Revealed: the best funds for 2018

Despite all the dire threats and warnings 2017 turned out to be another strong year for the markets with each of the main equity regions posting healthy gains. The most profitable areas to invest in were the Far East and the Emerging Markets with 11-month returns to the end of November of 27% and 21% respectively, although the US, Continental Europe and Japan all managed to achieve double digit increases with only the UK lagging behind at 8%.

The solid performance right across the board helped the average investment trust discount − excluding hedge funds, direct property funds and private equity − to narrow from 5.4% at the start of the year to 4.3% at the end of November, although things could change if there was a significant shift in investor sentiment.

Last year’s top performing investment trusts included Pacific Horizon (LON:PHI), Atlantis Japan Growth (LON:AJG) and BG Shin Nippon (LON:BGS), which all benefited from strong local market returns, while Scottish Mortgage (LON:SMT) was bolstered by the surge in US technology stocks, with all of them up by more than 40% in the 11 months to the end of November.

At the other end of the scale, the worst performers all tended to be dragged down by bad stock selection decisions rather than anything at the macro level, with the main culprits including Northern Investors (LON:NRI), Ranger Direct Lending (LON:RDL) and British & American (LON:BAF).

Investment trust recommendations

Ewan Lovett-Turner, Director of Investment Companies Research at Numis Securities, says that with many investors concerned about market valuations, a couple of investment trusts worth considering are RIT Capital Partners (LON:RCP) and Troy Income & Growth (LON:TIGT).

“RIT has an exceptional long-term track record through an unconstrained investment approach that seeks to deliver long-term capital growth, whilst preserving shareholders’ capital. I believe its return profile is attractive to many private investors, having historically participated in much of the market upside, whilst limiting exposure to downside.”

Troy Income & Growth is a UK Equity Income investment trust that is run by Troy Asset Management, who have built up an impressive track record based on a cautious investment approach.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

“The portfolio is heavily focused on defensive sectors including Consumer Goods companies that have strong brands/franchises and the pricing power to maintain margins. There is also a high weighting in Utilities. This cautious approach means that the fund has typically outperformed in tough markets, whilst lagging in strongly rising markets,” explains Lovett-Turner.

Emma Bird, Research Analyst at Winterflood Securities, says that with bull markets around the world looking ‘long-in-the-tooth’ and valuations in many markets looking full, they have decided to recommend the Capital Gearing Trust (LON:CGT), which seeks to achieve absolute returns through active asset allocation across equities (via investment trusts), bonds and commodities.

“The aim is to preserve capital over the short run and generate strong risk-adjusted returns over the long-run and the fund has an impressive record of delivering strong absolute returns with considerably lower volatility than equity markets.”

Safe pair of hands for a more challenging year

Ryan Hughes, Head of Fund Selection at AJ Bell, says that calling the top of the market is just a guessing game and that some of the most experienced investors are at odds over the outlook for equities.

“For private investors running their own portfolios the best course of action will be to have a clear understanding of how much risk they are prepared to take at the moment, position their portfolio accordingly and sit tight.”

Last year was a surprisingly benign one for world equity markets, but there is every chance that 2018 could be a lot more challenging given the higher valuations. In these circumstances it would make sense to stick with experienced managers with exceptional track records who have navigated through similar periods in the past.

One such is Neil Woodford, although it feels like a contrarian recommendation given the recent poor performance that has seen his £8 billion CF Woodford Equity Income fund return virtually zero in the last 12 months.

In these circumstances it would make sense to stick with experienced managers with exceptional track records who have navigated through similar periods in the past.

Laith Khalaf, Senior Analyst at Hargreaves Lansdown, says that Woodford has an uncanny knack of getting the big macroeconomic calls right, as well as the ability to add value for investors through stock selection.

“He has been down on his luck in 2017 and performance has disappointed, but his long-term track record is exceptional, and while some investors have given up the ghost, we think that patience will be rewarded.”

Woodford has recently said that the stock market is in a bubble that will inevitably burst. He sees echoes of the tech bubble and says that there are so many warning lights that he is losing count.

Khalaf also likes Lindsell Train Global Equity, which is managed by Nick Train who runs a concentrated portfolio of high conviction investments.

“Train looks for quality companies that are global brands and in charge of their own destiny. Like Woodford, he has a long and successful track record of delivering outperformance for investors.”

If you are optimistic about the outlook there are plenty of higher risk opportunities in the strongest performing regions.

Emerging Markets

Darius McDermott, MD of Chelsea Financial Services, says that despite having done well last year, he believes many areas within emerging markets are attractively valued relative to many of their developed market counterparts and the asset class could continue to do well in 2018.

One way to take advantage would be to invest in the Lazard Emerging Markets fund. This is heavily weighted towards the Financial and Information Technology sectors, with the largest geographic allocation being Emerging Asia at 56% of the portfolio.

“The fund benefits from a well-resourced emerging market team based in New York. We like their strong value discipline and the fact that they are trying to identify the global brands of the future,” explains McDermott.

He also suggests M&G Global Emerging Markets, run by Matthew Vaight since its launch in 2009. The manager has a strong focus on corporate governance and aims to find companies that other managers have missed.

Patrick Connolly, a Certified Financial Planner at Chase de Vere, Independent Financial Advisers, says that investors who are comfortable with the high risks associated with the region might want to consider JPM Emerging Markets.

“The fund has one of the largest, most experienced and well-resourced emerging markets investment teams with 39 managers and analysts. It is likely to be as close as investors will get to a safe pair of hands in the region, especially given the focus on investing in high quality companies that can demonstrate consistent growth.”

Japan

Japan’s main stock market index, the Nikkei 225, had a successful 2017 and there is a good chance that the bull market could continue given the business-friendly reforms being pursued by Prime Minister Shinzo Abe following his recent re-election.

“Japan had a strong year in 2017 as the economic reforms that have been taking place over the past few years continue to bear fruit. The tailwinds remain in place for 2018 and coupled with a rapidly improving shareholder focus from company management this should help the Japanese market to move higher this year,” explains Hughes.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

He suggests Baillie Gifford Japanese, which has one of the strongest management teams in the region. It is one of the oldest funds in the sector and has delivered excellent returns in the most difficult market conditions.

Another option from McDermott is T. Rowe Price Japanese Equity, which holds around 60 to 100 Japanese companies of all sizes, albeit with a notable overweight to smaller firms.

“The manager aims to find businesses he believes can deliver sustainable growth before other investors recognise their potential. He will adapt his investing style as needed to suit changing market conditions, which has helped him to outperform in different environments.”

Continental Europe

2017 was also a good year for Continental Europe where improved economic growth and falling unemployment helped bolster investor sentiment and supported a pick-up in M&A activity.

McDermott believes that there are still pockets of value that can be captured by selecting the right managers with one example being Henderson European Selected Opportunities.

“The fund provides exposure to a high-conviction portfolio of 50 to 65 mega and large-cap stocks that has neither a growth nor a value bias. We like the manager’s pragmatic approach and the fact that he takes the macroeconomic environment and sector trends into consideration, as well as looking at individual companies.”

Bonds should have an important role to play in many portfolios, although many fixed interest assets look expensive and could potentially be subject to falls.

Hughes prefers Crux European Special Situations, which is managed by the veteran Richard Pease, who focuses on companies that have exceptional management teams and a market leading position.

“Pease uses his many years’ experience to identify good management teams and is happy to invest in a high conviction manner away from the benchmark. This approach typically finds more opportunities in medium and smaller companies and while it can be more volatile than its competitors, it is proof that talented bottom-up stock pickers can add significant value.”

Bonds

The prospect of rising inflation and higher interest rates would normally put people off from investing in bond funds, but that wasn’t the case last year with the sector experiencing record-breaking inflows in August, September and October.

Connolly says that bonds should have an important role to play in many portfolios, although many fixed interest assets look expensive and could potentially be subject to falls, especially if interest rates rise.

“Rathbone Ethical Bond is a high conviction fund that has a good quality manager in Bryn Jones. It typically pays a competitive yield, which is currently 3.8%, and invests in many underlying holdings that aren’t usually found in other funds, meaning it provides strong diversification benefits.”

Hughes suggests Fidelity Strategic Bond because of the cautious nature of the manager, Ian Spreadbury, and the flexibility offered by the mandate that allows him to invest in different parts of the fixed interest market.

“With the extensive resources at Fidelity, the team now look to add value through relative value trades around the world, as well as traditional UK gilts and bonds giving an extra source of potential return. The extensive experience of Ian Spreadbury could well prove beneficial over the coming months.”

Another defensive option would be AXA Sterling Short Duration Bond, which only invests in high-quality corporates with maturities of less than five years. These are less vulnerable to higher interest rates, especially as about a fifth of the holdings mature each year, although the downside to this is that it is only yielding 1.8%.

FUND OF THE MONTH

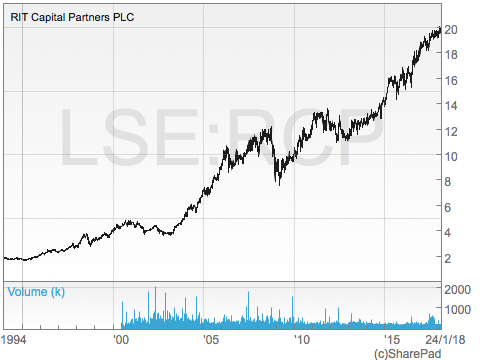

RIT Capital Partners (LON:RCP) aims to capture greater participation in up markets than down markets, in the belief that this will lead to both long-term outperformance and capital preservation. It has many of the attributes of a family office due to the influence of its founder and largest shareholder, Lord Rothschild.

The fund has developed a strong long‐term track record through a top‐down investment approach and exposure to some of the world’s leading investment managers. At the end of September the main portfolio weightings were: Quoted Equities 32%, Absolute Return and Credit 24%, Hedge Funds 21%, and Private Investments – Funds 13%.

If markets continue to rise RIT should capture a decent element of the upside, whereas if they fall it should protect against the worst of the declines. This is a highly unusual and valuable characteristic, which explains why it is trading on a small premium to NAV. The fund is recommended by both Numis and Winterflood Securities.

Fund Facts

Name: RIT Capital Partners (LON: RCP)

Type: Investment Trust

Sector: Global Growth

Total Assets: £3,293m

Launch Date: 1988

Current Yield: 1.6%

Gearing: 20%

Ongoing Charges: 1.14%

Website: www.ritcap.com

The graph would be more useful if we knew what the vertical axis represented.