Sureserve – a 50% rise on the cards?

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Under the stewardship of Bob Holt of Mears fame, this compliance-driven business looks highly undervalued and ready to pop, writes Mark Watson-Mitchell.

Ask anyone in the City and they will tell you that compliance is a growth business.

Whether it is for the control and regulation of financial matters or in the host of other sectors in which compliance is expected, then demand is certainly increasing for the performance of such services.

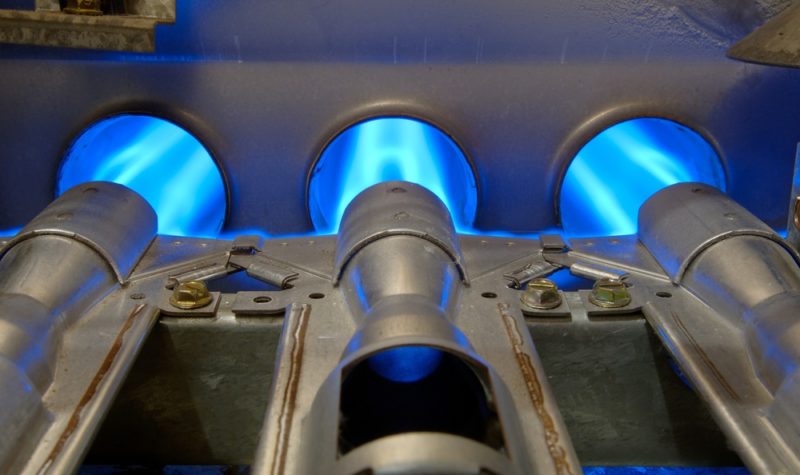

A little company that has very big potential in the compliance sector is Sureserve (LON:SUR). It is not in the compliance of financial matters, but instead in gas services, especially into the social housing sector – which can be similarly pressured by legislation.

We do not know the date yet, but the company should be reporting its September 2019 year-end results within days. They should show at least a 20% advance in pre-tax profits, making its shares look undervalued.

The Basildon based group, which employs over 2000 people and has some 23 offices across the UK, is a leading compliance and energy support services business.

It performs critical functions in homes, public and commercial buildings, with its focus on clients in the UK public sector and regulated markets.

The demand for the group’s services is strong.

It has gained a reputation for the delivery of quality services and has gained market leading positions in the highly regulated public sector gas maintenance and energy management sectors.

The company serves customers in the social housing, public buildings and education markets. It also has a broad mix of customers in energy services and an increasing number of industrial and commercial customers.

Some 60% of the group’s revenues are derived from its Compliance division and 40% from its Energy Services side.

The Compliance division comprises planned and responsive maintenance, installation, and repair services in the areas of gas, fire and electrical, water and air hygiene and lifts.

The Energy Services division comprises energy efficiency services, renewable technologies and smart metering services.

In July 2016 Bob Holt was appointed executive chairman. I witnessed the massive growth of Holt’s Mears Group, from the early 1990s into what is today a £350m organisation, with its shares reflecting sales and profits growth, rising from just 11p in 1996 to well over 525p in 2017. While he is no longer involved with Mears, he is very much involved with steering the strategic direction of Sureserve.

An important non-executive director of the company is Christopher Mills, the investment fund manager, whose Harwood Capital group actually bought 324,711 more shares in the company at 29p each in late November last year. That takes his stake up to almost 30.5m, representing 19.18% of the Sureserve equity.

There are 159m shares in issue, with other leading investors in the equity including Slater Investments (10.1%), Downing (5.88%), Legal & General (5.55%), and EFG Private Bank (3.11%). Connected investors also control another 25% of the equity.

Edison Research suggests that revenue for 2019 will have risen from £191m to £205m, with normalised pre-tax profits having leapt from £6.6m in 2018 to £8.1m for the year to end-September 2019. Earnings are estimated to have grown from 3.4p to 4.2p per share, with a minimal 0.25p dividend.

For the current year, Edison is looking for £216m revenues and £8.6m pre-tax, worth 4.4p in earnings and again with a 0.25p nominal dividend per share.

With the shares trading at around the 36p level, on just 8.5 times historic price earnings, they appear to be very undervalued.

Just 12 times would see the shares stand at 50p – which is where I now set as my end-2020 target price.

Comments (0)