AstraZeneca: a stock for all seasons

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Robert Stephens, CFA, discusses why pharmaceuticals giant AstraZeneca could produce capital growth in 2020 and beyond.

Shares that offer a mix of defensive characteristics and growth potential could outperform their peers in 2020. Risks to the global economy may remain at elevated levels, thereby making defensive stocks more attractive to investors. However, as 2019 has shown, an uncertain economic and political outlook will not necessarily inhibit global GDP growth.

AstraZeneca has defensive credentials as a result of its profitability being less closely correlated to the global economy’s performance than that of many of its FTSE 100 index peers. At the same time, its recent updates have shown that investment in its pipeline is delivering double-digit sales and profit growth that is set to continue into 2020 and beyond.

The increasing prevalence of non-communicable diseases (NCDs), such as cancer, could offer the company a favourable growth outlook in the long run. So too could its increasing exposure to emerging markets, where demand for its medicines is forecast to increase as factors such as an ageing population and urbanisation continue.

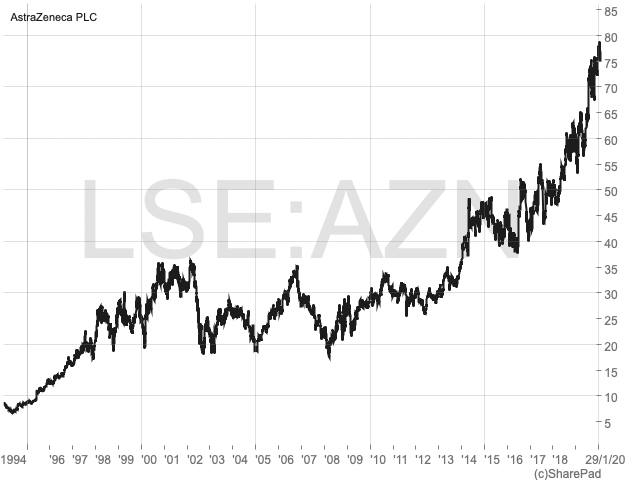

The company’s recent restructuring and its financial strength may further improve its growth prospects. Its valuation may not be cheap, while regulatory and pricing-related risks are set to remain in place. But its growth potential within an uncertain wider global economy could make it a ‘stock for all seasons’, with it offering further share-price growth prospects following its rise of more than 20% in 2019.

Improving performance

AstraZeneca’s third-quarter update displayed the progress it is making in its financial performance. For example, it generated sales growth of 22% at constant currency compared to the same quarter of the previous financial year. This led to a rise in its core earnings per share (EPS) of 36% on a constant currency basis. The company expects to produce further growth in 2020 after what has been a highly successful 2019 financial year.

This level of growth represents a significant change from the seemingly constant decline in sales and profitability over recent years. A key part of the company’s improving financial performance has been the investment made in its product pipeline. It currently has 164 projects in its pipeline, and has the financial strength to invest a significant amount of capital in this area in future. This is allowing the business to overcome the loss of patents on ‘blockbuster’ drugs that had threatened to characterise its performance in the 2010s. However, it ends the decade with an improving pipeline of new medicines that are delivering double-digit sales and earnings growth.

Emerging-market potential

Alongside the investment made in its pipeline, AstraZeneca has shifted its focus towards three main therapy areas: oncology; cardiovascular; renal and metabolism; and respiratory. These three therapy areas are experiencing high demand across emerging markets, and have contributed to a 50% rise in the company’s quarterly sales in emerging economies. It now generates over a third of its total sales from emerging markets, where it reported sales growth of 29% in its most recent quarter.

Emerging markets could provide a major growth catalyst for the business in the long run as wage levels are forecast to increase. In 2018, for example, emerging markets recorded a 6.4% rise in pharmaceutical sales. This compared to a 3.9% increase in pharmaceutical sales in established markets. By 2030, seven of the world’s 10 largest economies at purchasing power parity are expected to be emerging economies, with China’s economy forecast to be twice as large as that of the US. India’s economy is also expected to overtake the US economy in the next decade; it is forecast to be around 50% larger by 2030. Increasing wealth could offer a tailwind to companies operating in such economies, and may vindicate AstraZeneca’s decision to ramp up its investment in emerging markets.

Growth areas

A number of catalysts could cause demand for medicines to rise in 2020 and in future decades. Among them is a world population that is growing in size and age. The UN estimates that the world’s population will increase from 7.6 billion today to around 9.8 billion by 2050. In addition, one in six people are expected to be aged 65 or over by 2050. This represents a substantial rise from the current figure of one in 11. A larger population that is older is highly likely to demand greater healthcare resources – particularly in the three therapy areas on which AstraZeneca is now focused.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Another factor that could create growth in demand for the company’s medicines is urbanisation. The proportion of people who live in cities is expected to increase from 55% today to 68% by 2050. Urbanisation has been shown to increase the incidence of non-communicable diseases, which are conditions that cannot be passed directly from one person to another. This may be due to unhealthy lifestyles within an urban environment, as well as the poorer air quality that is often prevalent in major urban areas. The end result could be rising demand for many of AstraZeneca’s medicines – particularly in emerging economies where a large proportion of urbanisation is expected to take place.

Defensive characteristics

The pharmaceutical sector has often been viewed as a relatively defensive industry in which to invest. Its correlation with the wider global economy is arguably lower than for many other industries. The potential for a slowdown in global GDP growth in 2020, although not currently anticipated by forecasters such as the IMF, may mean that the healthcare industry becomes an increasingly popular place to invest. Risks such as a global trade war, slow growth in Europe and political challenges in the world’s two major economies may produce a volatile market performance in 2020.

Despite their defensive credentials, pharmaceutical companies such as AstraZeneca face ongoing risks. For example, the industry is experiencing higher costs in developing new medicines due to regulators demanding increasingly extensive evidence of their comparative effectiveness. There are also continued efforts by policymakers in the US to lower drug prices. This includes efforts to increase generic drug use to enhance competition. In addition, the difficulties experienced by AstraZeneca in recent years in terms of a loss of patents is an ongoing risk facing the wider pharmaceutical sector. Patents are finite, and investment in new medicines must continually yield results that can sustain sales and profit growth in the long run.

Investment potential

The company’s share-price rise of more than 20% in 2019 means that it now trades on a forward price-earnings ratio of around 26. This is higher than the ratings of some of its fellow global pharmaceutical peers, but they may fail to deliver earnings growth of a similar level to AstraZeneca in the long run. For instance, in 2020 the company is forecast to produce a rise in its EPS of almost 20%. This may not prove to be a one-off rise, since its performance in recent quarters has been robust.

The company’s dividend prospects have been hurt by its lack of growth in shareholder payments in the last decade, owing to a declining bottom line. When its share-price rise is factored in, the stock now has a yield of only 3%. There may be scope for a fast-paced rise in dividend payments over the long run as the company’s profitability looks set to improve. However, this potential must be weighed against the demands on the business from drug development and the expenses associated with maintaining a strong pipeline of new medicines.

Outlook

The long-term prospects for pharmaceutical companies appear to be bright. An increasing world population that is ageing could catalyse demand for medicines. Furthermore, continued urbanisation may mean that the incidence of NCDs rises and produces a tailwind across the industry. Additionally, continued GDP growth in emerging markets may mean that companies which have exposure to economies such as China and India are able to outperform businesses that are focused on established markets.

This could enable AstraZeneca to maintain its recent improvement in sales and profit growth. It has invested heavily in its pipeline, which has transformed its financial performance after what has been a tough decade for the business. Although it faces regulatory and pricing risks, a solid financial position means that it may be able to maximise the growth opportunities available within the therapeutic areas in which it operates.

As well as offering growth potential, the defensive attributes of the company and sector may mean that investors naturally gravitate towards it during 2020. The UK and world economies face geopolitical and economic risks that may cause increasing risk aversion among investors. Therefore, AstraZeneca’s relative lack of reliance on the performance of the world economy, in the short term at least, may increase the appeal of its shares.

It may not be a cheap stock, but its future prospects could make it an appealing investment opportunity. Its current share price may be worth paying, given its likely status as a ‘stock for all seasons’.

Comments (0)