McColl’s Retail – a super market investment?

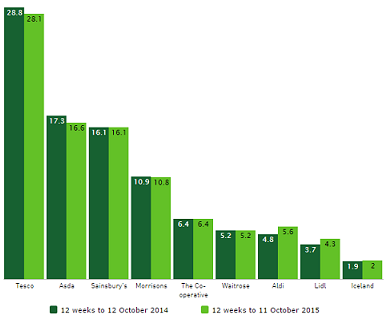

Figures released last week by Kantar Worldpanel on the Great Britain grocery sector did not make good reading for the London listed supermarkets. While Tesco remains the market leader by some way, its market share fell by 0.7 percentage points to 28.8% in the 12 weeks to 11th October. Morrisons also lost market share while Sainsbury’s remained flat as the discount retailers Aldi and Lidl continued to attract more customers.

Source: Kantar Worldpanel grocery share data

Overall supermarket sales grew by only 0.8% for the period. However, one part of the sector which is showing good momentum is the convenience store market, an area which FTSE Small Cap business McColl’s Retail is taking advantage of.

The Business

Founded by current CEO John Lancaster in 1973 as a vending machine operator, McColl’s is now the second largest multiple convenience store business in the UK and the largest independent operator of Post Offices. With a focus on local neighbourhood locations (as opposed to high streets) at the end of August this year the company had a total store base of 1,346, with 866 of these being convenience stores.

For reporting purposes the company divides its stores into several categories:

Premium Convenience – operating under the McColl’s brand name these are larger convenience stores which offer a wider range of groceries, including chilled and fresh products.

Standard Convenience – traditional convenience outlets which are typically larger than the (below) Food and Wine stores and stock a larger range of convenience products.

Food and Wine – newsagents that have been converted to convenience stores by introducing a grocery and alcohol range, longer trading hours and other improvements.

Newsagents – primarily trading under the Martin’s brand the newsagent portfolio contains smaller stores which sell the traditional confectionery, tobacco and news related products, along with services such as Post Office counters and Paypoint.

The company’s growth strategy is focussed around upgrading its stores to the higher value, better performing convenience formats. McColl’s is looking to have 1,000 convenience stores by the end of 2016 by converting newsagents into food & wine stores, upgrading standard stores to premium stores and via acquisitions, while also expanding the product range and maintaining a profitable newsagent operation.

Recent trading & financials

Over the financial years ended November 2011 to 2014 McColl’s grew revenues from £805 million to £922.4 million – a compound annual rate (CAGR) of 4.65%. Underlying operating profits grew over the same period by a CAGR of 10.2% to £25.5 million.

Upon listing on the Main Market in February last year McColl’s raised a net £44.7 million and used this to pay down borrowings. In 2014 this helped net interest costs before exceptionals (mainly associated with the IPO and non-cash share based payments) to more than halve, from £12.5 million to £6.2 million and pre-tax profits to almost double to £19.2 million.

Interims for the 26 weeks to May showed a much cleaner set of numbers

Total revenues for the period rose by 3.4% to £459.3 million; however a 1.9% fall in like-for-like sales spooked the market and saw the shares fall by 2.5% on the day of results. Net profits were strong at £5.9 million but even stronger was operating cash flow at £9.84 million. As a result the dividend was doubled to 3.4p per share, covered 1.8 times by adjusted earnings of 6.1p per share.

The most recent set of numbers were for the 13 weeks to 30th August and showed total sales up by 3%. However, like-for-like sales slipped by 2%, the company being hit by a 4.6% fall in its standard convenience and newsagents businesses. Nevertheless, good operational progress has been made in the financial year to date, with 46 new stores acquired, 26 food and wine conversions completed, alcohol being introduced to 100 newsagents and the 500th Post Office opened. McColl’s is also exploring additional income generating activities, with an agreement signed with sandwich giant Subway to trial a franchise operation. Overall, results for the full year are expected to be in line with expectations.

August also saw the company agree new terms for its £100 million total banking facilities, extending the expiration date by two years to August 2010 and reducing the interest paid by a minimum of 0.5 percentage points. And last week the company revealed that, after a portfolio review, it would be selling around 100 of its newsagents, for a price no less than asset value. Encouragingly, the decision is expected to be earnings neutral in 2016, with the funds being invested in profitable stores.

Risks & Opportunities

As the recent numbers from Kantar show, sales growth in the wider supermarket sector is slow, lagging the overall economy, with consumers having seen falling prices for over a year now. While convenience operators tend to be less price sensitive, recent numbers from McColl’s have shown that like-for-like figures have also been falling, hit by strong competition and price deflation. I note that McColls’ largest fall in like-for-like sales is being seen in the newsagents and standard convenience sector, so it is encouraging that the company has a strategy to upgrade these to the better performing convenience category stores.

Furthermore, the convenience market is one of the fastest growing subsets of the grocery market, driven by consumers moving from large shopping trips at out of town locations to smaller trips at more local venues. Recent figures from industry analysts at IGD suggest that in the 12 months to April 2015 the UK convenience market grew by 5.1% to £37.7 billion. It forecasts further sales growth of 17% between 2015 and 2020, putting McColl’s in a good position to grow given its specialised focus.

Management are incentivised to deliver growth, with the most recent long-term incentive plan awarding the directors with a combined £789,000 worth of shares at today’s price, should targets be met over the three years to November 2017. Most of the incentive plan is earnings based, with the full awards only given if cumulative earnings of at least 61.5p per share are achieved over the three years – quite a challenge given that it assumes a CAGR of around 14.3%. The remainder of the awards are based on total shareholder returns being in the top quartile of certain peers over the three years and there is a two year lock in period after vesting.

Other notable risks include the planned 10.8% rise in the UK minimum wage, from £6.50 to £7.20 for over-25s, from April next year, which will hit many retailers including McColl’s. In the longer term the National Living Wage, to be phased in between 2016-2020, is also a threat to profit margins. While the firm’s net debt remains relatively high at £35.3 million this is entirely manageable, with the company seeing strong cash flow and interest cover for the first half of this year being comfortable at 6.4 times.

Valuation

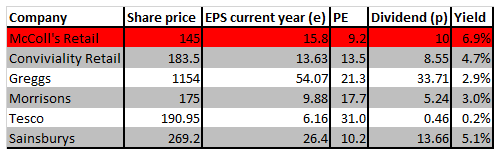

Since listing at a price of 191p in February last year McColl’s shares have not performed very well. While being given a temporary boost by a tip in the Daily Mail this August, at the current 145p they trade not far off all-time lows.

The current price puts the shares on a multiple of just 9.2 times market forecasts for the full year to November 2015. McColl’s is also an attractive income play, it targeting a payout of around 60% of profits before exceptional gains and after tax. With an expected dividend of around 10p per share for 2015 the current yield is a highly attractive 6.9%.

These valuation figures compare very favourably with other food retail sector peers – see table.

Data source: Digital Look

Overall, McColl’s Retail shares look like a decent value bet on the growth of the convenience sector, with a good yield to boot.

Comments (0)