Pump up your portfolio with The Gym Group

Currently two weeks into a self-imposed January booze ban my newly refreshed brain got thinking about the economic impact caused by the many drinkers who abstain from alcohol at this time of year. “Dry January”, as it is commonly known, is in fact a relatively recent phenomenon, with the trademark being registered by the charity Alcohol Concern in 2014.

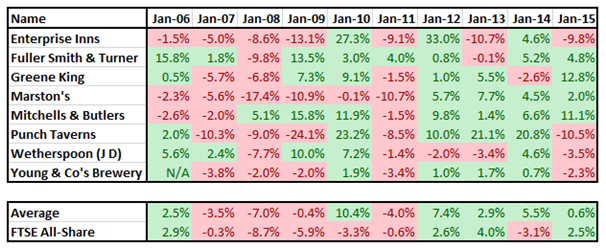

Typically practised by City workers after indulging in a few too many shandies over the Christmas holidays, you would expect the takings of certain Square Mile establishments to be down in the first month of the year. But having analysed the January performance of London listed pub companies there seems to be no discernible effect on their share prices – see table. In other words, there is no Dry January effect.

10 year January performance of London listed pub companies

Another sub-sector of the Travel & Leisure industry affected by New Year resolutions is gyms. In January, as people vow to lose their extra Christmas pounds, hundreds of fitness centres across the country see porky punters agree to divert £30-£40 a month from their bank accounts, regardless of whether they turn up or not.

One company which should benefit from this effect, but in a slightly different way, is Main Market listed The Gym Group.

The Business

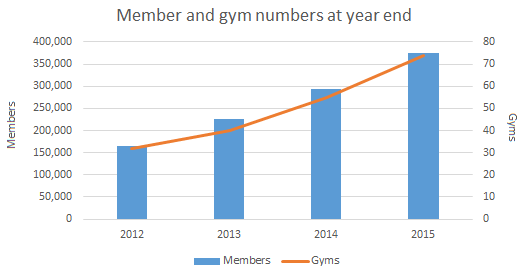

Having listed in November last year, The Gym Group (GYM) is a relatively young company, having opened its first “The Gym” branded outlet in Hounslow in July 2008. By the end of 2015 the portfolio had grown to 74 leased properties located in major towns and cities around the UK. Membership growth has been just as rapid, with total members standing at 376,000 at the end of 2015. Notably, the firm has never closed a gym.

Gym Group stands out amongst its competitors in that it does not require customers to sign lengthy and expensive contracts. Its business model focuses on a low cost and flexible offering, giving customers the freedom to come and go as they please. Other unique selling points include gyms being open 24 hours a day, seven days a week. Members get free Wi-Fi, fitness equipment is regularly updated and new ranges of free and paid-for studio exercise are offered. There are also an average 170 stations per gym, compared to an average of 63 for private sector competitors. As it stands Gym Group is the second largest operator in the low cost market behind Pure Gym.

The business model is technology driven to keep overheads down, with customers only able to sign up online or through dedicated kiosks in the gyms. This lowers costs due to there being no requirement for sales and marketing teams and associated admin expenses. As a result, the company brings in a relatively low average monthly membership fee of £16, which compares to the average private sector gym fee of around £42. But with customers preferring the flexibility they stay for an average of 26 months compared to 17 months amongst competitors.

Data source: Company prospectus and trading update

The medium-term growth strategy is focussed on opening between 15-20 new sites per annum. Potential sites will only be considered if they meet strict criteria, including the potential for a return on capital employed (ROCE) of 30% – the average ROCE of mature gyms in 2014 was high at 33%. While the main focus will be on organic growth the company is also considering selective acquisitions in what is a fragmented market, along with potential expansion overseas.

Financial record & recent trading

Revenue growth has been strong in the past few financial years on the back of the company’s brisk opening strategy. Between 2012 and 2014 sales grew by a compound annual growth rate of 43% to £45.48 million. On a statutory basis consistent losses have been posted. However, this is mainly down to the firm having large amortisation and depreciation charges. As such the cash flow performance has been much better, with the net cash inflow from operations in 2014 amounting to £9.47 million. Conversion of cash has consistently been over 100% of adjusted EBITDA. But with large capex spending on new openings overall cash flow has been negative.

Gym Group’s first update as a listed company was released last week and was well received by the market. It reported that results for 2015 will be in line with consensus market expectations, showing another year of strong revenue and EBITDA growth. During the year another 19 gyms were opened, with membership numbers growing by 28.3%. A further 15 to 20 openings are targeted for this year, with 12 already signed and a further 21 at the legal stage for 2016 and 2017.

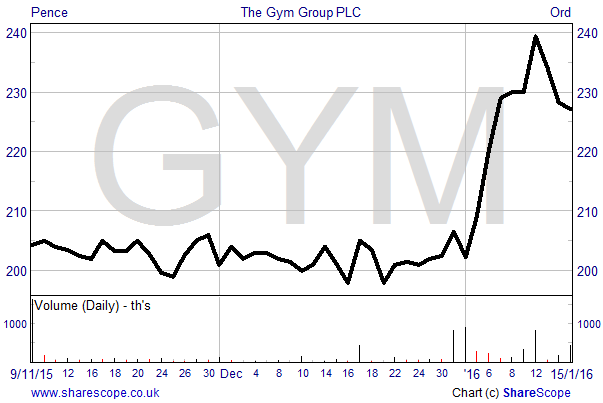

The second half of 2015 saw the company’s IPO, at which it raised a net £81 million at a price of 195p per share, along with £35 million for selling shareholders. The proceeds were mainly used to pay off borrowings, significantly strengthening the balance sheet. The trading update revealed that net debt stood at £7.1 million as at 31st December last year, down from £75 million as at 30th June, with this being lower than previously expected.

What a customer of Gym Group might look like

The treadmill of opportunity

The low cost segment of the gym market in which the company operates has grown rapidly in the past five years. According to sector analysts at research firm Leisure DB there were just 58 such operations in 2011, rising to 319 in 2015. Membership numbers have grown from 0.2 million to 1.3 million over the period as clients have been drawn from the mid-market and premium sectors. In addition to this source, Gym Group has also been attracting those new to health and fitness, with around 35% of its new members in the 12 months to June 2015 never having been a member of a gym before. There looks to be significant scope for further industry growth, with low cost gyms currently making up only 9% of the total market.

Valuation

Shares in The Gym Group have performed well since the company’s IPO, gaining 17% in just over three months. At the current price of 228.25p the company is capitalised at £292 million.

The company is a little tricky to value at present given the historic high interest payments, large non-cash charges and required capital spending on new gym openings. But from the first interim set of accounts we should see a much cleaner and more easily interpretable set of numbers. Taking adjusted EBITDA as a proxy for profits, the shares currently trade on a historic enterprise value to EBITDA ratio of 20 times. I believe that this looks fairly high but justifiable for a growth company.

What’s more, the near- and medium-term prospects for further revenue growth look strong given the clear expansion strategy and as newly opened gyms continue to grow to maturity (typically 24 months after opening). Additional economies of scale will also be enjoyed as new gyms are opened, further boosting the bottom line. Indeed, broker Numis, which currently has a target price of 265p, expects the company will treble its profits over the next four years. Despite the capital draining expansion strategy the company intends to adopt a progressive dividend policy, with an initial pay-out ratio of 10%-20% of adjusted net income being targeted.

Assessment

In a way The Gym Group reminds me of an early days JD Wetherspoons, the company having a clear growth strategy in the low cost area of its market. While it currently has high capital expenditures it is a strongly cash generative business and, while still at a relatively early stage of development, it is a major operator in a rapidly expanding growth market. If the business plan is successfully rolled out I see the potential for Gym Group to be a strongly profitable, mature and high-dividend paying constituent of the FTSE 250 within 5-10 years.

For the brave investor the shares are worthy of a punt.

Comments (0)