Forget “Pharmaceuticals” – Think Immunology and Synthetic Biology

As seen in the latest issue of Master Investor Magazine

Investors often suppose that biotechnology is all about the development of new wonder drugs which zap bacteria and viruses – pharmacology. But in fact the best investment prospects probably reside in other, newer fields of medicine, of which there are several. Today I’m taking a peek into just two of the emerging disciplines which could transform medicine within our lifetimes: immunotherapy and synthetic biology.

Recently I wrote that Big Pharma has shown itself to be inadequate to the challenge of antibiotic resistance[i] – because the development of new blockbuster drugs no longer pays. The economics of pharmacology have become unfavourable. The typical cost of bringing a new drug to market has soared from US$150 million to at least US$1 billion in the last 20 years. And for every successful drug brought to market there might be a dozen which are never commercialised. The pharmaceutical giant Pfizer Inc. (NYSE:PFE) is more interested in producing high margin multivitamins than in developing new blockbusters. But I also reflected recently in another piece that the extension of human longevity, which has more than doubled over the last 150 years, has been driven as much by soap as by penicillin[ii].

Indeed, there is much more to modern medicine than conventional pharmacology. For a start there is immunology – the science of empowering the body to use its own remarkable resources to fight infection. And gene therapies also promise extraordinary advances in medicine in years to come.

Immunology: from Cowpox to Cancer

Immunology starts with vaccines. This branch of medicine has been around since 1796 when Edward Jenner inoculated an eight year old boy with material from the cowpox blisters of a milkmaid. A vaccine (derived from the Latin word for cow) is a biological preparation that improves immunity to a particular disease. A vaccine typically contains an agent that resembles a disease-causing microorganism, and is often made from weakened forms of the microorganism or its toxins. The agent educates the body’s immune system – antibodies – to recognize it as foreign, destroy it, and remember it. As a result, the human or animal immune system can recognize and destroy any similar microorganisms encountered thereafter.

This is an example of where human ingenuity helps Mother Nature to do what she does anyway, only in a more timely and precise way. The number of lives that Jenner has enabled humankind to save over eight or so generations is incalculable.

Vaccines can be prophylactic (preventive) or therapeutic (treating an existing condition) and are administered in mind-boggling quantities on a planet of nearly seven and a half billion people. There cannot be an adult alive in any developed country who has not had a vaccination of some kind. And happily, the developing world is catching up fast. Analysts foresee huge potential growth of the vaccines market in India (growing at about 16 percent per annum) and China (18 percent) in the coming decade. Sales of human vaccines are virtually recession-proof and can only rise as sophisticated healthcare systems are rolled out across the developing world.

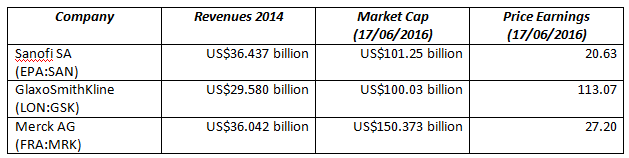

All the top global pharmaceutical firms offer vaccines in their product portfolios, but three firms dominate this increasingly important segment: Sanofi, GSK and Merck.

The French giant Sanofi SA (EPA:SAN) was the number four global pharmaceutical company by revenues in 2014[i]. It is a diversified player active in pharmaceuticals, vaccines and animal health. Sanofi-Aventis SA was formed in 2004 when Sanofi-Synthélabo (a former subsidiary of the French oil giant Total) acquired Aventis (formerly the organic chemicals division of Rhône-Poulenc). The company lacks high brand recognition in the English-speaking world but some of its leading products are nonetheless global brands like Gardasil (the cervical cancer vaccine) and Frontline Spot On the world’s best-selling anti-parasite treatment for cats and dogs. About 2 billion pipettes of Frontline have been sold.

Sanofi-Pasteur, the fully integrated vaccines business, is a world leader in human vaccine production offering a broad range of first-order and booster vaccines: for influenza, paediatric conditions, poliomyelitis, meningitis as well as measles, mumps, and rubella (MMR). Merial, another Sanofi subsidiary, is the global market leader in animal health, dedicated to the research, development, manufacture and delivery of vaccines used by veterinarians, farmers and pet owners. Merial’s Ivermectin entered pharmaceutical history a while back as the most successful animal health product ever launched. This family of products has been used for more than two decades by cattle ranchers, beef and dairy producers, and veterinarians.

Not all of Big Pharma wants to be in vaccines. In April 2014 Novartis (VTX:NOVN) sold its vaccines unit, with the exception of flu vaccines, to GlaxoSmithKline (LON:GSK). Central to the deal was Bexsero, Novartis’ vaccine for meningitis B – a potentially fatal disease – which currently has EU approval and orphan drug designation in the US. Glaxo also inherited 20 or so in-development vaccines to prevent hospital infections, tuberculosis, and a wide range of other maladies. Vaccines will contribute an estimated 14% of Glaxo’s revenues going forward.

Merck AG (FRA:MRK) has distinguished itself recently by developing an experimental vaccine for the Ebola virus. Ebola, which caused 11,325 deaths[ii] in the West African epidemic of 2014-15, is particularly tricky as it appears to be able to lurk undetected for a period of about 15 months. Authorities in affected countries have succeeded in stopping transmission of the virus only for fresh outbreaks to appear seemingly out of nowhere. Merck says that it will have 300,000 doses of this vaccine to help control such flare-ups[iii].

As new virus mutations arise, such as H1N1 (“Bird Flu”), these three will be at the forefront of preventive immunology.

From Immunology to Immunotherapy

While vaccines boost the ability of the immune system to combat specific infections, immunotherapy involves a new-generation of oncological drugs which are designed to re-activate or boost the body’s own immune system to fight cancer. One of the most pernicious features of many cancers is that they trick the body’s immune system into thinking that tumour tissue is benign. The main agent in immunotherapy is the monoclonal antibody. Monoclonal antibodies are antibodies which are specific to one type of cell or tissue. They are generated by identical immune cells that are all clones of a unique parent cell – in contrast to polyclonal antibodies, which are made from several different immune cells.

Immunotherapy has been hailed as the biggest breakthrough in cancer treatment for decades. The remarkable clinical efficiency of monoclonal antibodies suggests that immunotherapy has the potential to revolutionise modern medicine. Innovation Forum Oxford organised a key conference on the subject at the John Radcliffe Hospital, Oxford, on 11 April this year which was attended by academics, clinicians, industrialists and investors.

Oxford University Hospitals Foundation Trust has recently been trialling Nivolumab (known and marketed in the USA as Opdivo) on adults in their twenties and thirties suffering from Hodgkin lymphoma (a form of leukaemia). According to a recent report, 66 percent of the 80 participants experienced tumour shrinkage, while ten percent were completely cured[iv]. Nivolumab was discovered and developed by Medarex and brought to market by Bristol-Myers Squibb Corp. (NYSE:BMS) which acquired Medarex in 2009 for US$2.4 billion. BMS was the 15th largest pharmaceutical company by revenue 2014 with sales of US$15.88 billion. It should be noted that Medarex licensed Japanese rights to Nivolumab to Japan’s Ono Pharmaceutical Co Ltd (TYO:4528) in 2005.

Nivolumab works as a checkpoint inhibitor, blocking a signal that would normally prevent the activation of T-cells from attacking a cancerous tumour, thus allowing the body’s immune system to attack the cancer. From April this year, Nivolumab has been used for inoperable or metastatic melanoma in combination with a related monoclonal antibody, Ipilimumab (marketed as Yervoy). Nivolumab is also used as a second-line treatment for squamous non-small cell lung cancer and for renal cell carcinoma.

Nivolumab and Ipilimumab both work by interrupting the chemical signals that cancers use to convince the immune system they are healthy tissue. Nivolumab blocks the “off-switch” – a protein on the surface of white blood cells (T-cells) called PD-1. Ipilimumab blocks a similar switch called CTLA-4. However, there are side effects: the combination can cause inflammation in the bowels and liver as the drugs trigger the immune system to attack healthy tissue.

Promising clinical trial results made public back in 2012 caused excitement among industry analysts. Merck developed Pembrolizumab (Keytruda); and Roche (VTX:ROG), via its subsidiary Genentech, comMerialised Atezolizumab. Trials were announced by GSK in collaboration with the Maryland biotech company Amplimmune; and by Teva Pharmaceuticals (TLV:TEVA) in collaboration with the Israeli biotech company CureTech.

Ono Pharmaceuticals received approval from Japanese regulatory authorities to use Nivolumab to treat melanoma in July 2014, which was the first regulatory approval of a PD-1 inhibitor anywhere in the world. Merck received its first Food and Drug Administration approval for the PD-1 inhibitor, Keytruda, in September 2014. And – while I was writing this – on 17 June 2016 the National Institute for Health and Care Excellence (NICE) announced that the NHS will be permitted to use Ipilimumab and Nivolumab in combination[v] in the UK. These have been shown in recent UK trials to shrink the most aggressive and deadly type of melanoma (skin cancer) in 69 percent of patients. Melanoma kills around 2,000 people in the UK every year.

British Universities Get Entrepreneurial

A number of niche players active in different fields of immunology have emerged out of the research laboratories of British universities.

MedImmune Ltd, a subsidiary of AstraZeneca (LON:AZN), works to boost the immune systems of babies and grown-ups. Its flagship biotech product, Synagis, prevents respiratory syncytial virus (RSV), a major cause of pneumonia and other respiratory disease in infants and children. It has also commercialised FluMist, a nasal spray flu vaccine, and Ethyol which treats the side-effects of chemotherapy. The company is working on dozens of investigative therapies, including monoclonal antibodies, vaccines, and small molecule drugs in the areas of infectious disease, cancer, inflammation, autoimmune conditions and respiratory disorders. Durvalumab is now in Phase III clinical trials in a range of cancer types.

Immunocore Ltd offers a highly innovative immuno-oncology platform technology called ImmTACs. These are a novel class of drugs based on the company’s proprietary T-cell receptor (TCR) technology, which have the potential to treat diseases including cancer, viral infections and autoimmune diseases. Immunocore, commercialising the discovery of HLA (human leukocyte antigen) targets and T-cell receptor technology, has a pipeline of wholly-owned and partnered development programmes. Partners include Genentech, GlaxoSmithKline, MedImmune, and Eli Lilly and Co. (NYSE:LLY). Founded in 2008 by Oxford University researchers, Immunocore now has more than 230 staff. Immunocore’s major shareholders include Woodford Investment Management, Malin Corporation, Eli Lilly, RTW Investments and Fidelity Management & Research Company.

Autolus Ltd was founded by Dr Martin Pule in 2014 who remains Chief Scientific Officer. Dr Pule is the Clinical Senior Lecturer in the Department of Haematology at the University College London Cancer Institute. His research is focused on the genetic engineering of T-cells for cancer treatment. As well as being a senior Lecturer at UCL, Dr Pule holds the post of honorary consultant clinical haematologist in the UCL Hospital, lymphoma being his main clinical interest. Autolus Ltd is active in chemotherapy and radiology as well as in synthetic biology (see below).

Vaccitech Ltd will be using “viral vectors” to make new vaccines against emerging pathogens. This is a research area which has gained prominence since the recent Ebola outbreak in West Africa. Sarah Gilbert, Professor of Vaccinology at the Oxford of University, founded Vaccitech in May 2016 to accelerate the rapid clinical development of such vaccines. It was announced on 11 May that the start-up had secured £10 million of seed funding from Oxford Sciences Innovation, Invesco, Lansdowne Capital Partners and Woodford Investment Management[vi]. Vaccitech is one of nine spinoffs so far this year by Oxford University which has been the world’s top medical research university for the past five years.

Vaccitech will draw on research from Oxford University. It aspires to generate vaccines which boost cancer immunotherapies as well as a “universal” flu vaccine. The universal flu vaccine theoretically works against all human, avian and swine influenza strains by targeting two proteins inside the virus which do not change. The vaccine is “already showing promise” in Phase II trials.

Other companies in the race to market a universal flu vaccine include Wisconsin-based start-up FluGen, Israel’s Biondvax Pharmaceuticals (TLV:BVXV) and America’s Johnson & Johnson (NYSE:JNJ). In the cancer vaccines field, Vaccitech will be up against the likes of Denmark’s Bavarian Nordic A/S (FRA:BV3/CPH:BAVA), Inovio Pharmaceutical Inc. (NASDAQ:INO) and Aduro Biotech Inc. (NASDAQ:ADRO).

Immunotherapy is already being referred to in the medical profession as the fifth pillar of cancer treatment – the first four being surgery, radiotherapy, chemotherapy and conventional pharmacology. Note that radiotherapy itself is undergoing a revolution with the advent of proton beam therapy (PBT).

Gene Therapy: the Future is CRISPR

First, biologists set out to crack the code of human, animal and vegetable animal life by sequencing genomes. But now they have got a technology by means of which they can edit those genomes and splice out “faulty” genes which they know to cause defects in the organism. This technology is called CRISPR – which stands for clustered regularly interspaced short palindromic repeats. (Now you know!) CRISPR was named by the American Association for the Advancement of Science as the major scientific breakthrough of 2015.

In the jargon of the new science of synthetic biology, first we learned to read the code, but now we are developing the tools to write it. CRISPR is thought to offer a technique of tweaking genomes so as to avoid inherited conditions such as Duchenne muscular dystrophy. Most people would think of that as an incontrovertible advance. But many ethicists and scientists believe that this type of therapy may have legal and social implications. For example, some scientists think that depression has a genetic component. But would we feel comfortable if scientists then set about altering the human genome so as to minimise the risk of a disposition towards depression? That smacks of biological and social engineering gone too far. And there is the Frankenstein factor: the fear of what we might unleash if we could generate entirely new organisms.

That said, current projects underway in synthetic biology are practical and relatively uncontroversial. For example: to cure people of debilitating genetic diseases; to make mosquitoes (which spread malaria) sterile; to programme microbes to generate biofuels; to increase the nutritional value of plants; to create synthetic meat (great news for vegetarians – and beasts); and to create new materials with remarkable properties.

The cost of sequencing the genome of an organism has plummeted in recent years. According to the National Human Genome Research Institute (NHGRI) the cost of sequencing a string of a billion pieces of DNA has fallen from $10,000 in 2001 to less than one cent today. This is due to huge advances in DNA sequencing machines and in the software that they use. As a result, synthetic biology is not just reserved to Big Pharma. In the USA there are numerous small start-ups and so-called bio-hackers working out of laboratories in their garages and basements using cloud computing services to manipulate organisms in order to produce economically viable products.

One such outfit, Lygos, is altering the DNA of yeast and e-coli to produce nylon, polyester, and polypropylene for clothing. Refactored Materials is transforming proteins to create materials that mimic spider silk – a fibre six times tougher than Kevlar. Kevlar and Gore-Tex have been around for years and were developed long before synthetic biology was even possible; but the new fibres that could be engineered using synthetic biology could have even more astonishing applications.

Back in January 2013 David (now Lord) Willets, then Minister for Science, identified synthetic biology as one of the Eight Great Technologies[vii]. More recently, the value of the bio-economy in the UK was estimated at around £150 billion – and increasing rapidly.

The Biotech Brit-Pack Leads the Way

On 05 April 2016, the Institution of Engineering and Technology (IET) and SynbiCITE, the UK’s synthetic biology consortium of 56 industrial partners and 19 academic institutions based at Imperial College London, organised a one-day seminar in London on synthetic biology[viii]. The workshop attracted more than 100 scientists and engineers reflecting the UK government’s commitment to the UK’s leading position in the world of synthetic biology, in which the UK is second only to the US. The April workshop is to be followed by another, bigger event in December 2016 to be held at the IET headquarters in Savoy Place, London.

SynbiCITE is headed up by Dr Stephen Chambers. Dr Chambers joined Vertex Pharmaceuticals (NASDAQ:VRTX) in the US at an early stage as a founding scientist. Vertex subsequently had phenomenal success in commercialising treatments for cystic fibrosis, principally Orkambi[ix]. (It now has a market cap of US$22 billion.) Dr Chambers later became a co-founder of Abpro Inc., a Massachusetts biotech company specialising in rapid antibody production, which describes itself as a complete gene-to-antibody industrial biochemistry platform. In an interview with the Huffington Post last year, Dr Chambers stated that he came back to the UK for the same reason that he went to the US in the 1980s: to be where life science start-ups are happening[x].

Dr Chambers sees SynbiCITE as a foundry for DNA synthesis, assembly and verification. His goal is to help would-be scientist-entrepreneurs to translate their ideas and research in synthetic biology into viable products. SynbiCITE’s Lean Launchpad is a crash course in entrepreneurship, taking scientists out of their laboratories and providing them with the skills, knowledge and understanding to take their science to market. He tells the boffins to explain, not the pure science, but why there is a market for their product.

Nanocage Technologies is one such company. It has developed a technology that allows drugs to be transported to specific cells in the body inside tiny protein “cages”. This opens up the possibility of delivering cancer therapies to the precise location where they are needed thus reducing unpleasant and often debilitating side effects.

ETAL, a skincare manufacturer founded by molecular biologist Gracie Oury, A&E doctor Kieran Latham and pharmaceutical scientist Pitchaya Rungsereechai, found the challenge was the pressure they were under to come up with the right product. After attending Lean Launchpad they have used a specific protein to develop a stretch-mark cream for men![xi]

The products currently being developed with synthetic biology in the UK are remarkably varied. And this segment is almost entirely driven by dynamic new start-ups. A few years ago you had to travel to San Francisco to find this kind of innovation. But today you can just take the tube to SynbiCITE’s offices is in South Kensington.

Action

The UK is well placed to commercialise the medical advances made possible by life science technologies that are coming out of its top universities. The leaders of Big Pharma are well positioned to profit from huge growth of existing mature products such as vaccines in developing markets. Sanofi, GSK, Merck and Bristol Myers Squib should be core holdings in a large diversified portfolio with a biotech bias. But it is the start-ups in life science that offer the greatest potential for reward. The early bird catches the worm. Funds which invest in cutting-edge life science start-ups include Fidelity Select Biotechnology Portfolio (MUTF:FBIOX) though be aware that this is down by nearly 25% year to date.

In the US, Brad Loncar, who describes himself as an independent biotech investor, has created a new type of biotech index that focuses exclusively on cancer immunotherapy drugs which he feels have been overlooked by conventional biotech funds. Loncar’s fund, launched last autumn, is the Loncar Cancer Immunotherapy ETF (NASDAQ:CNCR). This ETF contains companies such as Merck, Bristol-Myers Squibb, Pfizer, Roche/Genentech, Juno Therapeutics (NASDAQ:JUNO), Kite Pharma (NASDAQ:KITE), Novartis and numerous others which are making huge investments in this space. Admittedly, biotech has not had a great year and the ETF is down about 20 percent year to date. But with Bristol Myers Squibb announcing that sales of Nivolumab/Opdivo will hit US$1 billion this year, now looks like a good time to buy in.

[i] See: Top 25 pharma companies by global sales at http://www.pmlive.com/top_pharma_list/global_revenues

[ii] Figure from Centers for Disease Control and Prevention (CDC). See: https://www.cdc.gov/vhf/ebola/outbreaks/2014-west-africa/

[iii] New Scientist, 07 May 2016, page 6.

[iv] Daily Telegraph, 11 June 2016.

[v] See: http://www.bbc.co.uk/news/health-36549674

[vi] See: FiercePharma, 11 May 2016 at: http://www.fiercepharma.com/vaccines/oxford-spinoff-vaccitech-nets-ps10m-for-flu-cancer-vaccines

[vii] As well as synthetic biology they are: advanced materials, agri-science, big data, energy storage, regenerative medicine, robotics and satellites. The UK government report on the subject can be downloaded at: http://www.policyexchange.org.uk/images/publications/eight%20great%20technologies.pdf

[viii] See: http://www.synbicite.com/news-events/synbicite-blog/ietsynbicite-joint-workshop-and-conference-enginee/

[ix] On 17 June 2016 NICE announced that Orkambi will not be funded for use in the NHS – provoking widespread criticism.

[x] Huffington Post 19/02/2015: http://www.huffingtonpost.com/steve-blank/life-science-startups-ris_b_6713414.html

[xi] See: http://www.upstartmagazine.co.uk/piece/londons-synthetic-biology-startups

[i] Antibiotic Persistence – Or Where Big Pharma Went Wrong, available at: http://masterinvestor.co.uk/equities/antibiotic-persistence-big-pharma-went-wrong/

[ii] Florence Nightingale’ Deep Mind, http://masterinvestor.co.uk/equities/florence-nightingales-deep-mind/

Comments (0)