Small Cap Corner: Update Edition – STM Group, PPH Hotels and Gear4music

As we enter the height of the company reporting season I have taken the chance to review the performance of some of the shares I have covered on this website/magazine over the past few months.

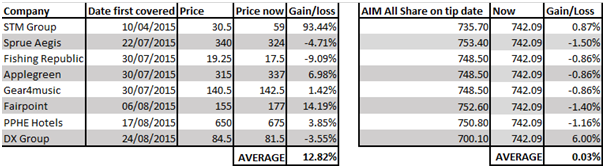

While there have been both winners and losers, I have had a pretty solid performance record overall. The eight companies I have analysed so far have gained an average of 12.82% on an equal weighted and mid-price (caveats recognised) basis. Not bad considering I have only been covering stocks in this capacity since April and that equivalent investments in the AIM All Share over that time would have only gained a piddling 0.03% – see table.

Prices source: Sharescope

Of course I recognise the huge contribution that one stock – STM Group – has made to the overall performance. Since my initial analysis on 10th April the overseas focussed pensions administrator has been the 34th best performing stock on the whole of AIM. Stripping this out the average gain would have only been 1.3%. But that is what small cap investing is all about – building a balanced portfolio and finding a few star performers which make a real difference.

And so to STM Group we go in this small cap update edition.

STM Group

At the start of the month the QROPS (Qualifying Recognised Overseas Pension Schemes) specialist reported another strong set of numbers. Pre-tax profits grew by 40% to £1.4 million in the six months to June, driven by solid growth in the Pensions and STM Life businesses, along with increased profit margins. Notably, the first half saw more IFAs added to the firm’s distribution network than in the whole of 2014. This was offset by (expected) revenue falls in the Corporate and Trustee Services division.

Strong cash generation continued, with the inflow from operations being well ahead of operating profits at £2.17 million. This was largely driven by a £1.96 million fall in trade receivables, with the company having specific initiatives to encourage faster payment and thus reduce debtor days. Cash at the period end stood at £7.12 million, although over half of this is restricted for regulatory purposes. While no dividend was proposed at the interim stage STM stated that “given the profitability and cash position, the Board intends to re-introduce a progressive dividend policy in due course.”

In my original analysis I flagged two main risks to the STM investment case. Since then they have been eliminated or significantly reduced – hence the strong share price performance. Firstly, the £2.55 million worth of loan notes at the end of 2014 have been reduced to just £0.3 million – this was via £0.7 million of repayments and £1.55 million worth of conversion into equity. Not only will this reduce financial costs but it also paves the way for the company to pay a dividend given the increased certainty over financing. Secondly, the regulatory hearing against subsidiary STM Fiduciaire saw the company found not guilty and thus there were no penalties.

Valuation

Shares in STM have almost doubled since my initial analysis and currently trade at levels last seen at the end of 2008. Following the partial loan note conversion market forecasts for 2015 and 2016 are now for respective earnings of 3.8p and 5p per share – the numbers being revised downwards slightly due to more shares being in issue.

Given the recent re-rating, STM shares now look more expensive, trading on a forward PE multiple of 11.8 times. But on an attractive looking price to earnings growth ratio (PEG) of just 0.37 times and with the potential for a decent dividend payment I believe they could have further to go. On an earnings multiple of 15 times I believe that a target price of 75p is not unreasonable for the end of 2016.

PPHE Hotels

Next up is PPHE Hotels, which I covered in mid-August and has since gained a modest 4% on the back of a decent set of results for the six months to June. The operator of the Park Plaza brand just about doubled normalised pre-tax profits to €15.2 million in the period on the back of revenue up by 12.4% to €141 million. The top line was boosted by around €10 million due to the strengthening of sterling against the firm’s reporting currency, the euro – the majority of revenues (67%) come from the UK.

More notably, showing the strength of the company’s operations, RevPAR (the key industry measure of revenue per available room) increased by 12.5% to €119.8. There was also an increase in another key performance measure, occupancy rate, which rose by 260 basis points to 82.9%. With the second half of the year being the strongest, the firm said that it expects full year numbers to be in line with recently increased expectations.

Valuation

Since my initial article the shares advanced to another all-time high of 685p, before slipping back slightly to the current 675p. Nevertheless, I still see significant upside, especially given the “hidden value” in the balance sheet. My updated base case net asset value (NAV) calculation is as follows:

– NAV as at 31st December 2014 = €349.27 million. Less intangibles of €31.18 million = €318.09 million.

– “Fair value upside” – Unfortunately the interim results do not provide us with enough information to calculate an updated figure so I stick with the end-December figure of €167.66 million – total property portfolio valuation of €990.66 million less the PPE net book value of €823 million.

Total = €485.75 million, which equates to £353.08 million or 841.7p per share.

This implies 24.7% further upside if the firm were trading at parity with NAV. Again this is a conservative estimate given probable valuation changes over the first half, no value being given to intangibles, upside from development projects and translation upside from the London assets being valued in sterling.

The shares also look reasonable value on a forecast earnings multiple of 10 times for 2015 (following recent forecast increases) and there is a well covered dividend yield of 3%. Overall, I believe that the shares continue to look like a solid long-term buy & hold.

Gear4music

Finally, my favourite company by product, Gear4music, announced a brief but upbeat trading statement at the start of the month. As a reminder, the company is a fast growing, York based online and offline retailer of musical instruments and accessories. The firm joined AIM in June this year raising a net £9 million to expand the business both in Europe and the UK. Read my initial analysis in the August Master Investor Magazine on Page 76 CLICK HERE

For the six months to August trading was said to be comfortably in line with expectations, with total sales growing by an impressive 43% to £12.49 million, driven by a 60% rise in European sales to £2.9 million. While growth was less strong in the core UK market it was still high at 38%, sales from the region rising to £9.6 million. These figures were all the more impressive given strong comparables, with UK sales up by 27% in the full year to February 2015 and European sales up by 87%.

Other highlights of the first half included a 29% rise in website visitors and active customers (those who have made a purchase in the last two years) up by 32% to 400,000. The total number of products available now stand at 29,000, up from 27,400 at the start of the financial year, with 11 new brands signed up in the period and more own brand products being launched. Unfortunately, no update was given on the opening of the firm’s planned flagship showroom in London. However, I would note that the statement was released just four days after the period end, which gives confidence in the quality of the firm’s reporting systems.

Valuation

Gear4music shares have edged up by 2p to 142.5p since my initial analysis, to capitalise the company at £28.72 million. Growth being seen puts the firm on track to post the forecast £0.66 million of pre-tax profits for the current financial year and earnings of 2.91p per share. In 2016 the forecast is for around 6p of earnings, putting the shares on a multiple of just under 24 times.

While the valuation may look relatively high, investors should note that the business is trading well, has a decent chunk of cash in the bank from the IPO, has the capacity to increase annual turnover to an estimated £50 million from its York facility and is forecast to (more than) double earnings next year. House broker Panmure Gordon has a 180p target price, which implies 26% upside. Followers of director purchases should also note that Chief Commercial Officer, Gareth Bevan, bought 13,920 shares at the end of August for a total of £19,810, taking his stake to 0.7%.

In my opinion, as a potential ASOS of the online musical equipment industry, Gear4music remains worthy of a speculative investment.

Comments (0)