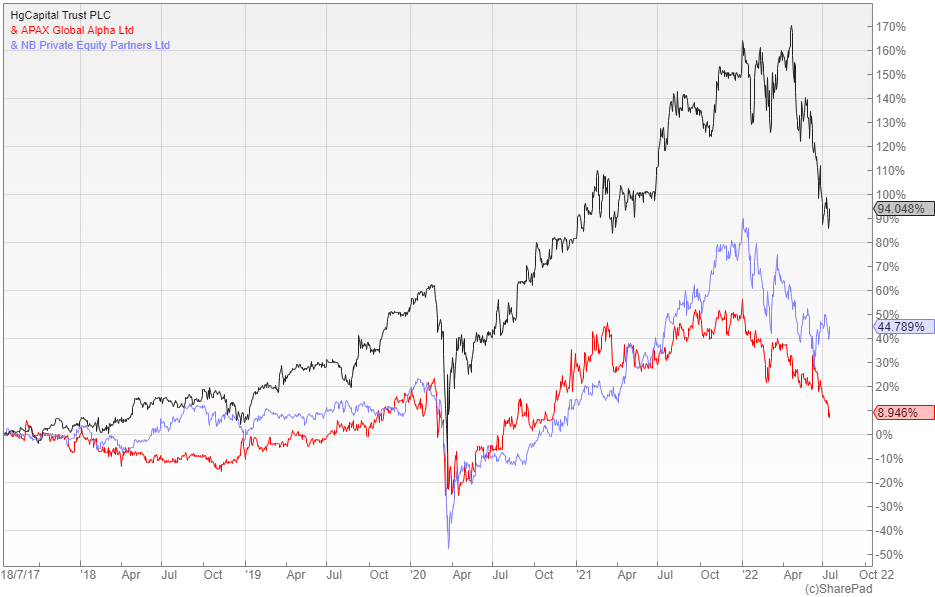

Numis believe that other trusts in this area may have been too severely treated given their focus on resilient businesses. Examples include: Hg Capital (LON: HGT) that has fallen by 22.9% and is available on a 30% discount; Apax Global Alpha (LON: APAX) down 20.4% and trading on a 30.8% discount; and NB Private Equity (LON: NBPE) with a loss of 19.3% and a discount of 40%.

Comments (0)