A Rare Period of Underperformance for Smithson

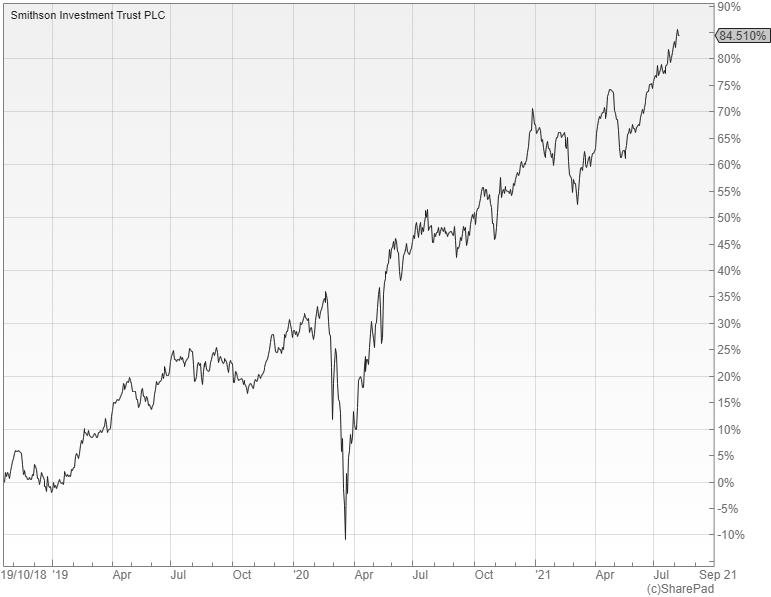

The Smithson investment trust (LON: SSON) has had a fantastic run since its launch in October 2018 delivering twice the return of the MSCI World Small and Mid-Cap benchmark, but its latest half year accounts reveal a rare period of underperformance.

Fund manager Simon Barnard invests in small and mid-sized global companies that he thinks can compound in value over many years. These would typically have already built up a track record of success before he buys them, such as by having established a dominant market share in their niche product or service or having brands or patents which others would find difficult, if not impossible, to replicate.

The sort of holdings that he targets exhibit strong profitability that should be sustainable over time and generate substantial free cash flow that can be reinvested back into the business. This should enable them to compound returns for shareholders with the fund keeping a watchful eye but otherwise following a buy and hold type strategy.

It is an approach that has worked remarkably well with an NAV total return of 82% from inception to the end of July compared with a 40% gain in the MSCI World Small and Mid-Cap index.The six months to the end of June was the first time that the fund had actually lagged behind its benchmark – six percent versus twelve percent. This was due to a rotation from growth to value, although it has almost entirely made up the shortfall in the period since.

Concentrated portfolio

Not many stocks meet these criteria so it’s a concentrated portfolio of 32 holdings with the top ten accounting for 43% of the assets and the top twenty making up 75%. The largest sector is technology at 43%, while the main country weightings are the US at 47% and the UK 21%.

In terms of the individual stocks, the biggest positions are: the online real estate portal Rightmove, travel technology company Sabre, up market drinks maker Fevertree, cyber security business Fortinet and food frim Domino’s Pizza. The last two of these added considerably to the recent absolute performance during an otherwise relatively weak period.

Turnover tends to be low, although two new positions were initiated in the latest accounts with the US pest control company Rollins and restaurant Wingstop both being added to the portfolio. The holding in the UK biotech business Abcam was sold due to the increased risk and cost from its proposed strategy to enter new markets.

Sticking to their guns

The recent underperformance was partly driven by the rotation from growth to value caused by fears of rising inflation, but Barnard doesn’t believe that inflation would cause any significant problems for the investee companies. This is because they have low input costs and capital requirements as well as pricing power that should enable them to pass on any cost increases.

Smithson was the largest ever investment trust IPO when it raised £822m at launch in October 2018 and it has consistently traded at a premium to NAV. The high demand has enabled it to repeatedly issue new shares with the fund growing to a sizeable £3bn.

The strategy of buying high quality companies at reasonable valuations and then holding them for the long-term has worked remarkably well both for this fund and its large-cap open-ended stable mate Fundsmith Equity that is run by Terry Smith. It remains to be seen if they can weather a higher inflation and interest rate environment as successfully as the managers seem to think.

Comments (0)