Personal Assets holds steady as the sell-off intensifies

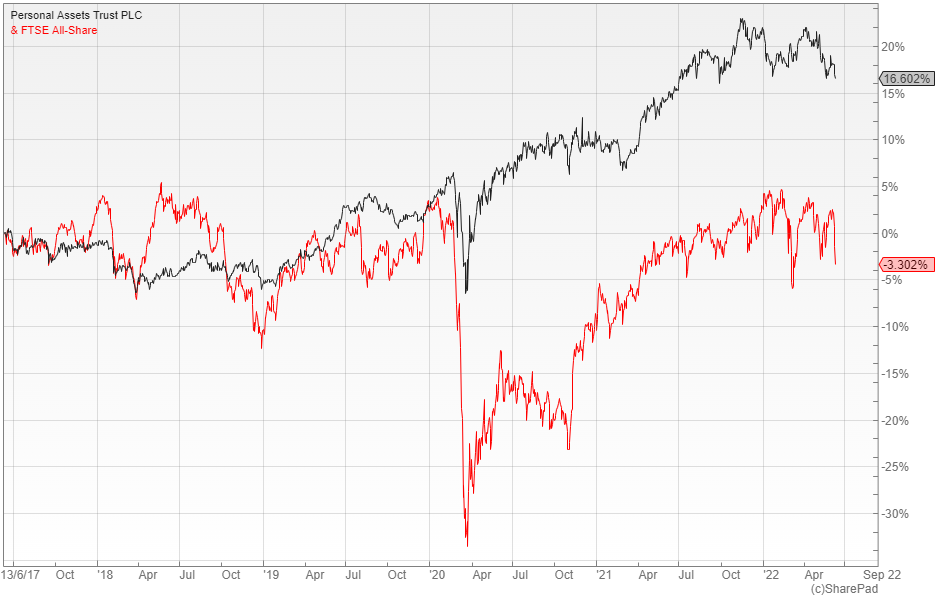

The £1.8bn Personal Assets Trust (LON: PNL) has just released its annual results for the year to the end of April in which it generated an NAV total return of 5.8% versus the 5.1% made by the FTSE All-Share. Since then however it has given back 1.7% of the gains with the index broadly unchanged.

Experienced manager Sebastian Lyon believes that the overvaluation of equities is far more evenly spread than during the tech bubble in 1999, when it was focused on a smaller number of stocks. He says there are fewer places to hide because of this, which is an apposite warning given that all the major US indices are down sharply from their recent highs.

Writing in the accounts he said that the supply constraints deriving from the pandemic have been more persistent than many expected, while the conflict in Ukraine has further exacerbated the inflationary pressure. Despite this the real Fed Funds rate is the lowest it has been for 70-80 years and the risk of a major policy error is rising.

The underlying portfolio

Lyon is sceptical of equities being a suitable defence against inflation, with exposure to this area being cut from 46% to 38% during the period. Instead he prefers gold bullion and index-linked bonds that are more resilient in a rising rate environment, where real rates – after adjusting for inflation − remain negative.

According to the latest available data at the end of May, the portfolio consisted of: 35% equities, 34% index-linked bonds, 11% gold-related investments, 16% UK T-bills and four percent cash. The equity allocation was made up of 15 quality companies including the likes of Microsoft, Alphabet, Unilever, American Express and Diageo.

The board has proposed a 100-to-one share split, in which each current share that is priced at around £480 will be divided into 100 separate shares. This would allow retail investors to trade in more manageable sizes, especially if they have a regular investment plan and may help the liquidity.

Does what it says on the tin

Personal Assets aims to protect and increase (in that order) the value of shareholders’ funds per share over the long-term and that is exactly what it has done. Since Sebastian Lyon took over as investment adviser in March 2009 the share price total return has been 180.7%, which compares with a gain of 278.5% for the FTSE All-Share and a 58.3% increase in the UK Retail Prices Index.

The broker Numis believes that this is a creditable track record given the portfolio’s low exposure to equity markets and that returns in recent years have proved the defensive nature of the trust. Since the start of January 2000 it has actually outperformed the FTSE All-Share at a much lower level of annualised volatility.

Lyon draws parallels between the current market sell-off and the 2000-2002 .com bear market and says the current market weakness, which started in November 2021, may have longer to run given the valuations and shift in the interest rate environment. Numis believe that the fund’s emphasis on capital protection matches the risk/return objectives of many private investors and consider it an attractive long-term vehicle for those with a more cautious approach.

Comments (0)