Simply the best – the best investment trusts on the market

Investment trusts have several important structural advantages over their open-ended peers, but they can also be more complicated and with hundreds to choose from it can be difficult to know which ones to buy. What follows is a personal selection to suit different objectives and attitudes to risk to help get you started.

Whatever you think of them, investment trusts have certainly stood the test of time as they are the oldest form of managed fund with some dating back more than a hundred years. They are structured as publicly listed companies with their shares quoted on the London Stock Exchange.

When an investment trust floats on the market it issues a set number of shares, which raises a permanent pool of capital to invest. Once it has listed, investors can buy or sell the shares whenever they want on the stock exchange in the same way that they would for any normal trading company.

Structural advantages

The fact that they have a permanent pool of capital gives them a significant advantage over their open-ended counterparts, because the purchase or sale of the company’s shares does not result in any cash flows into or out of the underlying portfolio. This allows the managers to take a longer term view and may enable them to invest in less liquid holdings like real-estate, or infrastructure assets that have the potential to generate higher returns.

Trusts also have the edge when it comes to dividends, as they can retain up to 15% of their annual income and add it to their revenue reserves. These can then be used to support the distributions in difficult years, as we saw during the pandemic when many of these vehicles were able to maintain their payments to investors.

Another attraction is that they are allowed to borrow money to invest. This is known as gearing and in a rising market it can help to boost the returns, although it can work against shareholders when markets fall and may add to the short-term volatility.

It is important to appreciate that the price of a trust will fluctuate according to the performance of the underlying portfolio and the prevailing investor sentiment. As a result the shares are able to trade at either a premium or discount to their underlying Net Asset Value (NAV).

Investors who get the timing right can use a discount to their advantage. If they buy when it is relatively wide and the underlying portfolio does well, the share price should increase closer to the newly appreciated NAV, which would generate a better than market return. The risk is that if they get it wrong the discount could widen against them.

If you are comfortable with all of these features then there is no reason why investment trusts shouldn’t play a significant role in your portfolio. What follows is a personal selection of some of my favourite options for investors with different objectives and attitudes to risk.

Capital growth

There are plenty of trusts that aim to generate long-term capital growth, but if you are comfortable with running the full market risk of an equity-only portfolio then you really need to start with Baillie Gifford’s flagship Scottish Mortgage (LON: SMT). With more than £20bn of assets under management it is by far and away the largest such vehicle on the LSE and has built up an exceptional track record with a 10-year total return of almost 1,100%.

Its managers look for exponential structural growth opportunities by identifying companies that can change and dominate consumer spending habits, which often leads them to take sizeable long-term positions in volatile stocks such as in the tech sector. They have a high-conviction, unconstrained approach with a global remit.

There have been some significant changes to the portfolio in the last year with the fund selling the majority of its holding in Tesla after the strong performance and exiting the likes of Facebook. They are now focusing on the key trends for the next decade, which include: the move away from fossil fuels; implications for the continued growth in computing power in areas such as transport and logistics; as well as healthcare, particularly synthetic biology.

Numis believe that Scottish Mortgage has the potential to deliver significant growth, especially from its interesting collection of unquoted investments. They think that the fund will be able to generate strong returns even in an inflationary/higher interest rate environment and that it acts as a useful diversifier because of its differentiated approach.

The £2.6bn Worldwide Healthcare Trust (LON: WWH) offers a way to benefit from the long-term growth prospects of the global healthcare sector. It is managed by OrbiMed Capital, a specialist in this area, whose well qualified staff look for companies with underappreciated products in the pipeline, high quality management teams and adequate financial resources.

OrbiMed has a talented team that cover everything in the sector from early stage companies with pre-clinical assets to the fully integrated biopharmaceutical mega caps. Between them they monitor around 1,000 stocks from which they put together a high conviction portfolio that currently consists of 89 holdings.

Healthcare is going through a golden era of innovation with new scientific discoveries leading to revolutionary treatments, so the potential is enormous. The trust has an impressive track record with a 10-year total return of around 480% and has the capability to keep on delivering regardless of the wider state of the global economy.

Capital growth and income

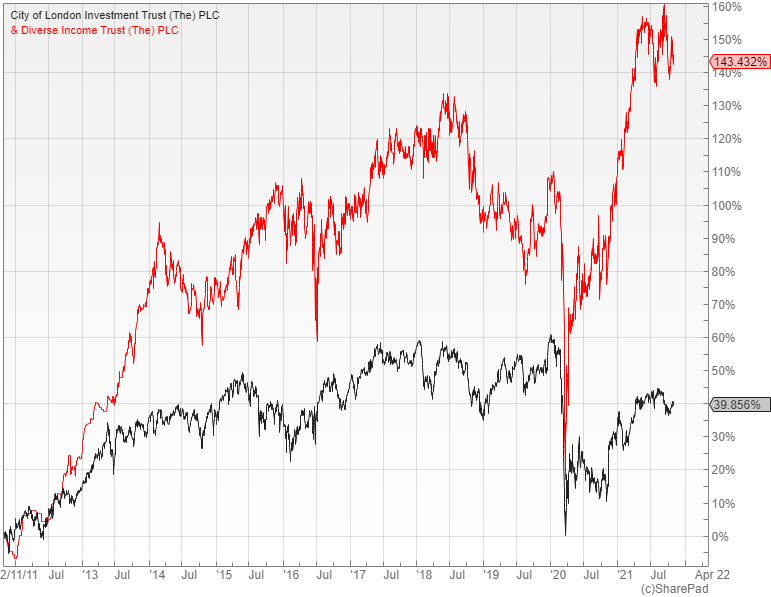

Investors who want a mixture of growth and income have some good options available in the UK equity income sector, most notably the £1.8bn City of London Trust (LON: CTY). It has been managed by Job Curtis since 1991 and has successfully increased its dividends every year for the last 55 years.

Curtis has tilted the 82-stock portfolio in favour of financials and consumer staples that between them account for almost 45% of the assets. Like all other equity trusts it struggled during the pandemic, but was able to draw on its revenue reserves to maintain the level of income paid out to investors.

City is a popular holding and normally trades close to its NAV. Over the last 10 years it has generated a total return of around 100%, which is comfortably ahead of its FTSE All-Share benchmark and is yielding an attractive five percent with quarterly distributions.

The analysts at Numis view it as a core holding for income investors in view of the strong long-term performance, attractive yield and unblemished history of dividend growth. It also benefits from one of the lowest ongoing charges ratios in the sector at just 0.36%.

A good complimentary holding would be the £415m Diverse Income Trust (LON: DIVI),whichprovides exposure to both large and small cap UK stocks including those listed on AIM. The investment in smaller companies gives it the chance to generate higher returns and this is reflected in its exceptional long-term record with a 10-year total return of just over 200%.

Manager Gervais Williams looks for stocks that can compound cash dividends over the long-term, which helps to support the current yield of 3.4%. He has put together a diversified portfolio of128 different holdings, of which 35% by value are listed on AIM with a further 14% in FTSE SmallCap stocks.

One of the most unusual and valuable features is that the trust uses options to protect the portfolio against a market crash. Williams and his team have followed this approach for years and sold the last one at the height of the sell-off in March 2020 before re-investing the proceeds at knock-down prices.

AFTSE 100 put option is currently in place that has an exercise level of 6,200 and which expires in December 2022. It covers 38% of the current portfolio value and provides some reassurance given the elevated state of the markets.

Alternative sources of income

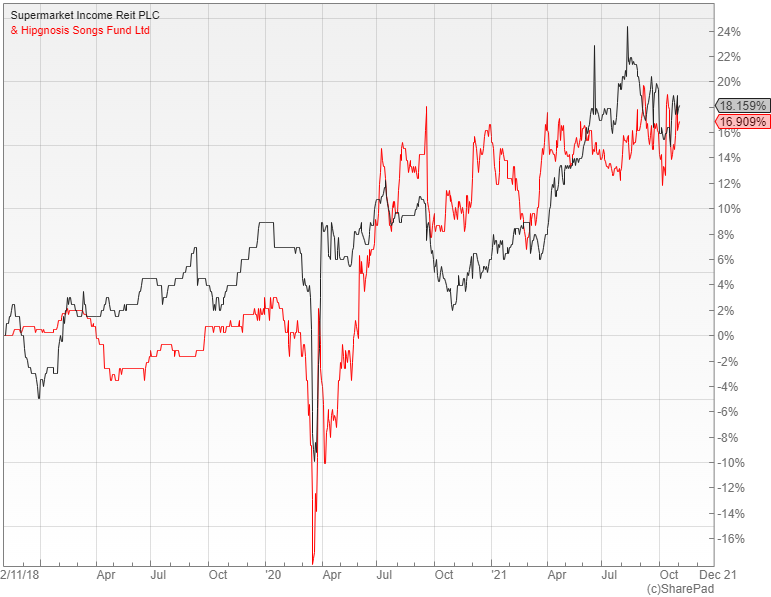

The Supermarket Income REIT (LON: SUPR) is a unique real estate investment trust that holds a portfolio of supermarket properties worth around £1.2bn. It aims to use these assets to generate a long-dated, secure, inflation-linked stream of income with the potential for capital growth and pays an attractive yield of five percent.

SUPR has a directly held portfolio of 35 stores that are mostly located in England and at the end of June they had a weighted average unexpired lease term of 15 years. There is also a 50:50 joint venture with the BA Pension Trustees which owns a 51% stake in a portfolio of 26 Sainsbury’s stores.

The trust’s future prospects will depend to a large extent on whether the management team are able to continue to find acquisitions at high enough yields to support the company’s dividends, although the indexation of leases in the current inflationary environment should result in stronger rental uplifts.

Music royalty trusts provide exposure to a relatively new type of asset class that has the potential to generate an attractive level of income that is uncorrelated to the financial markets. These sorts of funds acquire the copyrights to different music catalogues and then make money whenever one of the tracks is played.

The largest of them, Hipgnosis Songs (LON: SONG), was listed in July 2018 and has been back to the market a number of times since then to raise extra capital to buy additional catalogues by different musicians. It now has a market value of around £1.5bn and has established a solid track record with the shares often trading at a small premium to NAV.

Hipgnosis is able to capitalise on the growth in music streaming that is taking place around the world and by promoting the work can create new licensing opportunities. The reliable nature of the underlying cash flows allows it to pay a decent yield that currently stands at 4.4%.

Defensive growth options

Investors who are looking for long-term capital growth ahead of inflation, but who are unwilling to take on too much risk have a couple of excellent defensive options to choose from.

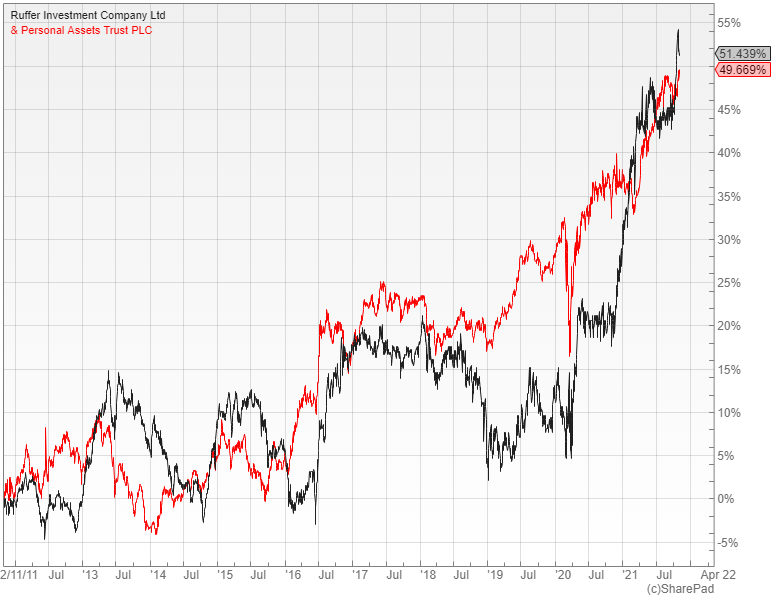

The £629m Ruffer Investment Company (LON: RICA) and the£1.6bn Personal Assets Trust (LON: PNL) are multi-asset funds that have done a great job growing investors’ wealth, while limiting losses at times of market stress such as during the sell-off at the start of the pandemic.

Ruffer aims to generate superior risk adjusted returns over the long-term, with a focus on capital preservation. The managers believe that we are entering a new era of inflation and have put together an “all-weather” portfolio that includes unconventional holdings to protect against this scenario.

They currently have around a third of the assets in index-linked government bonds, 44% in equities, nine percent in cash and cash equivalents, as well as seven percent in illiquid strategies and options and a similar amount in gold and gold equities. This unusual combination is designed to generate steady returns in all market conditions.

Since it was launched in 2005 it has beaten the FTSE All-Share index, which is a remarkable achievement especially given that the maximum drawdown, the largest peak to trough loss, was just 8.6%. The broker Investec has just issued a buy recommendation.

Personal Assets has a similar objective to Ruffer, but goes about it in a slightly different way. Manager Sebastian Lyon is more open-minded about the risk of high inflation given the deflationary forces in play, which makes it quite a good complimentary holding.

About a third of the portfolio is invested in US inflation-protected securities, rather than the index-linked gilts favoured by Ruffer, there is also around nine percent in gold bullion and a similar amount in cash and equivalents, with the balance invested in a portfolio of high quality stocks like Microsoft, Alphabet and Unilever.

Since Lyon took over in March 2009 the NAV total return has been 8.5% per annum, compared to 10.8% for the FTSE All Share, which is a decent result given his cautious approach and the fund’s emphasis on capital protection. Numis consider it to be an attractive long-term vehicle for cautious investors.

One-stop shops

If you don’t want to have to select individual investment trusts you could opt for one of the fund-of-funds that will do the job for you. There are not many of these to choose from, although there are a couple of decent ones to consider that would provide a ready-made and actively managed portfolio.

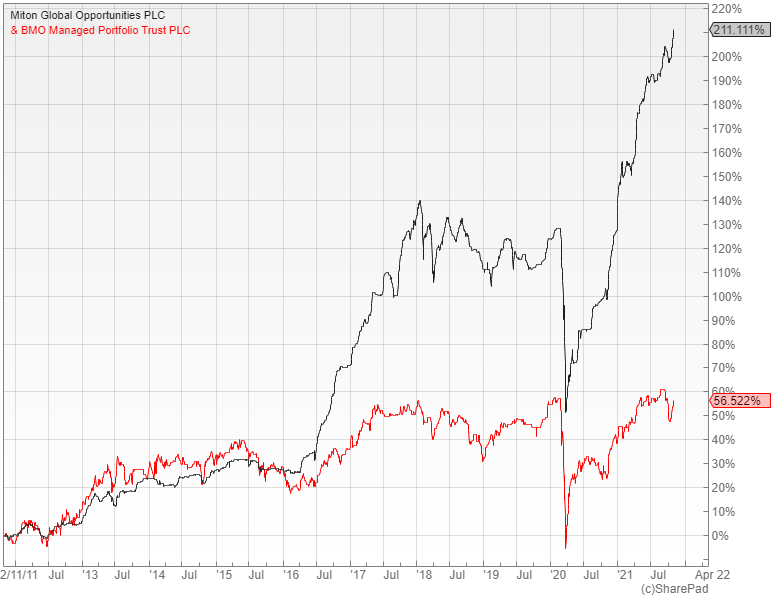

Those who are interested in capital growth can look at the £100m Miton Global Opportunities Trust (LON: MIGO) that is managed by Nick Greenwood. It has generated a creditable 10-year total return of just over 200%.

Greenwood mainly aims to exploit pricing anomalies, such as by buying investment trusts that are trading on wide discounts where he thinks there will be a catalyst for a re-rating. This approach enables him to put together a highly diversified portfolio of different asset classes that has a low correlation with mainstream indices.

Around 32% of the fund is currently held in an eclectic mix of different equity investment trusts, with 24% in private equity, 15% in property and 12% in mining trusts. It is a useful diversifier, although you need to be patient as the performance tends to be quite lumpy.

If it is income that you are after you could look at the £74m BMO Managed Portfolio Income (LON: BMPI) that provides exposure to a portfolio of investment trusts with the aim of generating an attractive dividend with the potential for income and capital growth. It is currently yielding a competitive 4.3% with quarterly distributions.

Manager Peter Hewitt has put together a diversified mix of assets with the largest holdings including the likes of: BB Healthcare (LON: BBH), NB Private Equity (LON: NBPE), HBM Healthcare (LON: HBMN), Scottish American (LON: SAIN) and JPMorgan Global Growth & Income (LON: JGGI). Over the last 10 years it has generated a 10-year total return of 116%.

Comments (0)