TT Electronics – 2019 results due within days should be good

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The imminent full-year results will hopefully show this one to be a long-term winner, argues Mark Watson-Mitchell.

Obviously this Covid-19 pandemic is rubbishing share prices all over the globe, but I do not consider that it is as catastrophic as the recent market falls have portrayed. Prices will rebound in due course.

Major market investors, like Buffett or Templeton, get stuck into such markets as we are now enduring – ‘buy when there is blood on the streets’ etc.

It may be very cynical but demand for products continues, regardless.

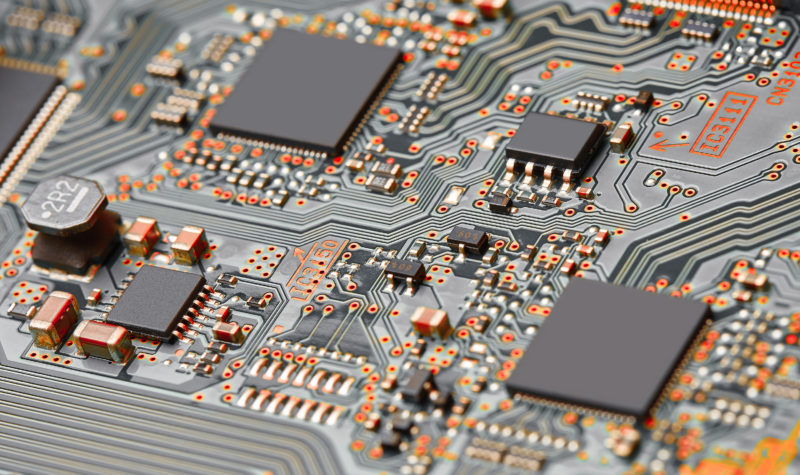

Today’s selection, TT Electronics (LON:TTG), operates with market-leading companies in the medical, transportation, industrial, aerospace and defence sectors.

It is a global provider of engineered electronics for the performance critical applications that its various customers need for their own operations.

It designs and manufactures specific products, including power management devices, sensors and connectivity solutions.

The group, which is headquartered in Woking, has over 5,000 employees working out of some 21 operational and seven sales and engineering offices at its sites across the UK, the US, Sweden and Asia.

It is split into three divisions: Sensors and Specialist components; Power and Connectivity; and Global Manufacturing Solutions.

On a revenue by market split the group’s industrial clients generate 44% of sales, medical 25%, aerospace and defence 20% and transportation 11%.

On a revenue by geography basis the split is 30% from the UK, North America 28%, Asia and the Rest of the World 23%, while the rest of Europe creates some 19%.

The company, which has 164m shares in issue, has more than a handful of leading institutional investors in its equity, including Aberforth Partners (9.04%), BlackRock (5.57%), Polar Capital (5.24%), M&G (5.13%), FIL (4.97%), JO Hambro (4.87%), Schroder (4.84%), NNIP Advisors (4.76%), Tweedy, Browne (4.67%), and Franklin Templeton (4.63%).

Early next month the group will be announcing its results for the 2019 year and they should be very positive. Last November it announced a trading update for the period up to the end of October, it showed strong organic growth with its revenue up 12% over the same period in 2018.

What was really driving the group was a very good performance by both its Power and Connectivity and its Global Manufacturing Solutions divisions, while it was suffering a slowing down on its Sensors and Specialist Components side.

The order book was ahead of the prior year, with good visibility from major customers in the aerospace and defence and in the medical markets, showing significant wins for multi-million recurring revenues.

Broker’s estimates for 2019 suggest that revenue has risen from £430m to £480m, with pre-tax profits more than doubling from £14.6m in 2018 to £36m. That could have seen earnings of 18p against 16.2p previously, while dividends will have risen from 6.5p to 6.9p per share.

For the current year predictions are for £500m of revenue, £37.5m of profits, earnings of 19p and 7.3p of dividend per share.

But, of course, those estimates were made pre-virus – even so the shares, now at 201p are trading on 11.2 times historic and just 10.5 times current year earnings, rating below those of its peers. The imminent finals will, hopefully, show that this a long-term winner.

I now set an end-2020 target price of 250p.

Comments (0)