Premier League investments in the football financial frenzy

I kicked off writing about football and economics back in February, hot on the heels of the English Premier League clubs spending a record £950 million on player transfer fees. I also suggested that if current trends continue, we could well see the first £1 billion player within the next 20 years.

While Gareth Bale’s £85.3 million purchase by Real Madrid has held the record for two years now, and despite the recently introduced UEFA Financial Fair play rules, there appear to be few signs of a slowdown in the huge amounts of cash being pumped into the game.

Records kicked into touch…

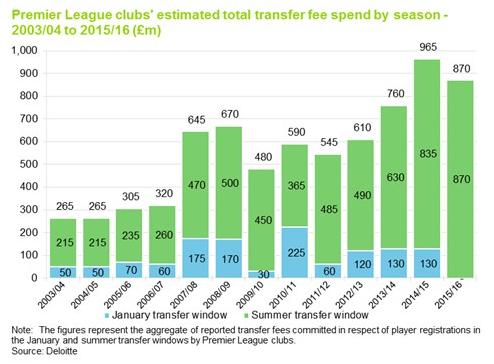

According to calculations from Deloitte, Premier League transfer fees in this season’s summer window once again hit an all-time high, up from £835 million in 2014 to £870 million in 2015. Backed by the estimated $1 trillion family fortune of owner Sheikh Mansour, Manchester City were the top dogs, spending £160 million on new players, a record for a single club.

But demonstrating a widespread spending spree, all but one Premier League club (Southampton) spent more than they earned on selling players, with net spending of £467 million also being a record. Total transfer fees across the summer and winter transfer windows surpassed £1 billion for the first time and spending in England was more than double that of any other European League – second was Italy’s Serie A at £405 million.

While the world record transfer fee for a single player remains unbroken since 2013, the number of large transactions in England this summer was noteworthy. For example, Christian Benteke’s £32.5 million move from Aston Villa to Liverpool is the inflation adjusted equivalent of three 1982 Diego Maradonas!

Of course, spending huge amounts is no guarantee of success on the pitch. Just look at Chelsea’s 4-2 defeat to Bradford City in the FA cup last year. Billionaire Roman Abramovich’s side had put been together for around £200 million, while Bradford’s team cost just £7,500 – less than Chelsea star Eden Hazard earns in six hours!

It’s not just Arab billionaires pumping money into the game…

Many Premier League clubs, such as Arsenal, Manchester City and Southampton, have built and moved into new, higher capacity stadiums this century, giving a boost to match day revenues. Season ticket price inflation has also been steep, with the BBC’s Price of Football survey finding that the average price of the cheapest match day ticket across the English leagues rose by 13% from 2011-14, well ahead of CPI inflation. And sponsorship and other commercial activities have become more lucrative.

But the main driver of the increased transfer fee spending has no doubt been the significant increases achieved by the Premier League for broadcasting revenues.

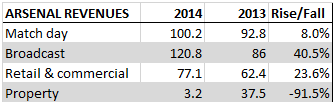

Demonstrating this, in their last financial report Arsenal said that broadcasting revenues soared by nearly 41% in the year to May 2014, overtaking match day revenues as the club’s number one source of income for the first time. Further, the rises in broadcast income have enabled all 20 Premier League clubs to be ranked in the top 40 globally by revenues.

Table: Arsenal revenues (£m). Data source – annual reports

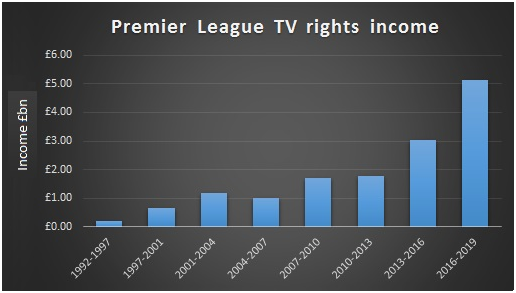

And the increases look set to continue. In February Sky (SKY) and BT (BT.A) agreed a £5.136 billion package for the UK television rights to show Premier League matches for three years from 2016. This was up by 71% on the £3.018 billion paid for the 2013-2016 rights, well ahead of expectations and worth £10.19 million a game.

Premier League TV rights UK income chart. Data source: Premier League

Clubs at the top of the Premier League are set to benefit further, with BT paying £299 million a year for the exclusive live UK TV rights to show Champions League games on its BT Sport channel for three seasons from 2015. The deal was done at a price more than double the previous arrangement.

Can investors take advantage of the huge football spending growth?

As a pure play bet on the financial success of football clubs there are few opportunities available in 2015. The past few years have seen scores of club owners (such as Tottenham, Millwall, Aston Villa, Watford and many others) delist their shares from the market. Also, a raft of football agent/wealth management owners (such as Premier Management, Formation and the dreadful First Artist) now operate in different guises. This is unfortunate for investors as there look to be significant opportunities in this industry – the average salary of a Premier League player rose from just £77,000 in 1992 to £2.27 million during the 2013-14 season (according to a Daily Mail survey).

As of today Arsenal (AFC) – listed on the ISDX market – and Celtic (CCP) – on AIM – remain the only teams quoted in London, with Manchester United (MANU) having a listing in New York.

Arsenal shares have performed remarkably well over recent years, despite the firm’s relative lack of success on the pitch. After building a new stadium and with a consistent presence in the money spinning Champions League the shares have doubled since the end of 2009. But at a current price of £16,000 to buy they remain out of reach of the average private investor.

Investors should also be aware that football clubs (as businesses) are run for goals and glory and not for the benefit of shareholders. And as such my stance on shares in football clubs is that that they are for fans and Russian/Saudi oligarchs only.

It is interesting to note that at the lower end of the football pyramid, where there is a distinct lack of available finance, several clubs have recently attempted, very aptly, to raise money from their crowds. FC United of Manchester used crowd funding last year to raise £51,000 in order to kit out its new function room. Grimsby Town raised £110,000 to buy new players and Darlington Football Club has gone to the market several times over the past few years.

Again, these are not investments in the traditional sense. Investors are unlikely to make any financial return, with all benefits being in the form of perks and non-monetary rewards – e.g. a photo with your favourite player. But with football clubs having notably loyal fan bases I expect that crowd funding efforts amongst the lower leagues will continue to grow.

There are other more attractive ways to make money from football…

On the periphery of the football market 5-a-side pitch operator Goals Soccer Centres (GOAL) caters for the amateur side of the game, but having pared down its expansion strategy a few years ago has not lived up to many investors’ expectations. Interim results last week delivered a profit warning after a weak summer period saw players cancel their kickabouts. But with a strongly cash generative business and good growth opportunities in the US there could be long-term opportunities for the patient investor.

My favourite pick is one of the broadcasters themselves.

While BT has been criticised (especially by Sky) for its aggressive and expensive entry into the market, the strategy looks to be performing well so far. The firm offers its sports channels for free to its BT TV & broadband customers, thus providing a unique selling point in a noisy and crowded market. In the quarter to March 2015 this helped fibre broadband net connections grow by 31% to 455,000. The shares currently trade on a forecast forward price to earnings multiple of 13 times and yield 3.7% – not bad for a growing FTSE 100 firm with a clear strategy.

Away from football, there are potential long-term benefits outside of the sports focussed area of the BT group. The end of November sees the deadline for the Competition and Markets Authority’s review into the company’s proposed acquisition of mobile business EE, which is expected to bring synergies of £360 million per annum within four years, huge cross selling opportunities and an additional 31 million customers.

Overall, there look to be few opportunities for investors to make money in football. But with my forecast for a £1 billion player by 2035 still standing, potential parents might like to start thinking now about investing in bringing up the Ronaldo of tomorrow.

Comments (0)