Why investors should shun the FTSE 100

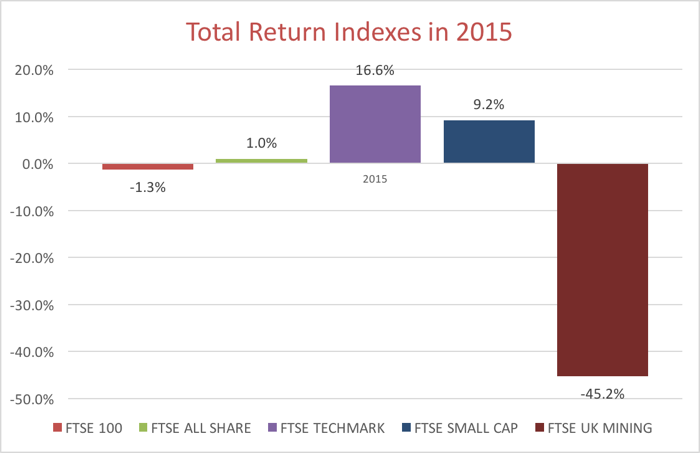

2015 was a particularly tough year for British equities. At the beginning of the second quarter everything was gaining traction with the FTSE 100 index rising 8.5pc and recording a multi-year high at 7,122.74; but then things soured and the index was caught in a huge descent that stole 1,250 points from that level. With the Chinese economy growing below the double-digits we were used to and with so much uncertainty mounting around a potential rate hike in the US, British equities couldn’t resist and were battered down. At the end of the year, the FTSE 100 was losing 4.9% while the core European countries were celebrating near two-digit gains. But the FTSE 100 index tells little about what happened, as it hides a heterogeneous reality.

A first look into the FTSE 100 index reveals that only 37 constituents ended 2015 in negative territory. Without any remaining data I would guess the FTSE had risen. But, as already pointed above, it instead declined 4.9% (a decline of 1.3% after dividend adjustments). A good explanation for this is the fact that the FTSE 100 carries a few heavyweight constituents that closed in the red and then dragged down the overall index. Mining companies led the laggards table with Anglo American, Glencore, and BHP Billiton recording epic losses of 75.1pc, 69.7pc, and 45.3pc respectively. Companies inside the mining sector have been downtrending since 2011, but were hit particularly hard during the last eight months, just after the FTSE 100 recorded its historical high. This trend reminds us that what is artificially inflated must later be deflated. The mining sector grew disproportionately between 2002 and 2008 and, even after being hit by the financial crisis of 2008-2009, quickly recovered between 2009 and 2011 to its prior high levels, as the result of central bank and government action around the globe. On the one hand, cheap money increases the appetite for large mining companies to invest in new projects. On the other hand, cheap money and excessive government investment increase the demand for raw materials (in particular in China and other emerging economies). The consequence is of course a huge investment in new exploration.

Many mining companies created giant mines in Australia, Brazil, West Africa, Chile, Peru, Indonesia, Arizona, and Mongolia. Some of these explorers spent billions on new projects in order to capture a share of the commodities supercycle. The problem is that the supercycle was artificially created and would be reversed as soon as demand reverted to normal. With the Chinese government now allowing growth to hover around the 7% level and the FED attempting to reverse years of cheap money, the drag in the mining sector has been epic. Anglo American announced 85,000 new job cuts in December while the company also suspended its dividend. They’re certainly now regretting a recent investment in a supermine in Brazil. Rio Tinto has also recently announced spending cuts while Glencore suspended its dividend and raised $2.5 billion in stock to cut debt. All these companies have been involved in supermine projects that are too big to shut down and will continue to be a drag on future profits. Both Rio Tinto and Glencore are amongst the largest drags on the FTSE 100 in 2015.

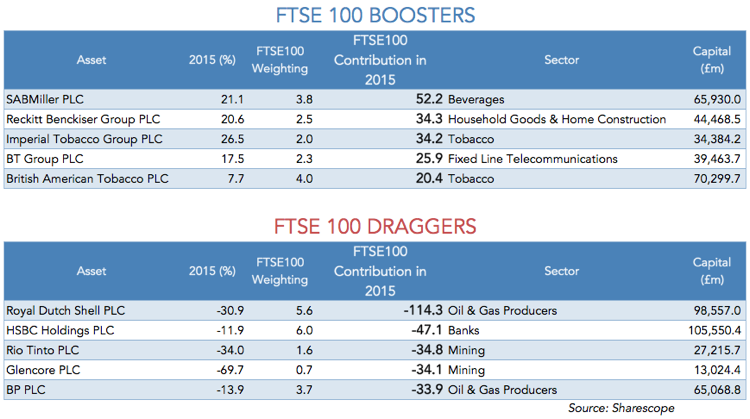

But 2015 was not only about mining, it was also about oil. While Saudi Arabia appears to intent on keeping its promise to bust everyone, oil prices declined more than 30% (on top of 45% in 2014). For this reason Royal Dutch declined 30.9%. Even though not being the largest decline in the FTSE 100, it was the largest drag on it due to the company’s 5.6pc weighting in the index. The second largest drag comes from a bank – HSBC. The bank is a big lender in the Asia-Pacific area, which has been affected by China’s deterioration. Not that the 11.9% decline the bank suffered in 2015 was that large (in particular when compared with other banks), but the bank’s weight in the FTSE 100 is.

On the positive side, SAB Miller made the largest positive contribution to the FTSE 100 due to a mega deal worth £71 billion, led by Budweiser brewer Anheuser-Busch InBev.

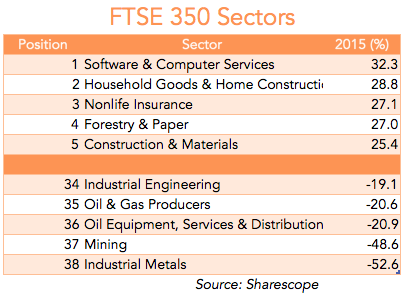

In terms of sectors, everything related to raw materials has been in deep trouble. Industrial Metals and Mining declined around 50% in 2015, followed by Oil Equipment, Services & Distribution and Oil & Gas Producers, which declined around 20%. Software & Computer Services was the best sector inside the FTSE 350, which is part of a major outperformance trend observed for the technology industry. Following in the same footsteps is everything related to home construction. The herd towards technology and home construction is not unexpected. It’s simply the result of quantitative easing, low interest rates, excess availability of cash and lack of a decent yield. When money is so widely available, investors naturally look for opportunities to speculate. These are rarely inside the traditional economy and often in assets that are harder to value (usually small caps and technology shares). At the same time, the low interest rates also favour an increase in demand for land and housing, which helps boost the home construction sub-sector and many other related sub-sectors.

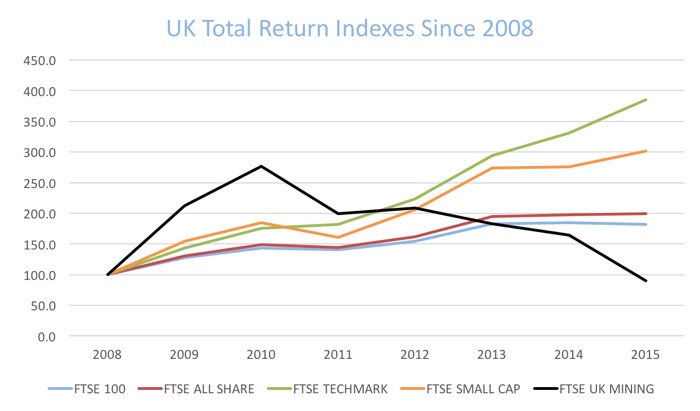

The FTSE Techmark and the FTSE Small Cap indices have been outperforming the overall market since 2008. Someone investing £10,000 in the FTSE 100 index at the end of 2008 would by now have accumulated £18,200. But, if the same amount had been invested in the FTSE Small Cap index it would by now be worth £30,150. The same investment in the FTSE Techmark would have risen to £33,180.

Currently, the P/E ratio of the technology industry is around 37x, which may be too high to enter. But the situation within the FTSE 100 is not much better. Despite having experienced a large price decline over the last eight months, the index P/E ratio steadily rose from 7.9x in 2011 to 16.8x today, which is near multi-year highs. With so many supermines still to deal with and a relatively high P/E, the FTSE 100 seems too vulnerable. In better position is the FTSE 250, which shows a higher P/E but is still much below its level at the beginning of 2010. But the best bets for now may be found within the Consumer Goods industry. The industry will benefit from a continuation of the status quo in terms of monetary policy, as the BoE will continue to keep rates low in order to boost real wages and consumption.

Comments (0)